Dr. Carol Harris, CPA, is a single taxpayer and she lives at 674 Yankee Street, Durham, NC

Question:

Dr. Carol Harris, CPA, is a single taxpayer and she lives at 674 Yankee Street, Durham, NC 27409. Her Social Security number is 793-52-4335 and her birthdate is July 1, 1968. Carol is an Associate Professor of Accounting at a local college. Carol’s earnings and withholding from the college for 2016 are:

FICA tax of $3,385.20 and Medicare tax of $791.70 were also withheld from Carol’s earnings. Carol’s other income includes interest of $167 from a savings account at Bank of the Carolinas and $485 of qualified dividends from Microsoft.

Carol received a 2016 Form 1099-G from the state of North Carolina reporting a state income tax refund of $127 from 2015. Carol itemized her deductions in 2015.

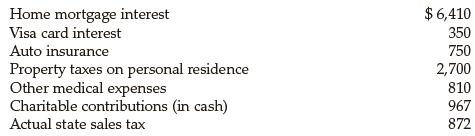

During the year, Carol paid the following amounts (all of which can be substantiated):

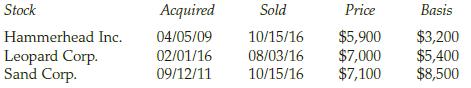

Carol had the following stock market transactions, all of which were reported on Form 1099-B, along with the basis of the stock sold:

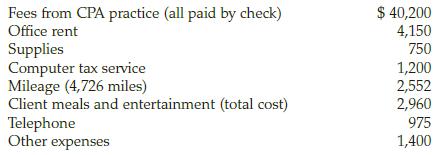

In addition to being a professor at the local college, Carol maintains a CPA practice located at 700 Accounting Way, Durham, NC 27409. Income and expenses from this activity are:

Carol drove her car (placed in service on January 1, 2014) 20,000 miles in total, of which 5,000 miles were for commuting. Carol made 2016 estimated tax payments to the U.S. Treasury of $3,000 for each quarter.

Required: Complete Carol’s federal tax return for 2016. Use Form 1040, Schedule A, Schedule C, Schedule D, Form 8949, Schedule SE, and the Qualified Dividends and Capital Gains Tax Worksheet on Pages 9-51 through 9-63 to complete this tax return. Make realistic assumptions about any missing data.

Step by Step Answer:

Income Tax Fundamentals 2017

ISBN: 9781305872738

35th Edition

Authors: Gerald E. Whittenburg, Steven Gill, Martha Altus Buller