Martin Realtors, a real estate consulting firm, specializes in advising companies on potential new plant sites. The

Question:

Martin Realtors, a real estate consulting firm, specializes in advising companies on potential new plant sites. The company uses a job order costing system with a predetermined overhead allocation rate, computed as a percentage of direct labor costs.

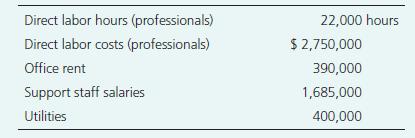

At the beginning of 2016, managing partner Jennifer Martin prepared the following budget for the year:

Root Manufacturing, Inc. is inviting several consultants to bid for work. Jennifer Martin wants to submit a bid. She estimates that this job will require about 240 direct labor hours.

Requirements 1. Compute Martin Realtors’

(a) hourly direct labor cost rate and

(b) predetermined overhead allocation rate.

2. Compute the predicted cost of the Root Manufacturing job.

3. If Martin wants to earn a profit that equals 55% of the job’s cost, how much should she bid for the Root Manufacturing job?

Step by Step Answer:

Horngrens Accounting The Managerial Chapters

ISBN: 9781292105871

11th Global Edition

Authors: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura