The following totals were drawn from Independence City's Schedule of Changes in Capital Assets by Function and

Question:

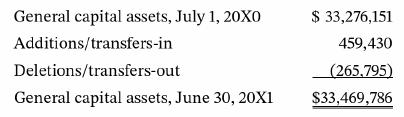

The following totals were drawn from Independence City's "Schedule of Changes in Capital Assets by Function and Activity," included in the city's financial statements for the year ending June 30, 20Xl:

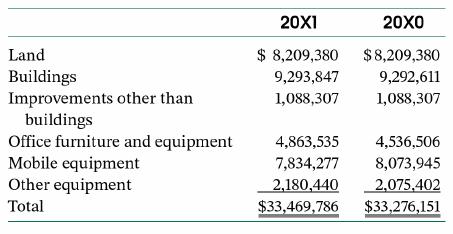

The complete schedule disaggregates the data by function (e.g., general government, public safety, public works, health and welfare, culture, and recreation) and subfunction (e.g., park maintenance, recreation, tourism). Another schedule, "Schedule of General Capital Assets by Source," shows the beginning and ending balances of the specific types of assets:

1. Assume that the assets, excluding land, had an average useful life of 20 years. What percentage of the total assets, excluding land, would you expect to have been retired each year?

2. What percentage of the assets (beginning of year values), excluding land, were actually retired during 20Xl (assuming that all deletions/ transfers out represent retirements)?

3. What was the average useful life of the assets as implied by this percentage?

4. Assume that the entire $265,795 of the deletions and transfers-out applied to the mobile equipment. What would have been the useful life of the equipment as suggested by the percentage of the equipment retired?

5. Do you think it is likely that the city was conscientious about removing assets from its general capital assets account as they were taken out of service?

6. Is it true that under the provisions of Statement No. 34 a government's failure to remove from its accounting records assets that it has taken out of service after they exceeded their useful lives have relatively little significance on its government-wide statements? Explain.

Step by Step Answer:

Government And Not For Profit Accounting Concepts And Practices

ISBN: 9781119803898

9th Edition

Authors: Michael H. Granof, Saleha B. Khumawala, Thad D. Calabrese