A company has an 11% WACC and is considering two mutually exclusive investments (that cannot be repeated)

Question:

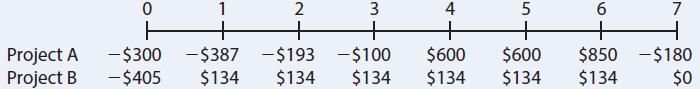

A company has an 11% WACC and is considering two mutually exclusive investments (that cannot be repeated) with the following cash flows:

a. What is each project’s NPV?

b. What is each project’s IRR?

c. What is each project’s MIRR?

d. From your answers to parts

a, b, and

c, which project would be selected? If the WACC was 18%, which project would be selected?

e. Construct NPV profiles for Projects A and B.

f. Calculate the crossover rate where the two projects’ NPVs are equal.

g. What is each project’s MIRR at a WACC of 18%?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Financial Management

ISBN: 9780357517574

16th Edition

Authors: Eugene F. Brigham, Joel F. Houston

Question Posted: