Abigail (Abby) Boxer is a single mother (birthdate April 28, 1982) working as a civilian accountant for

Question:

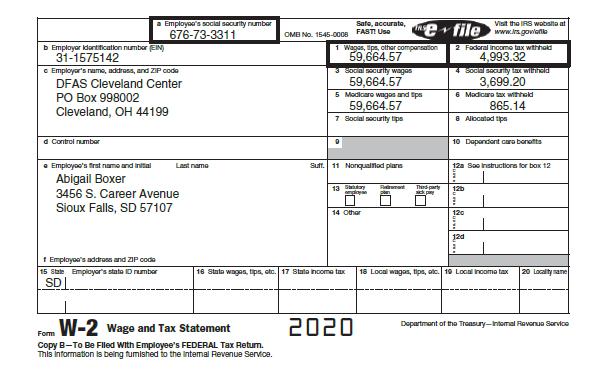

Abigail (Abby) Boxer is a single mother (birthdate April 28, 1982) working as a civilian accountant for the U.S. Army. Her Social Security number is 676-73-3311 and she lives at 3456 S Career Avenue, Sioux Falls, SD 57107. Helen, Abby’s 18-year-old daughter (Social Security number 676-73-3312 and birthdate April 16, 2002), is a dependent child living with her mother, and she does not qualify for the child tax credit due to her age but does qualify for the other dependent credit of $500. Abby’s Form W-2 from the U.S. Department of Defense shows the following:

Abby also has taxable interest from Sioux Falls Savings and Loan of $127 and tax-exempt interest from bonds issued by the state of South Dakota of $300. Abby received a $1,700 EIP in 2020.

Required:

Complete Form 1040 for Abigail for the 2020 tax year.

Step by Step Answer:

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill