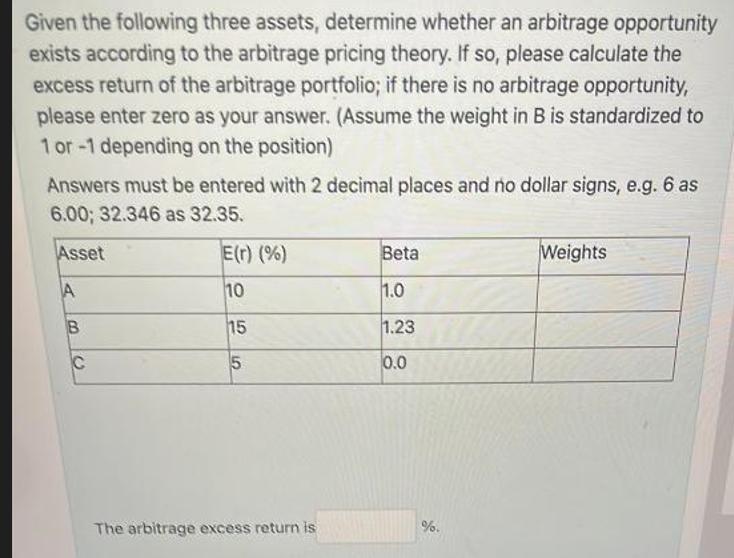

Question: Given the following three assets, determine whether an arbitrage opportunity exists according to the arbitrage pricing theory. If so, please calculate the excess return

Given the following three assets, determine whether an arbitrage opportunity exists according to the arbitrage pricing theory. If so, please calculate the excess return of the arbitrage portfolio; if there is no arbitrage opportunity, please enter zero as your answer. (Assume the weight in B is standardized to 1 or -1 depending on the position) Answers must be entered with 2 decimal places and no dollar signs, e.g. 6 as 6.00; 32.346 as 32.35. Asset E(r) (%) Beta A 10 1.0 B 15 1.23 C 5 0.0 The arbitrage excess return is %. Weights

Step by Step Solution

There are 3 Steps involved in it

To determine whether an arbitrage opportunity exists according to the arbitrage pricing theory APT we need to calculate the expected return of a portf... View full answer

Get step-by-step solutions from verified subject matter experts