Use the data given in PB13-1 for Tiger Audio. Required: 1. Compute the gross profit percentage in

Question:

Use the data given in PB13-1 for Tiger Audio.

Required:

1. Compute the gross profit percentage in the current and previous years. Are the current year results better, or worse, than those for the previous year?

2. Compute the net profit margin for the current and previous years. Are the current year results better, or worse, than those for the previous year?

3. Compute the earnings per share for the current and previous years. Are the current year results better, or worse, than those for the previous year?

4. Stockholders’ equity totaled $65,000 at the beginning of the previous year. Compute the return on equity ratios for the current and previous years. Are the current year results better, or worse, than those for the previous year?

5. Net property and equipment totaled $115,000 at the beginning of the previous year. Compute the fixed asset turnover ratios for the current and previous years. Are the current year results better, or worse, than those for the previous year?

6. Compute the debt-to-assets ratios for the current and previous years. Is debt providing financing for a larger or smaller proportion of the company’s asset growth?

7. Compute the times interest earned ratios for the current and previous years. Are the current year results better, or worse, than those for the previous year?

8. After Tiger released its current year financial statements, the company’s stock was trading at $17. After the release of its previous year financial statements, the company’s stock price was $12 per share. Compute the P/E ratios for both years. Round to one decimal place. Does it appear that investors have become more (or less) optimistic about Tiger’s future success?

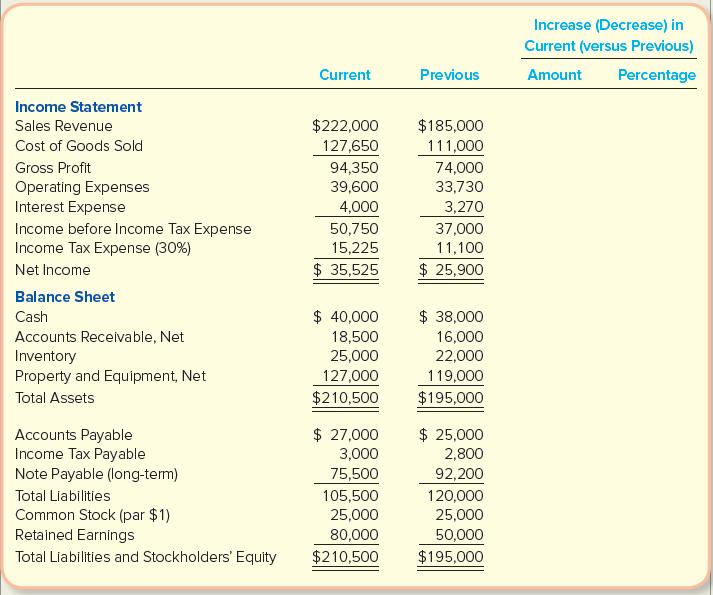

Data From PB13-1

Tiger Audio declared and paid a cash dividend of $5,525 in the current year. Its comparative financial statements, prepared at December 31, reported the following summarized information:

Step by Step Answer:

Fundamentals Of Financial Accounting

ISBN: 9781265440169

7th Edition

Authors: Fred Phillips, Shana Clor Proell, Robert Libby, Patricia Libby