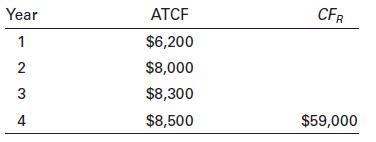

Bezie Foster has estimated the annual after-tax cash flows and after-tax net proceeds from sale (CFR) of

Question:

Bezie Foster has estimated the annual after-tax cash flows and after-tax net proceeds from sale (CFR) of a proposed real estate investment as noted below for the planned 4-year ownership period.

The initial required investment in the property is $55,000. Bezie must earn at least 14%

on the investment.

a. Calculate the net present value of the proposed investment.

b. Estimate the IRR (to the nearest whole percentage point) from the investment.

c. From your findings in parts a and b, what recommendation would you give Bezie? Explain.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Investing

ISBN: 9781292153988

13th Global Edition

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk

Question Posted: