Carl Conch and Mary Duval are married and file a joint return. They live at 1234 Mallory

Question:

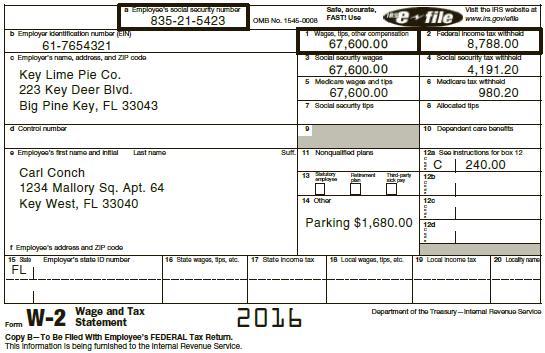

Carl Conch and Mary Duval are married and file a joint return. They live at 1234 Mallory Sq. Apt. 64, Key West, FL 33040. Carl works for the Key Lime Pie Company and Mary is a homemaker after losing her job in 2015. Mary’s Social Security number is 633-65-7912 and Carl’s is 835-21-5423. Carl’s birthdate is June 14, 1971 and Mary’s is October 2, 1971. Carl’s earnings are reported on the following Form W-2:

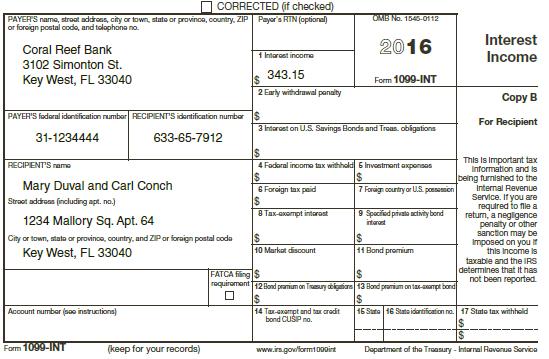

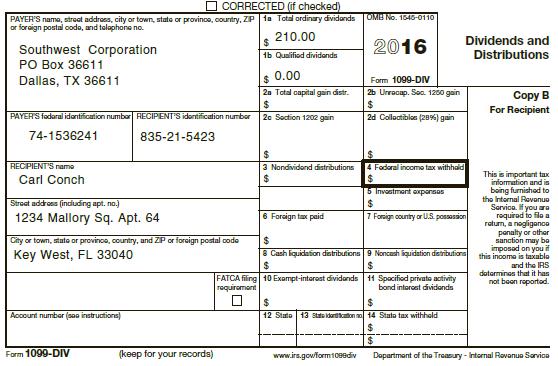

Carl and Mary received the following Form 1099s in 2016:

Mary is divorced and she pays her ex-husband (Tom Tortuga) child support. Pursuant to their divorce decree, Mary pays Tom $500 per month in child support. All payments were made on time in 2016.

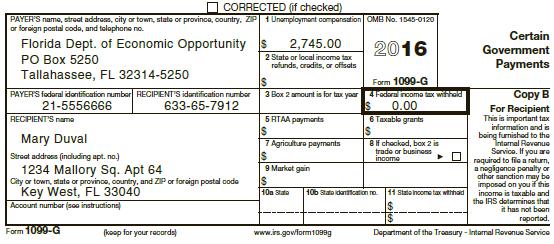

In June of 2016, Mary’s father gave her a cash gift of $75,000. Mary also received unemployment compensation as shown on the following Form 1099-G:

Mary won a $750 prize in a women’s club raffle in 2016. No income tax was withheld from the prize.

The Key Lime Pie Company provides Carl with a company car to drive while he is working. The Company spent $6,475 to maintain this vehicle during 2016. Carl never uses the car for personal purposes. The Key Lime Pie Company also provides a cafeteria for all employees on the factory premises. Other restaurants exist in the area and so Carl is not required to eat in the cafeteria, but he typically does. The value of Carl’s meals is $650 in 2016.

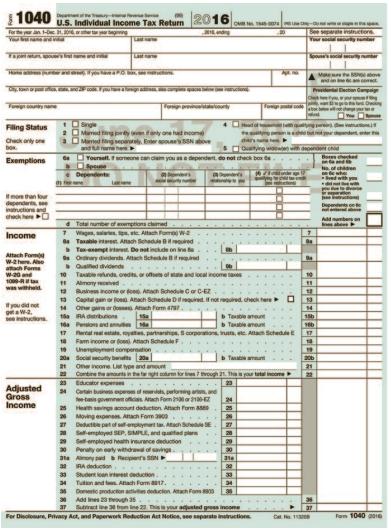

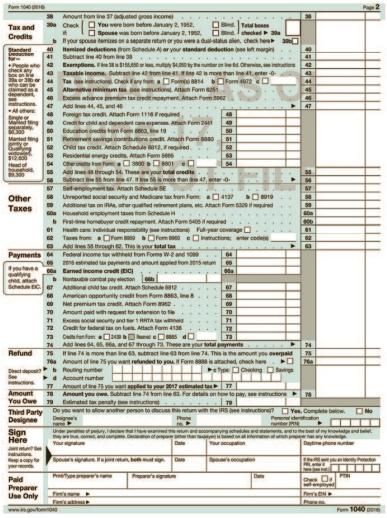

Required: Complete Carl and Mary’s federal tax return for 2016. Use Form 1040 on Pages 2-53 and 2-54. Make realistic assumptions about any missing data.

Form 1040:

Step by Step Answer:

Income Tax Fundamentals 2017

ISBN: 9781305872738

35th Edition

Authors: Gerald E. Whittenburg, Steven Gill, Martha Altus Buller