Consider the following details of the income statement of Fountain Pen Ltd, a Swedish company that produces

Question:

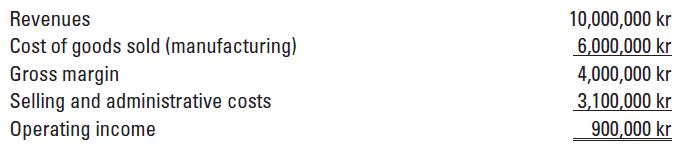

Consider the following details of the income statement of Fountain Pen Ltd, a Swedish company that produces special pens, for the last year:

An analysis of Fountain Pen Ltd’s costs reveals that its fixed manufacturing costs were 2,400,000 kr and its fixed selling and administrative costs were 2,300,000 kr. The sales and administrative costs include sales commissions (3% of sales). The company had sold 2,000,000 pens near the end of the year. King Burger had offered to buy 150,000 pens on a special order. To fill the order, a special clip bearing King Burger emblem would have had to be made for each pen. King Burger’s intends to use the pens in special promotion during next Christmas.

Even though Fountain Pen Ltd has some idle plant capacity, the president rejects King Burger’s offer of 660,000 kr for the 150,000 pens. He said that King Burger’s offer is too low. While Fountain Pen would avoid paying commission, it would incur an extra cost of 0.20 kr per clip for the emblem and assembling it with the pens. If Fountain Pen reduced its selling price, it would begin a chain reaction of competitors’ price-cutting and of customers wanting special deals.

Fountain Pen wants to sell at no lower than 8% above its full cost of 9,100,000 kr (2,000,000 @ 4.55kr), plus the extra 0.20 kr per clip less the savings in commissions.

Required

1. Compute the variable cost per unit for:

a. Manufacturing cost

b. Selling and administrative costs

2. Compute the incremental contribution margin of accepting the order.

3. By what percentage would operating income increase or decrease if King Burger’s order had been accepted?

4. Do you agree with the president’s decision? Why?

Step by Step Answer:

Horngrens Cost Accounting A Managerial Emphasis

ISBN: 9780135628478

17th Edition

Authors: Srikant M. Datar, Madhav V. Rajan