Question:

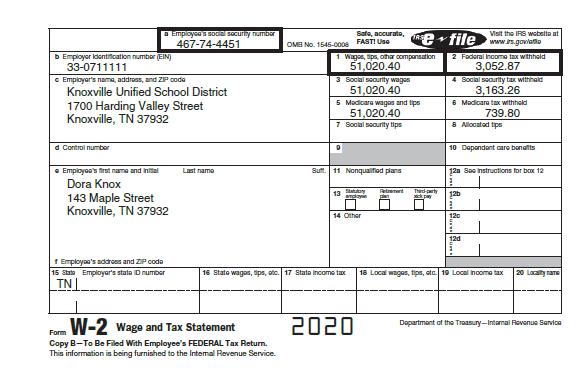

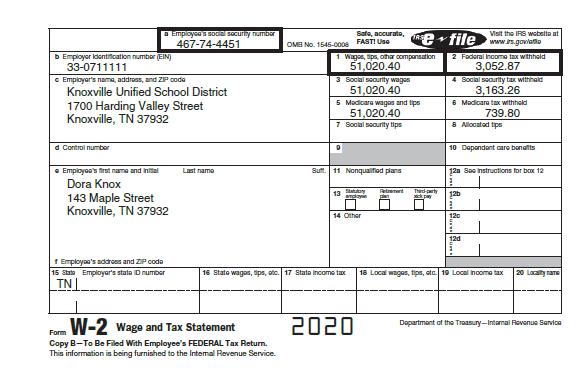

Hardy and Dora Knox are married and file a joint return for 2020. Hardy’s Social Security number is 466-47-3311 and her birthdate is January 4, 1976. Dora’s Social Security number is 467-74-4451 and her birthday is July 7, 1975. They live at 143 Maple Street, Knoxville, TN 37932. For 2020, Hardy did not work, and Dora’s W-2 from her teaching job showed the following:

Hardy and Dora have a son named Fort (birthdate December 21, 2000, Social Security number 552-52-5552), who is a dependent living with them, is not a full-time student, and generates $5,200 of gross income for himself. Hardy and Dora received a $2,400 EIP in 2020.

Required:

Complete Form 1040 for Hardy and Dora for the 2020 tax year.

Transcribed Image Text:

a Employee's social security number

467-74-4451

b Employer Identification number (EIN)

33-0711111

e Employer's name, address, and ZIP code

Knoxville Unified School District

1700 Harding Valley Street

Knoxville, TN 37932

d. Control number

e Employee's first name and intal

Dora Knox

143 Maple Street

Knoxville, TN 37932

1 Employee's address and ZIP code

15 State Employer's state ID number

TN

Last name

OMB No. 1545-0008

Form W-2 Wage and Tax Statement

Copy B-To Be Filed With Employee's FEDERAL Tax Return.

This information is being furnished to the Internal Revenue Service.

1 Wages, tips, othar compensation

51,020.40

3 Social security wages

51,020.40

D

Safe, accurate,

FAST! Use

5 Medicara wages and tips

51,020.40

7 Social security tips

Su 11 Nonqualified plans

13

16 State wagos, sps, atc. 17 State Income tax

Statutory

14 Other

2020

Se

Peter

55

Third-party

pay

file www..goo

2 Federal Income tax withheld

3,052.87

4 Social security tax withhold

3,163.26

6 Madicara tax withhold

Visit the IRS webelto at

& Allocated tips

10 Dependent care benefits

12b

120 Sao instructions for box 12

1

1

120

739.80

12d

18 Local wages, tips, etc. 19 Local income tax 20 Locality name

Department of the Treasury-Internal Revenue Service