1. The following additional information is available for the family of Albert and Allison Gaytor. In 2016,...

Question:

1. The following additional information is available for the family of Albert and Allison Gaytor.

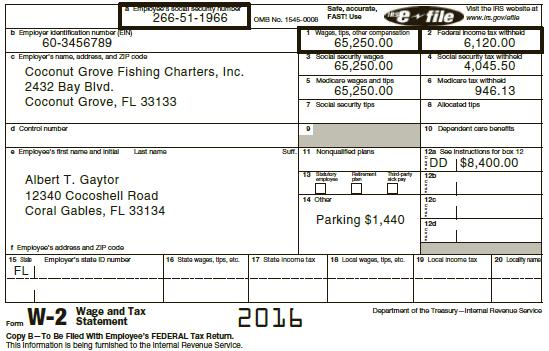

In 2016, Albert received a Form W-2 from his employer, Coconut Grove Fishing Charters, Inc.:

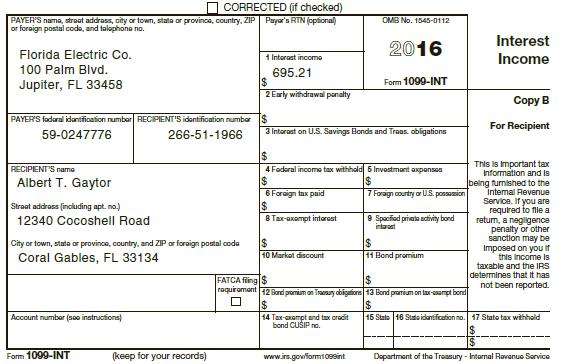

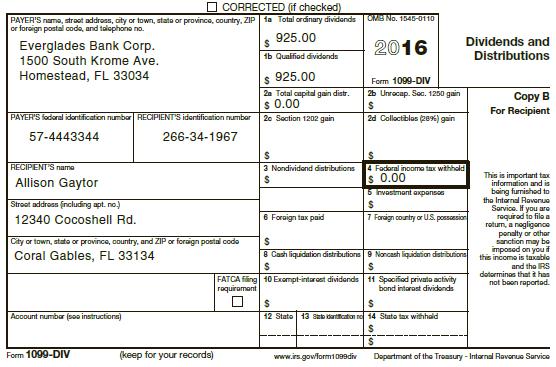

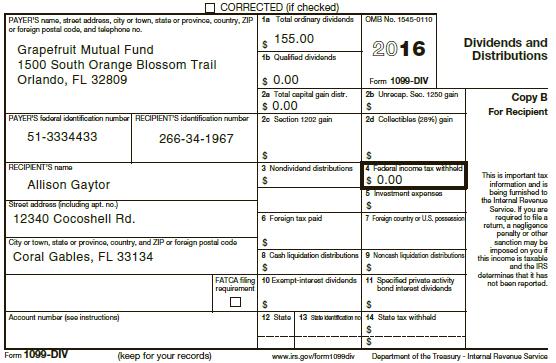

In addition to the interest from Chapter 1, Albert and Allison also received three Form 1099s:

The Gaytors also received qualified dividends of $500 from Florida Sugar Corp. and interest of $725 from bonds issued by the Miami-Dade County Airport Authority (Form 1099s not shown).

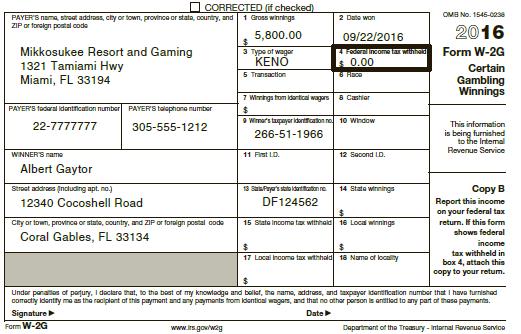

Albert went to the casino on his birthday and won big, as reflected on the following Form W-2G:

Albert had no other gambling income or losses for the year.

In February, Allison received $50,000 in life insurance proceeds from the death of her friend, Sharon.

In July, Albert’s uncle Ivan died and left him real estate (undeveloped land) worth $72,000.

Five years ago, Albert and Allison divorced. Albert married Iris, but the marriage did not work out and they divorced a year later. Under the divorce decree, Albert pays Iris $11,400 per year in alimony. All payments were on time in 2016 and Iris’ Social Security number is 667-34-9224. Three years ago, Albert and Allison were remarried.

Coconut Fishing Charters, Inc. pays Albert’s captain’s license fees and membership dues to the Charter Fisherman’s Association. During 2016, Coconut Fishing paid $1,300 for such dues and fees for Albert.

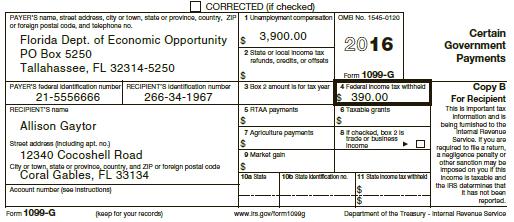

Allison was laid off from her job on January 2, 2016. For 2016, she received a Form 1099-G for unemployment benefits:

Albert and his family are covered by an employee-sponsored health plan at his work. Coconut Fishing pays $700 per month in premiums for Albert and his family. During the year, Allison was in the hospital for appendix surgery. The bill for the surgery was $10,100 of which the health insurance reimbursed Albert the full $10,100.

Coconut Fishing also pays for Albert’s parking at the marina. The monthly cost is $120.

Required: Combine this new informatiovn about the Gaytor family with the information from Chapter 1 and complete a revised 2016 tax return for Albert and Allison. Be sure to save your data input files since this case will be expanded with more tax information in later chapters.

Step by Step Answer:

Income Tax Fundamentals 2017

ISBN: 9781305872738

35th Edition

Authors: Gerald E. Whittenburg, Steven Gill, Martha Altus Buller