Tencent is a Chinese investment conglomerate founded in 1998. It controls hundreds of subsidiaries, creating a broad

Question:

Tencent is a Chinese investment conglomerate founded in 1998. It controls hundreds of subsidiaries, creating a broad portfolio of ownerships and investments across a diverse business, like social network, mobile games, music, e-commerce and payment systems.

It is one of the most active investment corporations in the world, with stakes in 600 companies, of which most of them are located in Asia, but it has also invested in US companies, like Epic Games (offering the famous Fortnite game). Today, Tencent is the world’s largest gaming company, and one of the largest social media companies.

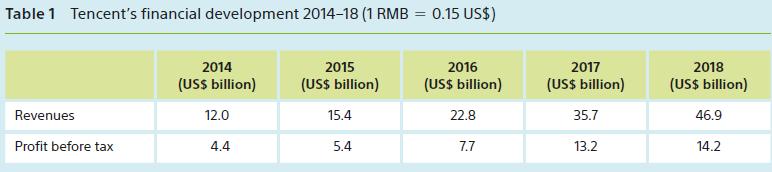

Table 1 shows the financial development of Tencent from 2014 to 2018.

Tencent is Asia’s most valuable company with a market capitalization of around USD 550 billion (April 2018). By the end of 2018 there were 55,000 employees in Tencent.

Tencent’s WeChat and the competition The crown jewel in the product portfolio of Tencent is WeChat. This is the app that many have called the ‘Facebook of China’. The app has morphed into a super app that Chinese consumers are using throughout the day to message each other, order meals, watch films and play games. First released in 2011, it was first marketed as Weixin (for the local audience) and was rebranded as WeChat in 2012 for the international audience. So, WeChat is the international version of WeiXin, which is the local Chinese version. They are basically just the same app (in the following we just use the term, WeChat). WeChat has a lot of popular app features: Voice and text messaging, group messaging, payment and mobile games. Today (April 2019)

Tencent has nearly 1.1 billion monthly active users (MAU) of which 90 per cent are living in China. This makes WeChat to one of the leading social networks worldwide, placing fifth in MAU (no. 1 is Facebook).

Many analysts think that WeChat’s share of China’s mobile payment market will soon overtake that of Alibaba Group’s Alipay. In 2018 WeChat’s share of the Chinese mobile payment market increased to nearly 40 per cent (with WePay) whereas Alipay’s share fell to 50 per cent. The size of the Chinese mobile payment market (in 2018 it was around US$6,000 billion) is 40 times bigger than the US mobile payment market at US$150 billion.

The battle between Tencent and Alibaba is spilling beyond China’s borders. Earlier this week, Tencent announced a partnership between WeChat and Silicon Valley startup Citcon to roll out a cashless payment service for Chinese travellers in the USA. WeChat now offers cashless payment in 15 other countries, including Japan and Singapore. Alipay offers cashless payment in 26 countries. Payments have become a key battleground for the online giants. Walmart, which along with Carrefour is among the biggest foreign retailers in China, has been accepting Alipay in its 400-plus stores in the country. However, in March 2018 Walmart said it had entered into partnership with WeChat Pay in the western region. Payments yield only very thin profits but have enabled the two tech companies to expand their financial services arms to include more profitable areas spanning loans, insurance and asset management.

Shops, taxis and hospitals across China accept both the payment methods of Tencent and Alibaba, with some shops and services refusing to accept cash.

Alibaba remains the industry leader but Tencent has made huge inroads. Tencent, for example, scored an early win with Starbucks’ coffee shops across China but in the beginning of 2018 the chain said it would accept Alipay too.

In the car ride-sharing sector, Tencent-backed Didi Dache was up against Alibaba-backed Kuaidi Dache.

They have spent hundreds of millions of dollars on promotions and rebates until agreeing in 2015 on a strategic merger. The new company (as a result of the strategic merger between the two), Didi Chuxing, has chosen to ‘attack’ Uber, which surrendered and chose to leave China in 2017.

In 2018, the war between Tencent and Alibaba appeared on a new front: bike-sharing. Tencent-backed Mobike (which uses WePay), and Alibaba-backed Ofo (which uses Alipay) dominate the sector.

WeChat has also a very engaged user base, which in 2018 on average used 70 minutes per day, whereas the average Facebook user used 60 minutes on the app. Furthermore, about a fifth of WeChat users used the app between two and four hours per day.

Tencent’s Gaming Tencent’s biggest cash engine is the online gaming, which accounted for nearly 40 per cent of the revenues in 2018. Within ‘PCs’ Tencent is a clear no. 1 with 66 per cent market share in China. Within ‘smart phone’ games Tencent’s market share is lower, but still they are no. 1 with 38 per cent market share (2018).

China’s online game market is the world’s largest and is dominated by top players such as Tencent and NetEase. Tencent owns Riot Games which is most known as the developer of the successful game, League of Legends, which generated US$2.0 billion in revenues in 2018 and has about 80 millions of monthly active players.

Tencent also own 85 per cent of game developer Supercell which is the owner of the game, Clash of Clans.

In 2012, Tencent purchased a 48 per cent stake of Fortnite developer, the US-based Epic Games, for US$330 million. Fortnite is widely considered to be one of the most popular games of all times, with estimates of about US$300 million in revenues monthly and over 125 million players worldwide.

In middle of 2018, Tencent experienced a drop in the games turnover, after the government in Beijing stopped approving commercial licences for new games. Beijing has criticized one of the company’s top games for being too addictive for children. The Chinese government has also indicated that excessive gaming damages children’s eyesight. In response, Tencent limited the time children could spend on games. The company even launched a pilot game using facial recognition to ensure that children were not trying to get around the limits by signing in with adult IDs.

Tencent is now considering focusing more on business customers, as the rival Alibaba has done by rolling out cloud services for business customers.

Tencent business model Compared to Facebook, Tencent has a much more diversified revenue stream, which is less dependent on ad revenue for growth. Tencent is more building on a membership system, where users are offered value added services (VAS). In 2018 advertising Tencent’s advertising revenues made up 20 per cent of the total revenues, which is much lower than Facebook. The biggest Tencent revenue generator is the fee-based revenues for online games.

Tencent is entering an alliance with LEGO China has the first place as the world’s largest toy producer and exporter with 1,300 large-scale toy manufacturers in China. At the same time, China has 236 million kids ranging from zero to 14 years old, and 76 per cent of the Chinese urban population is expected to become middle class by 2022, with higher disposable income and expense.

Lego has seen a slowdown in toys sales growth in recent years, but the Chinese market has been a bright spot with sales growing approximately 20–25 per cent per year in the period 2015–18. The toys market in China is very fragmented, and LEGO has only about a 4 per cent market share in China, followed by global competitors, Mattel and Hasbro with around 3 per cent and 2 per cent.

In November 2016, Lego opened a factory in Jiaxing, China, which it expects to produce 70–80 per cent of all Lego products sold in Asia.

In beginning of 2018, Lego announced the partnership with Tencent, China’s biggest social network and gaming company, aimed to create a safe online environment covering content, platforms, and experiences tailored for Chinese children.

China’s online game market has experienced dramatic growth in recent years, but the government is showing increased concern about what it sees as the industry’s negative aspects, including violent content and its effect on the eyesight of the country’s youth.

What LEGO is looking for now with Tencent is to find more creative ways of reaching children, and creating attractive content with Tencent, in video games.

The partnership includes developing a Lego video zone for children on the Tencent video platform, as well as developing and operating Lego branded licensed games. It also includes LEGO BOOST — a building and coding set that lets children turn their brick creations into moving objects — and will explore developing a joint social network for children in China.

Questions

You are an international marketing specialist and a Tencent board member has asked you to give your view on Tencent’s future global marketing strategy. They have asked you to answer the following questions:

1. Explain the global competitive advantage of Tencent versus Alibaba and Facebook.

2. Should Tencent focus more on the business customers (B2B market) and follow in the footsteps of Alibaba?

3. Focusing on servicing global business customers will require a strategy shift within Tencent. What organizational changes should take place as a consequence of this change towards domestic and international B2B customers?

4. What are the motives of LEGO and Tencent to enter an alliance?

5. Which metrics should Tencent use in order to control the global marketing activities?

Step by Step Answer: