Snappy Tiles is a small distributor of marble tiles. Snappy identifies its three major activities and cost

Question:

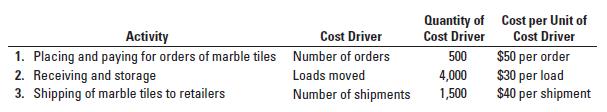

Snappy Tiles is a small distributor of marble tiles. Snappy identifies its three major activities and cost pools as ordering, receiving and storage, and shipping, and it reports the following details for 2019:

Required

For 2019, Snappy buys 250,000 marble tiles at an average cost of $3 per tile and sells them to retailers at an average price of $4 per tile. Assume Snappy has no fixed costs and no inventories.

1. Calculate Snappy’s operating income for 2019.

2. For 2020, retailers are demanding a 5% discount off the 2019 price. Snappy’s suppliers are only willing to give a 4% discount. Snappy expects to sell the same quantity of marble tiles in 2020 as in 2019. If all other costs and cost-driver information remain the same, calculate Snappy’s operating income for 2020.

3. Suppose further that Snappy decides to make changes in its ordering and receiving-and-storing practices. By placing long-run orders with its key suppliers, Snappy expects to reduce the number of orders to 200 and the cost per order to $25 per order. By redesigning the layout of the warehouse and reconfiguring the crates in which the marble tiles are moved, Snappy expects to reduce the number of loads moved to 3,125 and the cost per load moved to $28. Will Snappy achieve its target operating income of $0.30 per tile in 2020? Show your calculations.

Step by Step Answer:

Horngrens Cost Accounting A Managerial Emphasis

ISBN: 9780135628478

17th Edition

Authors: Srikant M. Datar, Madhav V. Rajan