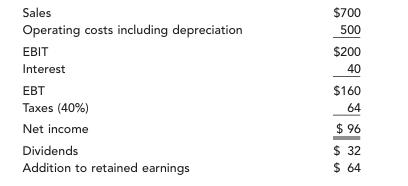

Austin Grocers recently reported the following 2005 income statement (in millions of dollars): This year the company

Question:

Austin Grocers recently reported the following 2005 income statement (in millions of dollars):

This year the company is forecasting a 25 percent increase in sales, and it expects that its year-end operating costs including depreciation will equal 70 percent of sales. Austin’s tax rate, interest expense, and dividend payout ratio are all expected to remain constant.

a. What is Austin’s projected 2006 net income?

b. What is the expected growth rate in Austin’s dividends?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Financial Management

ISBN: 9781111795207

11th Edition

Authors: Richard Bulliet, Eugene F Brigham, Brigham/ Houston

Question Posted: