1. The following information is available for the Albert and Allison Gaytor family in addition to that...

Question:

1. The following information is available for the Albert and Allison Gaytor family in addition to that provided in Chapters 1–6.

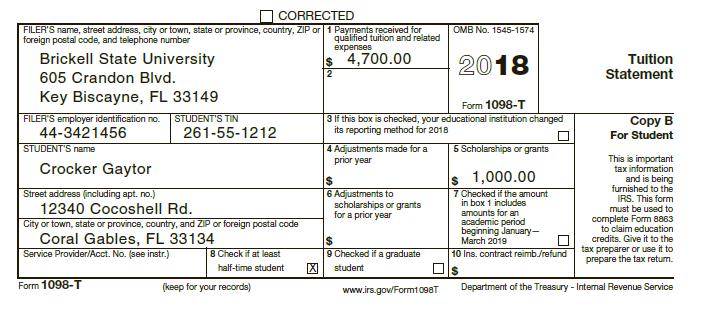

The Gaytors paid tuition and fees for both Crocker and Cayman to attend college. Recall that Crocker is a freshman at Brickell State and Cayman is a part-time student in community college. Crocker received a $1,000 scholarship from Brickell State. Crocker’s Form 1098-T is shown below. The Gaytors paid tuition and fees of $1,400 for Cayman in 2018.

In December 2017, Albert’s 82 year-old aunt, Virginia Everglades (Social Security number 699-19-9000), was unable to support herself and moved in with the Gaytors. She lived with them for all of 2018. The Gaytors provided more than one-half of Aunt Virginia’s support. Virginia’s only source of income is a small annuity that paid her $3,100 in 2018. While Albert and Allison were working, the Gaytors hired a nanny service from time to time to take care of Aunt Virginia. The Gaytors paid $3,400 to Nannys R Us in 2018. Nannys R Us (EIN 34-1234123) is located at 80 SW 22nd Avenue, Miami, FL 33133.

Required:

Combine this new information about the Gaytor family with the information from Chapters 1–6 and complete a revised 2018 tax return for Albert and Allison. Be sure to save your data input files since this case will be expanded and completed with more tax information in Chapter 8.

Step by Step Answer:

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill