On January 1, 2019, Chris Hunts and Carol Lo formed the Chris and Carol Partnership by investing

Question:

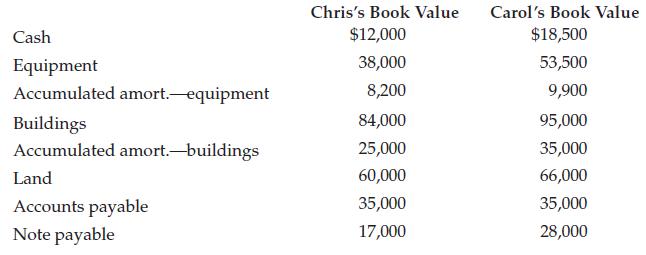

On January 1, 2019, Chris Hunts and Carol Lo formed the Chris and Carol Partnership by investing the following assets and liabilities in the business:

An independent appraiser was hired to provide the current market values of all assets. The values are: Chris’s equipment $29,000, Carol’s equipment $47,500, Chris’s building $90,000, Carol’s building $110,000, Chris’s land $78,000, and Carol’s land $80,000.

Chris and Carol agree to share profits and losses in a 60:40 ratio. During the first year of operations, the business net income is $74,000. Each partner withdrew $30,000 cash.

Required

1. Prepare the journal entries to record the initial investments in the business by Chris and Carol.

2. Prepare a balance sheet dated January 1, 2019, after the completion of the initial journal entries.

Step by Step Answer:

Horngrens Accounting

ISBN: 9780135359785

11th Canadian Edition Volume 2

Authors: Tracie Miller Nobles, Brenda Mattison, Ella Mae Matsumura, Carol A. Meissner, Jo Ann Johnston, Peter R. Norwood