Garage, Inc., has identified the following two mutually exclusive projects: a. What is the IRR for each

Question:

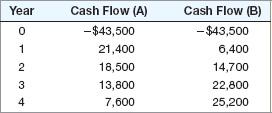

Garage, Inc., has identified the following two mutually exclusive projects:

a. What is the IRR for each of these projects? Using the IRR decision rule, which project should the company accept? Is this decision necessarily correct?

b. If the required return is 11 percent, what is the NPV for each of these projects? Which project will the company choose if it applies the NPV decision rule?

c. Over what range of discount rates would the company choose project A? Project B? At what discount rate would the company be indifferent between these two projects? Explain.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

Answer a Internal Rate of Return IRR The Internal Rate of Return IRR is the discount rate at which the Net Present Value NPV of a project becomes zero ...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Fundamentals of Corporate Finance

ISBN: 978-0077861704

11th edition

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

Question Posted:

Students also viewed these Business questions

-

NPV versus IRR Bumble??s Bees, Inc., has identified the following two mutually exclusive projects: a. What is the 1RR for each of these projects? Using the IRR decision rule, which project should the...

-

Inc., has identified the following two mutually exclusive projects: a. What is the IRR for each of these projects? Using the IRR decision rule, which project should the company accept? Is this...

-

Garage, Inc., has identified the following two mutually exclusive projects: a. What is the IRR for each of these projects? Using the IRR decision rule, which project should the company accept? Is...

-

A square garden has an area of 900 square feet. If a sprinkler (with a circular pattern) is placed in the center of the garden, what is the minimum radius of spray the sprinkler would need in order...

-

If the instructor wanted to try to change the culture in the class you analyzed, what steps would you recommend that he or she take?

-

A national survey of small-business owners was conducted to determine the challenges for growth for their businesses. The top challenge, selected by 46% of the small-business owners, was the economy....

-

What is the role of HR professionals in information security and privacy management?

-

A work cell at Chris Ellis Commercial Laundry has a workstation with two machines, and each unit produced at the station needs to be processed by both of the machines. (The same unit cannot be worked...

-

Correlle dishes are known for being mostly unbreakable in daily use. Kevin's 12-year-old son decided to test this "unbreakable" idea by throwing a plate hard onto the floor. It broke. what this is an...

-

For the cash flows in the previous problem, what is the NPV at a discount rate of zero percent? What if the discount rate is 10 percent? If itis 20 percent? If it is 30 percent? Data From Previous...

-

Consider the following two mutually exclusive projects: Sketch the NPV profiles for X and Y over a range of discount rates from zero to 25 percent. What is the crossover rate for these two projects?

-

The variable capacitance of an old radio tuner consists of four plates connected together placed alternately between four other plates, also connected together (Fig. 19-92). Each plate is separated...

-

What type of cost accounting system would be best suited for a company like Apple, INC.

-

The standard portion size of sliced honey pork loin is 8 ounces, and the current edible portion cost is $0.30 an ounce. If the kitchen staff slices 10-ounce portions and the restaurant sells 50...

-

You will need to create a portfolio of evidence to document your work; this must be documented clearly and presented professionally and submitted to the assessor for assessment. The assessor, in...

-

Please discuss about the financial reporting cycle in the context of GAAP vs. IFRS. Please elaborate with examples and compare and contrast.

-

Calculate accurately and completely the total that would be reported for the inventory and accounts payable in the subsidiary's translated balance sheet.

-

You predict that interest rates are about to fall. Which bond will give you the highest capital gain? a. Low coupon, long maturity. b. High coupon, short maturity. c. High coupon, long maturity. d....

-

a) Calculate the goodwill that was paid by Major Ltd on the acquisition of Minor Ltd. [10 marks] b) Prepare the consolidated statement of financial position for Major Ltd at 31 July 20X8. [30 marks]...

-

If jPhone, Inc., has an equity multiplier of 1.35, total asset turnover of 1.64, and a profit margin of 7 percent, what is its ROE?

-

Jiminy Cricket Removal has a profit margin of 8 percent, total asset turnover of 1.16, and ROE of 14.30 percent. What is this firms debt-equity ratio?

-

For the past year, De Vries, Inc., had a cost of goods sold of $59,382. At the end of the year, the accounts payable balance was $13,689. How long on average did it take the company to pay off its...

-

what is your goal as a professional civil engineer?

-

What innovation in your field of specialization will be beneficial to us Filipinos and in our present conditions? (Advances in your field as civil engineer) 2. Why it is relevant or beneficial?...

-

what is the relevance of great books to civil engineers?

Study smarter with the SolutionInn App