De Beers is a private holding company engaged in the exploration, mining and marketing of diamonds. The

Question:

De Beers is a private holding company engaged in the exploration, mining and marketing of diamonds.

The company primarily operates in Africa and markets its products across the globe. It is headquartered in Johannesburg, South Africa, and employs nearly 20,000 people. In the 2016 financial year, the company recorded revenues of US$6.1 billion.

Since the late 1800s, the South African multinational De Beers (www.debeersgroup.com) has regulated both the industrial and gemstone-diamond markets and effectively maintained an illusion of diamond scarcity. It has developed and nurtured the belief that diamonds are precious, invaluable symbols of romance. Every attitude consumers hold today about diamonds exists – at least in part –

because of the persistent efforts of De Beers.

Moreover, by monitoring the supply and distribution of diamonds throughout the world, De Beers has introduced and maintained an unprecedented degree of price stability for a surprisingly common mineral: compressed carbon. Such unique price stability lies within the cartel’s tight control over the distribution of diamonds. De Beers’ operating strategy has been pure and simple: to restrict the number of diamonds released into the market in any given year and to perpetuate the myth that they are scarce and, therefore, should command high prices.

De Beers spends about US$200 million a year to promote diamonds and diamond jewellery.

De Beers controls a producer’s cartel that operates as a quantity-fixing entity by setting production quotas for each member (as does OPEC). De Beers has successfully convinced the producers that the diamond supply must be regulated in order to maintain favourably high prices and profits.

During the early part of the last century much of the diamond cartel’s strength rested with De Beers’

control of the South African mines. Today, the source of power no longer comes from rough diamond production alone, but from a sophisticated network of production, marketing sales and promotion arrangements, all administered by De Beers.

It is interesting to note that diamond prices have little or no relation to the cost of extraction (production).

Table 1 shows average or ‘normal’ price markups on gemstones along the channel of distribution.

A diamond that may cost US$100 to mine can end up costing a consumer $920 at a local jewellery store. Business cycles and individual commercial practices may positively or negatively influence these figures, together with the gemstone quality. Diamond sales, known in the trade as ‘sights’, are held ten times a year in London, Lucerne, Switzerland and Kimberley, South Africa.

The sales are limited to approximately 160 privileged ‘sight-holders’, primarily owners of diamond-cutting factories in New York, Tel Aviv, Mumbai and Antwerp, who then sell to the rest of the diamond trade.

Diamond output from De Beers’ self-owned and self-operated mines constitutes only 40 per cent of the total world value of rough diamonds. Because it is not the sole producer of rough stones in the world, De Beers has had to join forces with other major diamond-

producing organizations, forming the international diamond cartel that controls nearly 70% of the world market. Furthermore there is increasing competition from Russian and Australian diamond producers.

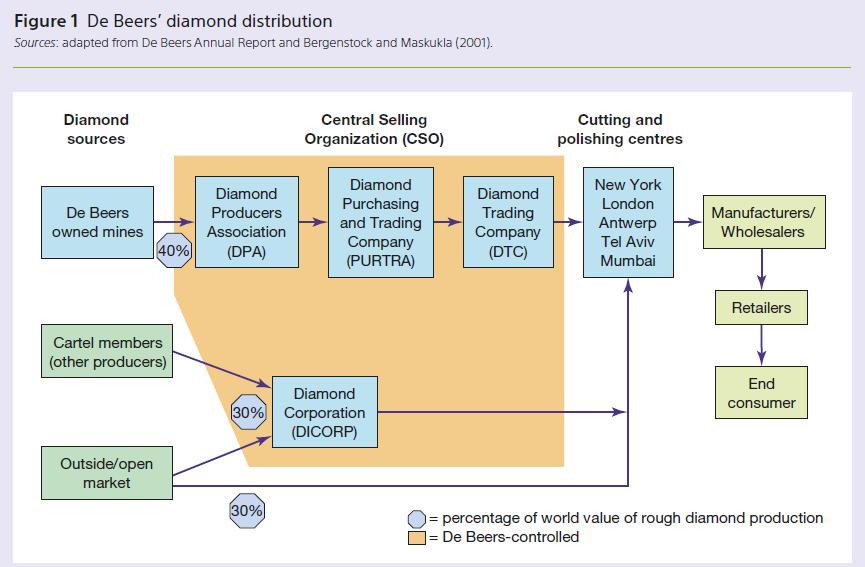

De Beers has constructed a controlled supply and distribution chain whereby all cartel producers are contracted to sell the majority of their entire output to a single marketing entity: the De Beers-controlled Central Selling Organization (CSO) (see Figure 1).

The total rough diamond supply controlled by the CSO comes from three sources: De Beers/Centenaryowned mines, outside suppliers contracted to the CSO (cartel members) and open market purchases via buying offices in Africa, Antwerp and Tel Aviv (rough output purchased from countries that have not signed an agreement with De Beers). De Beers functions as the sole diamond distributor. In any given year, approximately 70 per cent of the world’s diamonds pass through the CSO to cutters and brokers.

The economic success of the cartel depends highly on strict adherence to their rules, written or unwritten. Clients who follow the rules are rewarded with consistent upgrades in the quality and quantity of rough stones in their boxes, while those who circumvent them find progressively worse allocations and risk not being invited back to future sights

De Beers’ ‘forward integration’ decision

Until 2001, De Beers concentrated on supplying its diamonds to brand manufacturers, such as Cartier.

The core business of the De Beers Group remains the mining and marketing of rough diamonds. However, in January 2001 De Beers entered into a retail 50:50 joint venture with French luxury goods company Louis Vuitton Moet Hennessy (LVMH) to establish an independently managed De Beers diamond jewellery company. The joint venture, called De Beers Diamond Jewellers Ltd, sells diamond jewellery. The first De Beers boutique opened in 2002 on London’s Old Bond Street as the brand’s flagship store. A year later, the brand expanded to Asia with the opening of its first Tokyo stores. The brand expanded into the US with stores on Fifth Avenue in New York and Rodeo Drive in Beverly Hills in 2005. De Beers further expanded in the US in 2007 with stores in Las Vegas, Houston and McLean, VA, coinciding with the launch of a website with e-commerce capability. By 2010, there were De Beers retail stores in England, France, the US, Ukraine, Russia, Japan, Taipei, Hong Kong, Dubai and Macau. The joint venture’s worldwide store network of 40 shops extended across the US (7), Europe (7), Middle East (4), Asia (16).

LVMH is the home of premier brands in the categories of fashion and leather goods, watches and jewellery, wine and spirits, cosmetics and perfumes.

LVMH will contribute with its extensive experience in both developing luxury brands and rolling out premium retail concepts.

The ‘mother’ company, De Beers SA, contributes to the joint venture with its over 100 years of experience in the form of technology and individual experts to allow for the selection of the most beautiful diamonds.

As part of the joint venture agreement, De Beers SA transferred to De Beers LV the worldwide rights to use the De Beers brand name for luxury goods in consumer markets. From that point, De Beers would design, manufacture and sell premium diamond jewellery under its own brand name. The diamonds bearing De Beers’

brand name are now sold exclusively through De Beers stores, under the name De Beers Jewellers.

If customers are buying De Beers Jewellers diamonds online, the transportation to the buyer’s home is normally taken care of by FedEx premium service, that promise securely delivery.

Questions

1. What could be De Beers’ motives for making this ‘forward integration’ into the retail and consumer market?

2. Is it a wise decision?

3. How should De Beers develop its internet strategy following this ‘forward integration’ strategy?

4. Would it be possible for De Beers, with its branded diamonds, to standardize the international marketing strategy across borders?

Step by Step Answer: