Given the inputs to the Black-Scholes option pricing formula provided in Example 16.2, calculate call and put

Question:

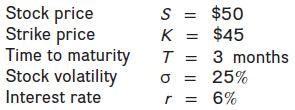

Given the inputs to the Black-Scholes option pricing formula provided in Example 16.2, calculate call and put option deltas. The necessary values for d1, N(d1), and N(–d1) were provided in Example 16.2.

![]()

Example 16.2

Calculate call and put option prices, given the following inputs to the Black-Scholes option pricing formula:

Transcribed Image Text:

N (d) = N(1.02538) = .84741 N(-d)=1-N (d) = .15259

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Therefore Call option d...View the full answer

Answered By

Cyrus Sandoval

I a web and systems developer with a vast array of knowledge in many different front end and back end languages, responsive frameworks, databases, and best code practices. My objective is simply to be the best web developer that i can be and to contribute to the technology industry all that i know and i can do. My skills include:

- Front end languages: css, HTML, Javascript, XML

- Frameworks: Angular, Jquery, Bootstrap, Jasmine, Mocha

- Back End Languages: Java, Javascript, PHP,kotlin

- Databases: MySQL, PostegreSQL, Mongo, Cassandra

- Tools: Atom, Aptana, Eclipse, Android Studio, Notepad++, Netbeans.

Having a degree in Computer Science enabled me to deeply learn most of the things regarding programming, and i believe that my understanding of problem solving and complex algorithms are also skills that have and will continue to contribute to my overall success as a developer.

I’ve worked on countless freelance projects and have been involved with a handful of notable startups. Also while freelancing I was involved in doing other IT tasks requiring the use of computers from working with data, content creation and transcription.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Fundamentals Of Investments Valuation And Management

ISBN: 9781266824012

10th Edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

Question Posted:

Students also viewed these Business questions

-

In the United States, SFAS 123 required firms to report employee stock option (ESO) expense either in its financial statements proper or in a financial statement. Many firms based their expense...

-

KYC's stock price can go up by 15 percent every year, or down by 10 percent. Both outcomes are equally likely. The risk free rate is 5 percent, and the current stock price of KYC is 100. (a) Price a...

-

Refer to the salesforce.com financial statement excerpts given below to answer the questions. On January 31, 2015, the price of salesforce.com stock was $56.45, and there were 650,596,000 shares of...

-

Research is a process of discovering new knowledge. In the Code of Federal Regulations (45 CFR 46.102(d)) pertaining to the protection ofhuman subjects,research is defined as:...

-

Little Oil has outstanding 1 million shares with a total market value of $20 million. The firm is expected to pay $1 million of dividends next year, and thereafter the amount paid out is expected to...

-

Brunswick Parts is a small manufacturing firm located in eastern Canada. The company, founded in 1947, produces metal parts for many of the larger manufacturing firms located in both Canada and the...

-

Describe the rights and responsibilities of employees.

-

Dan Simms is the president and sole shareholder of Simms Corporation, 1121 Madison Street, Seattle, WA 98121. Dan plans for the corporation to make a charitable contribution to the University of...

-

Type cd and then hit enter key. Now, create a directory lab2 and perform following steps in lab2 directory. root bin etc users tmp usr john work work carol play 1. Create the directory tree depicted...

-

Find the option Greeks for an option on General Mills (GIS).

-

In the Black-Scholes option pricing model, the value of an option contract is a function of five inputs. Which of the following is not one of these inputs? a. The price of the underlying stock b. The...

-

Angrist and Krueger (1991) use quarter of birth as an instrumental variable to estimate the returns to schooling, using a sample of 327,509 from the 1980 census. The model of interest is \(\ln (W A G...

-

BF1 BF 2 BF 3 BF4 SQL Query SELECT O.pid, O.orderDate FROM Department D JOIN Order O ON (D.did=O.did) WHERE D.dName = 'Database Management' AND O.orderDate> '2021-08-19; SELECT O.did FROM Supplier S...

-

Create a Java function that takes a List> representing a matrix and returns the matrix in spiral order.

-

Write a Java function that efficiently computes the nth Fibonacci number using dynamic programming.

-

Can digital technologies improve every part of the job of teaching in positive and productive ways? When might technology be unhelpful or even counterproductive? To explore these questions,...

-

Exercise 4. a) Establish the Disjunctive Property for S4: HOA VB yields A or B. Hint: Use the Kripke models construction from the proof of Disjunctive Property for Int. Check the details. b) Does the...

-

Why is account classification a preferred method for estimating costs when submitting a proposal for grant funding? For example, a not-for-profit organization might apply to the Gates Foundation for...

-

Which of the following statements is false? a. Capital leases are not commonly reported in a Capital Projects Fund. b. A governmental entity may report a Capital Project Fund in one year but not the...

-

Match each of the following accounts with the appropriate description that follows. _____ Raw materials inventory _____ Work-in-process inventory _____ Finished goods inventory _____ Cost of goods...

-

Match each of the following terms used in a manufacturing companys income statement with the equivalent term used in a merchandising companys income statement. _____ Cost of goods manufactured _____...

-

The following list of personnel within organizations comes from Figure 1.1. 1. Board of directors 2. Chief financial officer 3. Controller 4. Managerial accountant 5. Financial accountant 6. Tax...

-

How do transnational networks and global governance structures impact the formation and dissemination of agendas across borders, and what mechanisms are employed to harmonize diverse agendas and...

-

Determine the present value of the following single amounts. Note: Use tables, Excel, or a financial calculator. Round your final answers to nearest whole dollar amount. (FV of $1. PV of $1. FVA of...

-

A block 1.2 kg is on the plane that makes 30 degrees relative to horizontal. There is no friction. What is the mass m on the string if the block is moving to the right with acceleration 1.5 m/s? What...

Study smarter with the SolutionInn App