Beachwood Builders merged with Country Point Homes on December 31, 2002. Both companies were builders of midscale

Question:

Beachwood Builders merged with Country Point Homes on December 31, 2002. Both companies were builders of midscale and luxury homes in their respective markets. In 2019, because of tax considerations and the need to segment the business, Beachwood decided to spin off Country Point, its luxury subsidiary, to its shareholders. Beachwood retained Bernheim Securities to value the spin-off of Country Point as of December 31, 2019.

When the books closed on 2019, Beachwood had $140 million in debt outstanding due in 2028 at a coupon rate of 8 percent, which is a spread of 2 percent above the current risk-free rate. Beachwood also had 5 million common shares outstanding. It pays no dividends, has no preferred shareholders, and faces a total tax rate of 30 percent. Bernheim is assuming a market risk premium of 11 percent.

The common equity allocated to Country Point for the spin-off was $55.6 million as of December 31, 2019. There was no long-term debt allocated from Beachwood.

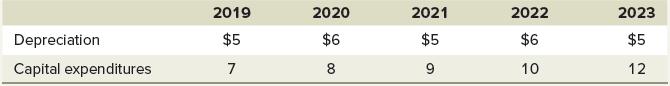

The managing directors in charge of Bernheim’s construction group, Denzel Johnson and Cara Nguyen, are prepping for the valuation presentation. Ms. Nguyen tells Mr. Johnson that Bernheim estimated Country Point’s net income at $10 million in 2019, growing $5 million per year through 2023. Based on Ms. Nguyen’s calculations, Country Point will be worth $223.7 million in 2023. Ms. Nguyen decided to use a cost of equity for Country Point in the valuation equal to its return on equity at the end of 2019 (rounded to the nearest percentage). Ms. Nguyen also gives Mr. Johnson the table she obtained from Beachwood projecting depreciation and capital expenditures ($ in millions):

1. What is the estimate of Country Point’s free cash flow (FCF) in 2021?

a. 25

b. 16

c. 11

2. What is the cost of capital that Ms. Nguyen used for her valuation of Country Point?

a. 18 percent

b. 17 percent

c. 15 percent

3. Given Ms. Nguyen’s estimate of Country Point’s terminal value in 2023, what is the growth assumption she must have used for free cash flow after 2023?

a. 7 percent

b. 9 percent

c. 3 percent

4. The value of beta for Country Point is:

a. 1.09

b. 1.27

c. 1.00

5. What is the estimated value of Country Point in a proposed spin-off?

a. $144.5 million

b. $162.5 million

c. $178.3 million

Step by Step Answer:

Fundamentals Of Investments Valuation And Management

ISBN: 9781266824012

10th Edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin