Suppose that in April 2019, Nike had EPS of $2.57 and a book value of equity of

Question:

Suppose that in April 2019, Nike had EPS of $2.57 and a book value of equity of $6.23 per share.

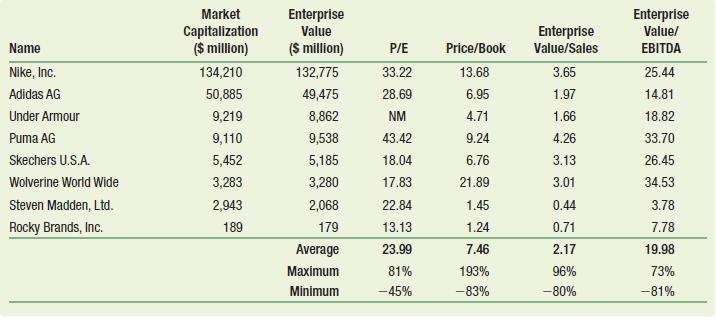

a. Using the average P/E multiple in Table 10.1, estimate Nike’s share price.

b. What range of share prices do you estimate based on the highest and lowest P/E multiples in Table 10.1?

c. Using the average price-to-book value multiple in Table 10.1, estimate Nike’s share price.

d. What range of share prices do you estimate based on the highest and lowest price to-book value multiples in Table 10.1?

Data from Table 10.1

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Corporate Finance

ISBN: 9780135811603

5th Edition

Authors: Jonathan Berk, Peter DeMarzo, Jarrad Harford

Question Posted: