Barbara Analee, a registered nurse and businesswoman, recently retired at age 50 to pursue a life as

Question:

Barbara Analee, a registered nurse and businesswoman, recently retired at age 50 to pursue a life as a blues singer. She had been running a successful cosmetics and aesthetics business. She is married to Tom, a retired scientist (age 55). They have saved $3 million in their portfolio and now they want to travel the world. Their three children are all grown and out of college and have begun their own families. Barbara now has two grandchildren. Barbara and Tom feel that they have achieved a comfortable portfolio level to support their family’s needs for the foreseeable future.

To meet their basic living expenses, Tom and Barbara feel they need $75,000 per year in today’s dollars (before taxes) to live comfortably. As a trained professional, Barbara likes to be actively involved in intensively researching investment opportunities. Barbara and Tom want to be able to provide $10,000 per year (pretax) indexed for inflation to each of their grandchildren over the next 10 years for their college education. They also want to set aside $15,000 each year (pretax) indexed for inflation for traveling for Barbara’s musical performances around the United States. They have no debt. Most of their portfolio is currently in large-cap U.S. stocks and Treasury notes.

They have approached Pamela Jaycoo, CFA, for guidance on how to best achieve their financial goals. Inflation is expected to increase at an annual rate of 3 percent into the foreseeable future.

1. What is the Analees’ return objective?

a. 6.67 percent

b. 6.17 percent

c. 3.83 percent

2. What is their tolerance for risk?

a. Average

b. Below average

c. Above average

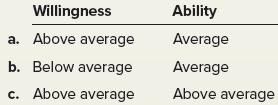

3. What are Barbara’s willingness and ability to assume risk?

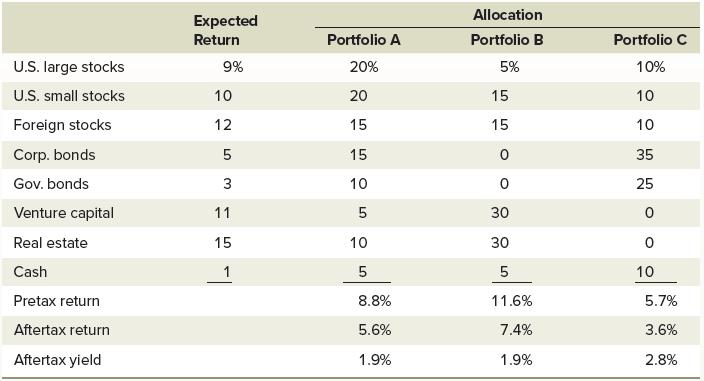

4. Based on the information in the case, which one of the following portfolios should the Analees choose?

a. Portfolio A

b. Portfolio B

c. Portfolio C

Step by Step Answer:

Fundamentals Of Investments Valuation And Management

ISBN: 9781266824012

10th Edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin