Amos Sharp recently opened his own accounting firm on October 1, which he operates as a sole

Question:

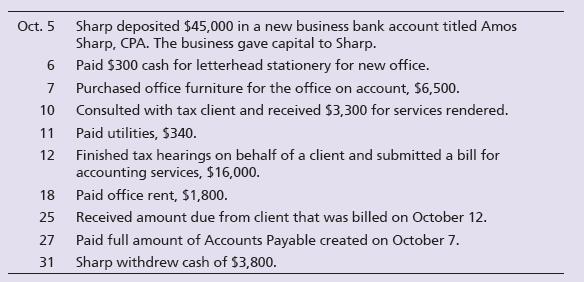

Amos Sharp recently opened his own accounting firm on October 1, which he operates as a sole proprietorship. The name of the new entity is Amos Sharp, CPA. Sharp experienced the following events during the organizing phase of the new business and its first month of operations in 2024:

Requirements

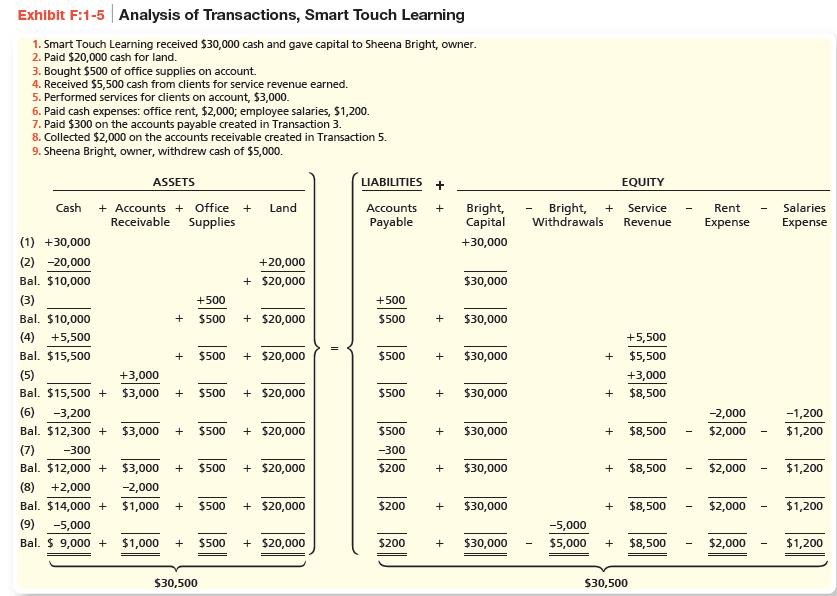

1. Analyze the effects of the events on the accounting equation of Amos Sharp, CPA. Use a format similar to Exhibit F:1-5. Use the following accounts: Cash; Accounts Receivable; Office Supplies; Furniture; Accounts Payable; Sharp, Capital; Sharp, Withdrawals; Service Revenue; Rent Expense; and Utilities Expense.

In Exhibit F:1-5.

2. Prepare the following financial statements:

a. Income statement for the month ended October 31, 2024.

b. Statement of owner’s equity for the month ended October 31, 2024.

c. Balance sheet as of October 31, 2024.

Step by Step Answer:

Horngrens Accounting The Financial Chapters

ISBN: 9780136162186

13th Edition

Authors: Tracie Miller Nobles, Brenda Mattison