Suppose that in April 2019, Nike had sales of $36,397 million, EBITDA of $5,219 million, excess cash

Question:

Suppose that in April 2019, Nike had sales of $36,397 million, EBITDA of $5,219 million, excess cash of $5,245 million, $3,810 million of debt, and 1573.8 million shares outstanding.

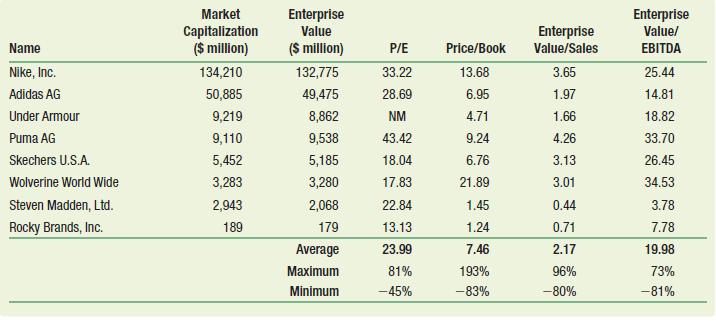

a. Using the average enterprise value to sales multiple in Table 10.1, estimate Nike’s share price.

b. What range of share prices do you estimate based on the highest and lowest enterprise value to sales multiples in Table 10.1?

c. Using the average enterprise value to EBITDA multiple in Table 10.1, estimate Nike’s share price.

d. What range of share prices do you estimate based on the highest and lowest enterprise value to EBITDA multiples in Table 10.1?

Table 10.1

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Corporate Finance

ISBN: 9780135811603

5th Edition

Authors: Jonathan Berk, Peter DeMarzo, Jarrad Harford

Question Posted: