Question: 1. Carol Harris, Ph.D, CPA, is a single taxpayer and she lives at 674 Yankee Street, Durham, NC 27409. Her Social Security number is 793-52-4335.

1. Carol Harris, Ph.D, CPA, is a single taxpayer and she lives at 674 Yankee Street, Durham, NC 27409. Her Social Security number is 793-52-4335. Carol is an Associate Professor of Accounting at a local college. Carol’s earnings and withholding from the college for 2010 are:

Earnings from the college $54,000 Federal income tax withheld 8,800 State income tax withheld 2,500 FICA tax of $3,348 and Medicare tax of $783 were also withheld from Carol’s earnings.

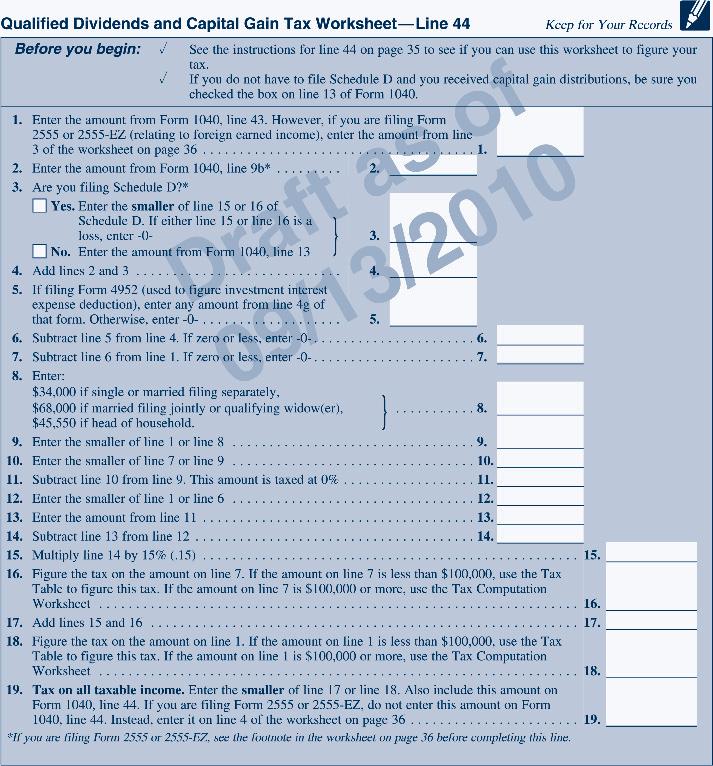

Carol’s other income includes interest of $145 from a savings account at New England Bank and $450 of qualified dividends from Microsoft.

During the year, Carol paid the following amounts (all of which can be substantiated):

Carol drove her car 20,000 miles in total, of which 5,000 miles were for commuting.

Carol made 2010 estimated tax payments to the U.S. Treasury of $3,000 for each quarter.

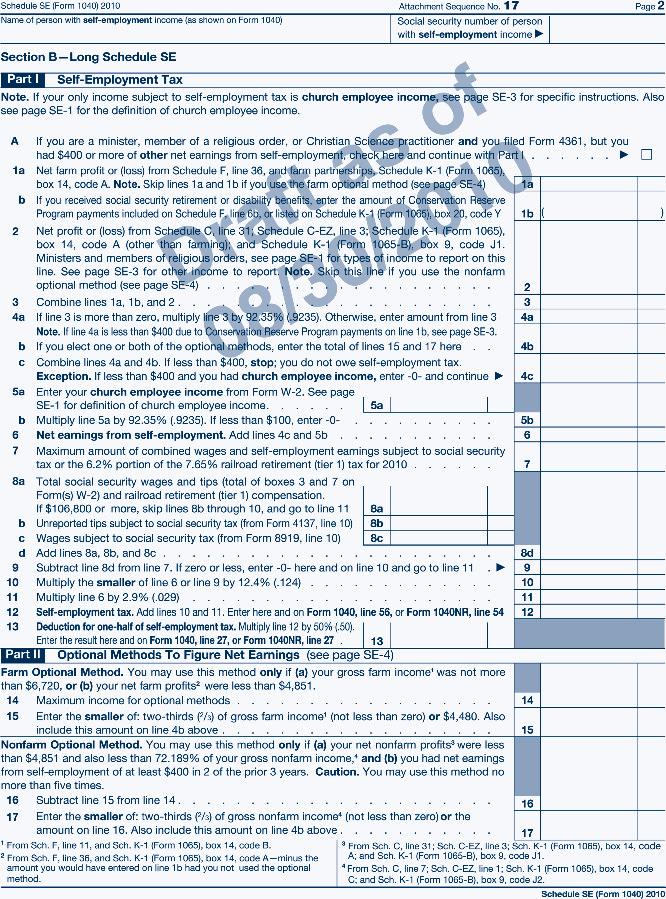

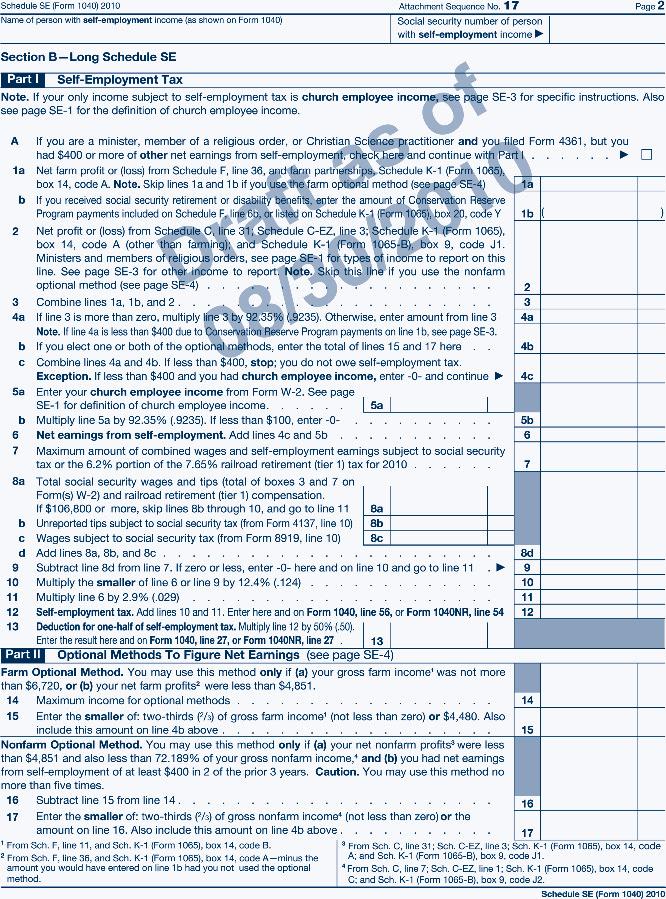

Required: Complete Carol’s federal tax return for 2010. Use Form 1040, Schedule A, Schedule C, Schedule D, Schedule SE, Schedule M, and the worksheet on pages 9-49 through 9-60 to complete this tax return. Make realistic assumptions about any missing data.

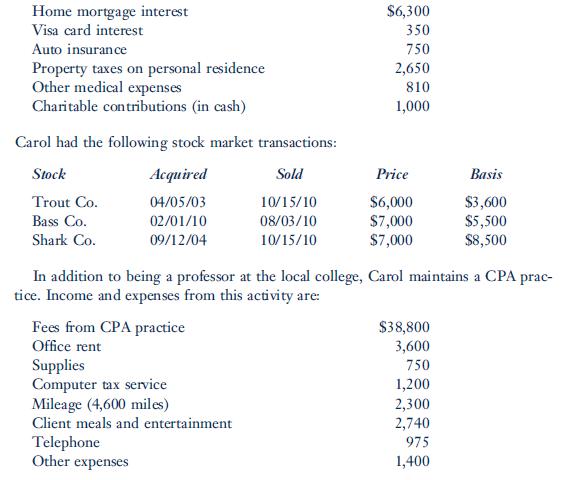

Home mortgage interest Visa card interest Auto insurance Property taxes on personal residence Other medical expenses Charitable contributions (in cash) Carol had the following stock market transactions: $6,300 350 750 2,650 810 1,000 Stock Acquired Sold Price Basis Trout Co. 04/05/03 10/15/10 $6,000 $3,600 Bass Co. 02/01/10 08/03/10 $7,000 $5,500 Shark Co. 09/12/04 10/15/10 $7,000 $8,500 In addition to being a professor at the local college, Carol maintains a CPA prac- tice. Income and expenses from this activity are: Fees from CPA practice $38,800 Office rent 3,600 Supplies 750 Computer tax service 1,200 Mileage (4,600 miles) 2,300 Client meals and entertainment 2,740 Telephone 975 Other expenses 1,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts