The Akais just finished calculating their taxable income for their 2014 joint federal income tax return. It

Question:

The Akais just finished calculating their taxable income for their 2014 joint federal income tax return. It totaled \($68,750\) and showed no tax credits. Just prior to filing their return, the Akais realized that they had treated a \($2,000\) outlay as an itemized deduction rather than correctly treating it as a \($2,000\) tax credit.

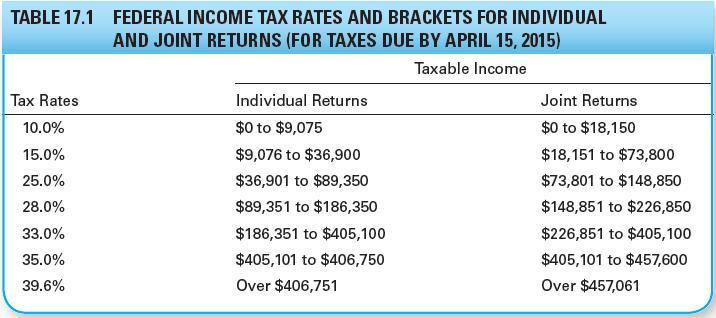

a. Use the tax rate schedule in Table 17.1 to calculate the Akais’ tax liability and tax due on the basis of their original \($68,750\) estimate of taxable income.

b. How much taxable income will the Akais have if they correctly treat the \($2,000\) as a tax credit rather than a tax deduction?

c. Use your finding in part a to calculate the Akais’ tax liability and tax due after converting the \($2,000\) tax deduction to a tax credit.

d. Compare and contrast your findings in parts a and

c. Which would you prefer, a tax deduction or an equal-dollar-amount tax credit? Why?

Step by Step Answer:

Fundamentals Of Investing

ISBN: 9781292153988

13th Global Edition

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk