During the year just ended, Jean Sanchezs taxable income of ($48,000) was twice as large as her

Question:

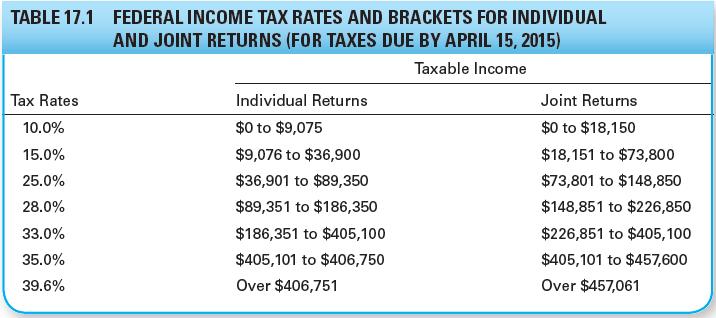

During the year just ended, Jean Sanchez’s taxable income of \($48,000\) was twice as large as her younger sister Rachel’s taxable income of \($24,000.\) Use the tax rate schedule in Table 17.1 to answer the following questions with regard to the Sanchez sisters, who are both single.

a. Calculate each sister’s tax liability.

b. Determine

(1) the marginal tax rate

(2) the average tax rate for each sister.

c. Do your findings in part b demonstrate the progressive nature of income taxes? Explain.

Transcribed Image Text:

TABLE 17.1 FEDERAL INCOME TAX RATES AND BRACKETS FOR INDIVIDUAL AND JOINT RETURNS (FOR TAXES DUE BY APRIL 15, 2015) Tax Rates 10.0% 15.0% Individual Returns $0 to $9,075 $9,076 to $36,900 25.0% $36,901 to $89,350 28.0% 33.0% 35.0% 39.6% Over $406,751 $89,351 to $186,350 $186,351 to $405,100 $405,101 to $406,750 Taxable Income Joint Returns $0 to $18,150 $18,151 to $73,800 $73,801 to $148,850 $148,851 to $226,850 $226,851 to $405,100 $405,101 to $457,600 Over $457,061

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

ANSWER a Tax Liability Calculation Jean Sanchez Taxable Income 48000 According to Table 171 for sing...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Fundamentals Of Investing

ISBN: 9781292153988

13th Global Edition

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk

Question Posted:

Students also viewed these Business questions

-

Sam invested $7700, some at 6.8% interest and the rest at 9%. How much did he invest at each rate if he received $631.40 in interest in one year?

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

This assignment requires you to complete the 2022 tax reporting for a fictional woman named Anna Smith. Question 1 T1 - step 4 - line 66 This is Anna's taxable income Answer: Question 2 T1 - step...

-

An interior room is maintained at an air temperature of 210C by a radiant panel covering one of the room walls, calculate the temperature of the radiant panel necessary to achieve the thermal comfort...

-

On January 1, 2016, Monica Company acquired 70 percent of Young Company's outstanding common stock for $665,000. The fair value of the non-controlling interest at the acquisition date was $285,000....

-

YellowCard ASA manufactures accessories for iPods, iPhones, and iPads. It had the following selected transactions during calendar 2019. (For any part of this problem requiring an interest or discount...

-

You are considering investing money in Treasury bills and wondering what the real risk-free rate of interest is. Currently, Treasury bills are yielding 4 percent and the future inflation rate is...

-

Reducir, Inc., produces two different types of hydraulic cylinders. Reducir produces a major subassembly for the cylinders in the Cutting and Welding Department. Other parts and the sub-assembly are...

-

How will the Information Assurance program benefit you in the future?

-

Assume you have a sizable gain on 200 shares of stock that you bought 2 years ago for \($22\) per share and that is now (December 15) selling for \($50\) per share. Given a just announced tax rate...

-

What is tax planning? Describe the current tax rate structure and explain why it is considered progressive.

-

A two-stage compressor in a gas turbine brings atmospheric air at 100 kPa, 17C to 500 kPa, then cools it in an intercooler to 27C at constant P. The second stage brings the air to 2500 kPa. Assume...

-

Fig. D2.7 shows a servo system. Determine (a) Characteristics equation (b) Undamped frequency of oscillation (c) Damping ratio (d) Damping factor (e) Peak overshoot (f) First undershoot (g) Time...

-

Scan the literature and determine the various LAN oper- ating systems available. Describe the relative strengths and weaknesses of these systems. Do these systems seem to be adequate for distributed...

-

Draw a cash flow diagram of any investment that exhibits both of the following properties: 1. The investment has a 4-year life. 2. The investment has a 10 percent/year internal rate of return.

-

A bullet is fired horizontally from a high-powered rifle. At the same instant, a bullet that was resting on top of the rifle falls off. Which bullet hits the ground first?

-

On a rifle that has a telescopic sight, the telescope is usually not parallel to the barrel of the rifle. The angle the telescope makes with the barrel has to be adjusted for the distance to the...

-

A wire having a linear mass density of 1.00 g/cm is placed on a horizontal surface that has a coefficient of kinetic friction of 0.200. The wire carries a current of 1.50 A toward the east and slides...

-

Can partitioned join be used for r r.A s? Explain your answer

-

Cane Company manufactures two products called Alpha and Beta that sell for $ 1 2 0 and $ 8 0 , respectively. Each product uses only one type of raw material that costs $ 6 per pound. The company has...

-

The stockholders' equity accounts of Blossom Corporation on January 1, 2027, were as follows. Preferred Stock (7%, $100 par noncumulative, 5,200 shares authorized) Common Stock ($4 stated value,...

-

On December 3 1 , 2 0 2 3 , ?Parent Co purchased 9 5 % ?of Sub Co for $ 1 2 0 , 0 0 0 ?cash. The Balance Sheet of each corporation just prior to the acquisition is presented below. Additionally,...

Study smarter with the SolutionInn App