Trail Equipment is a partnership owned by three individuals. The partners share profits and losses in the

Question:

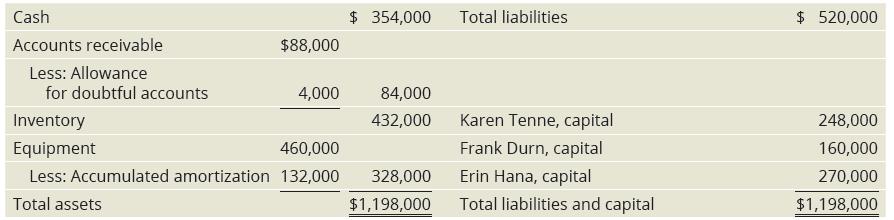

Trail Equipment is a partnership owned by three individuals. The partners share profits and losses in the ratio of 30 percent to Karen Tenne, 40 percent to Frank Durn, and 30 percent to Erin Hana. At December 31, 2020, the firm has the following balance sheet amounts:

Karen Tenne withdraws from the partnership on December 31. Required Record Tenne’s withdrawal from the partnership under the following independent plans:

a. In a personal transaction, Tenne sells her equity in the partnership to Michael Adams, who pays Tenne $176,000 for her interest. Durn and Hana agree to accept Adams as a partner.

b. The partnership pays Tenne cash of $72,000 and gives her a note payable for the remainder of her book equity in settlement of her partnership interest.

c. The partnership pays Tenne $260,000 cash for her equity in the partnership.

d. The partners agree that the equipment is worth $548,000 (net). After the revaluation, the partnership settles with Tenne by giving her cash of $44,000 and inventory for the remainder of her book equity.

Step by Step Answer:

Horngrens Accounting

ISBN: 9780135359785

11th Canadian Edition Volume 2

Authors: Tracie Miller Nobles, Brenda Mattison, Ella Mae Matsumura, Carol A. Meissner, Jo Ann Johnston, Peter R. Norwood