Ebbelly Transport Services is a trucking business in the United States. The company has two divisions (Loading

Question:

Ebbelly Transport Services is a trucking business in the United States. The company has two divisions (Loading and Off-loading) and uses the dual-rate method for allocating trucking costs to each round-trip to both divisions. At the start of 2019, the budgeted costs were:

Variable cost per round-trip........................$ 1,500

Fixed costs...................................................$200,000

The actual results for 225 round trips made in 2019 were:

Variable costs.............................................$303,750

Fixed costs..................................................$180,000

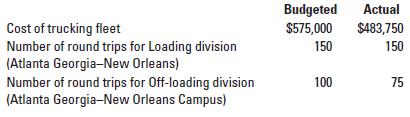

Ebbelly Transport Services charge the divisions for variable costs (drivers, fuel, and tolls) and fixed costs (vehicle depreciation, insurance, and registration fees) of operating the trucks. Each division is evaluated based on division operating income. In 2019, the trucking fleet had a practical capacity of 250 round trips between Atlanta, Georgia, and New Orleans, Louisiana. It recorded the following information:

Required

1. Using the dual-rate method, what are the costs allocated to the Loading division and the Off-loading division when

(a) variable costs are allocated using the budgeted rate per round-trip and actual roundtrip used by each division and

(b) fixed costs are allocated based on the budgeted rate per round-trip and round-trips budgeted for each division.

2. From the viewpoint of Loading division, what are the effects of using the dual-rate method rather than the single-rate method?

Step by Step Answer:

Horngrens Cost Accounting A Managerial Emphasis

ISBN: 9780135628478

17th Edition

Authors: Srikant M. Datar, Madhav V. Rajan