An analyst compared the performance of a hedge fund index with the performance of a major stock

Question:

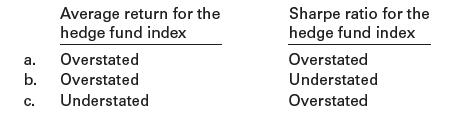

An analyst compared the performance of a hedge fund index with the performance of a major stock index over the past eight years. She noted that the hedge fund index (created from a database) had a higher average return, lower standard deviation, and higher Sharpe ratio than the stock index. All the successful funds that have been in the hedge fund database continued to accept new money over the eight-year period. Are the average return and the Sharpe ratio, respectively, for the hedge fund index most likely overstated or understated?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Investing

ISBN: 9781292153988

13th Global Edition

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk

Question Posted: