Muriel Thomas, accountant for Duchlorol Ltd., was injured in a hiking accident. Another employee prepared the income

Question:

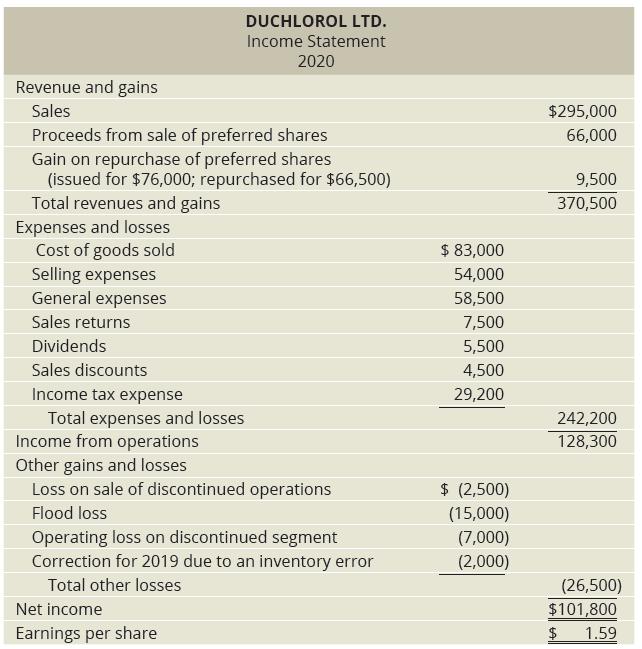

Muriel Thomas, accountant for Duchlorol Ltd., was injured in a hiking accident. Another employee prepared the income statement shown on the next page for the fiscal year ended December 31, 2020.

The individual amounts listed on the income statement are correct. However, some accounts are reported incorrectly, and others do not belong on the income statement at all. Also, income tax (30 percent) has not been applied to all appropriate figures. Duchlorol Ltd. issued 64,000 common shares in 2012 and has not issued or repurchased common shares since that time. The Retained Earnings balance, as originally reported at December 31, 2019, was $242,500. There were no preferred shares outstanding at December 31, 2020.

Required

Prepare a corrected combined statement of income and retained earnings for the year ended December 31, 2020; include earnings per share. Prepare the income statement portion in single-step format. Use a two-column layout. Report expenses from largest to smallest.

Step by Step Answer:

Horngrens Accounting

ISBN: 9780135359785

11th Canadian Edition Volume 2

Authors: Tracie Miller Nobles, Brenda Mattison, Ella Mae Matsumura, Carol A. Meissner, Jo Ann Johnston, Peter R. Norwood