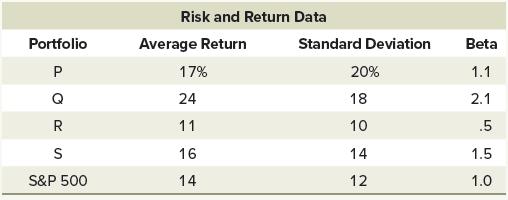

The Treynor portfolio performance measure for Portfolio P is: a. 8.18. b. 7.62. c. 6.00. d. 5.33.

Question:

The Treynor portfolio performance measure for Portfolio P is:

a. 8.18.

b. 7.62.

c. 6.00.

d. 5.33.

A pension fund administrator wants to evaluate the performance of four portfolio managers. Each manager invests only in U.S. common stocks. During the most recent five-year period, the average annual total return on the S&P 500 was 14 percent and the average annual rate on Treasury bills was 8 percent. The table above shows risk and return measures for each portfolio.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Investments Valuation And Management

ISBN: 9781266824012

10th Edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

Question Posted: