Assume that Olive Corporation, in Comprehensive Problem 1, is an S corporation owned 50 percent by Linda

Question:

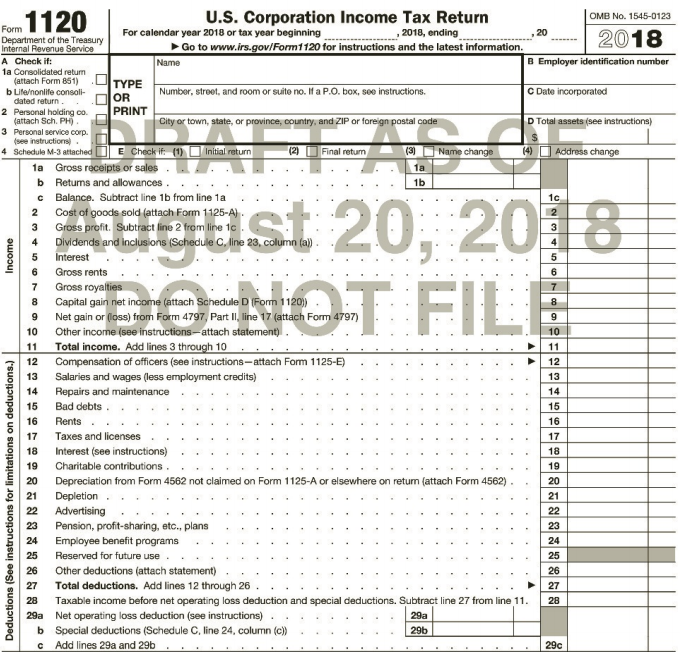

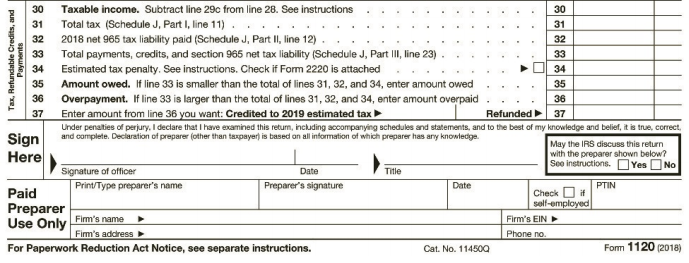

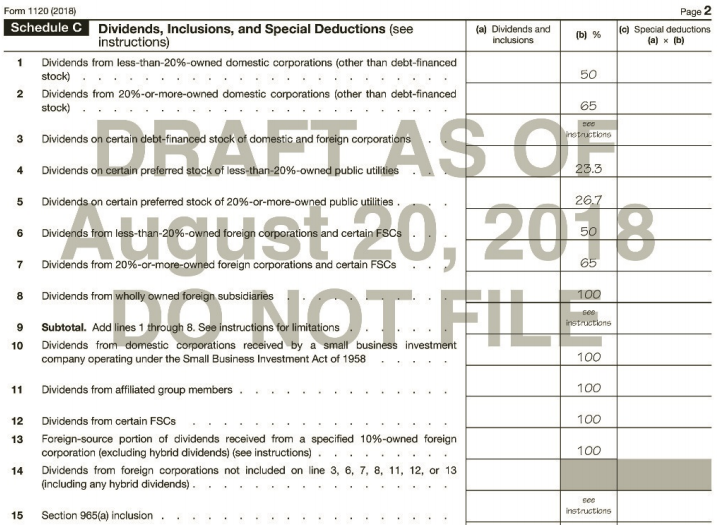

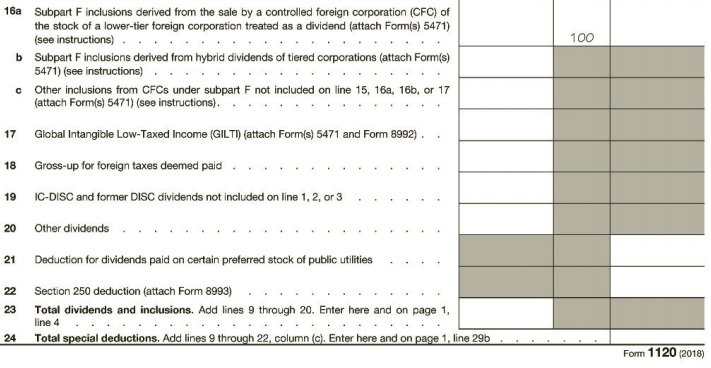

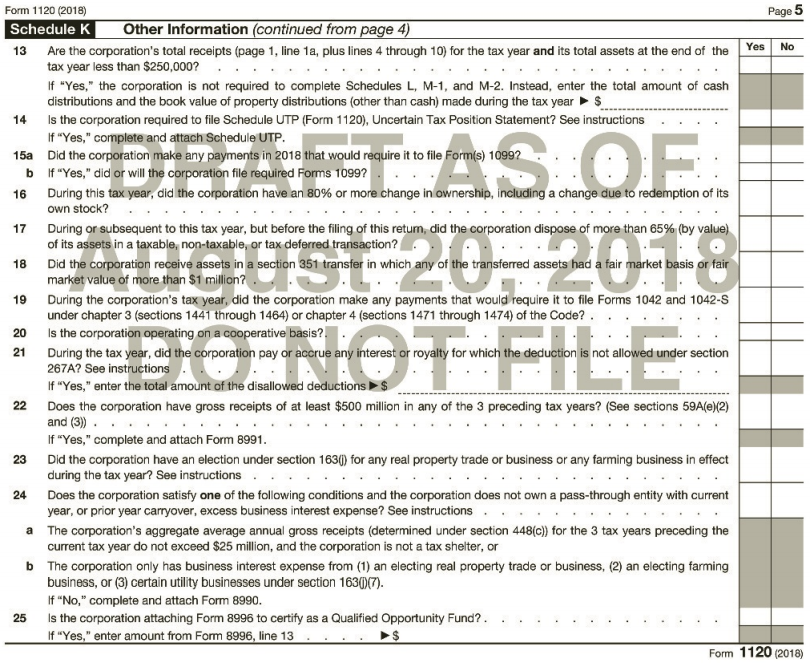

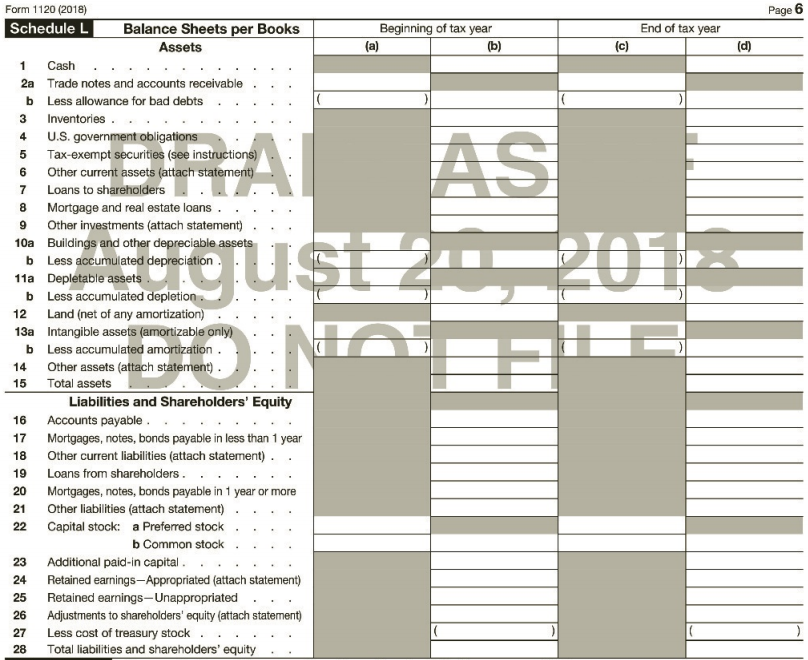

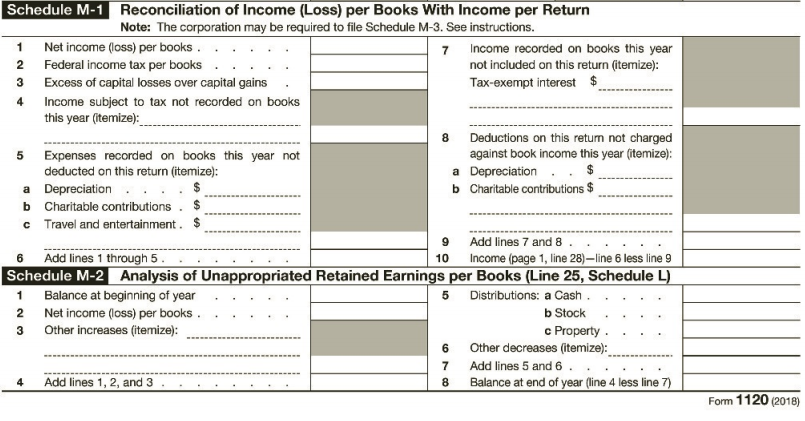

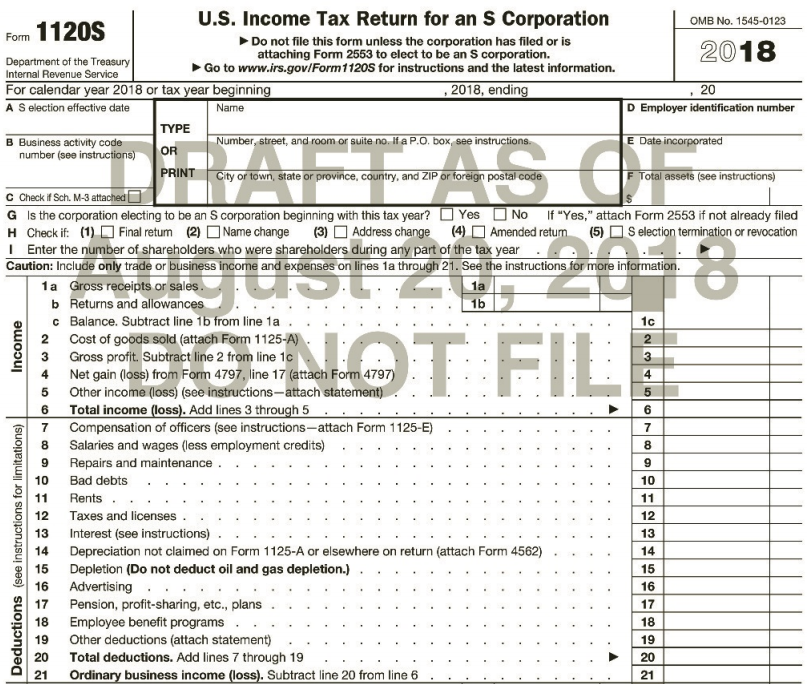

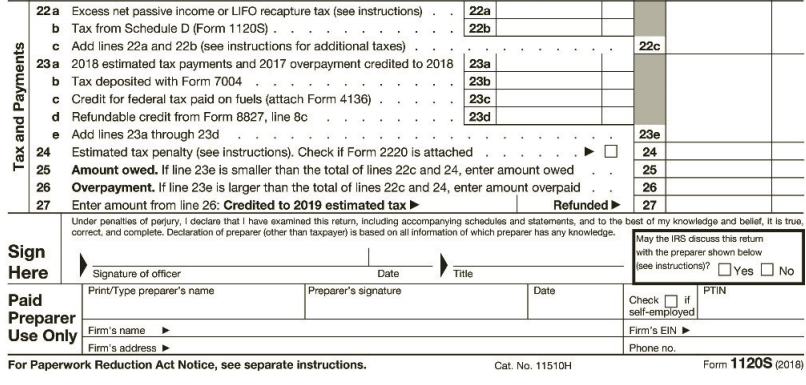

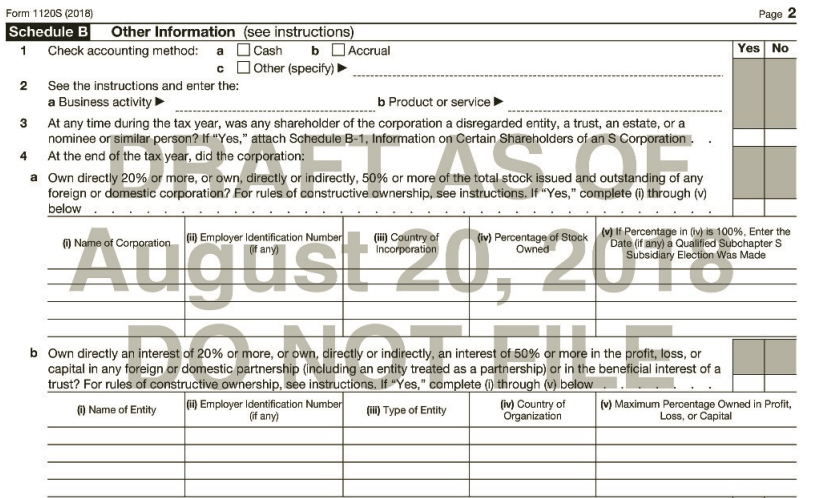

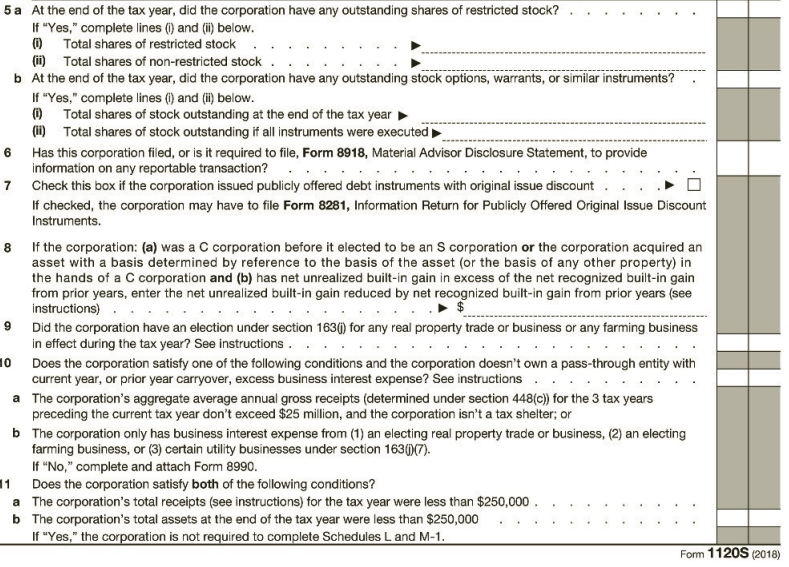

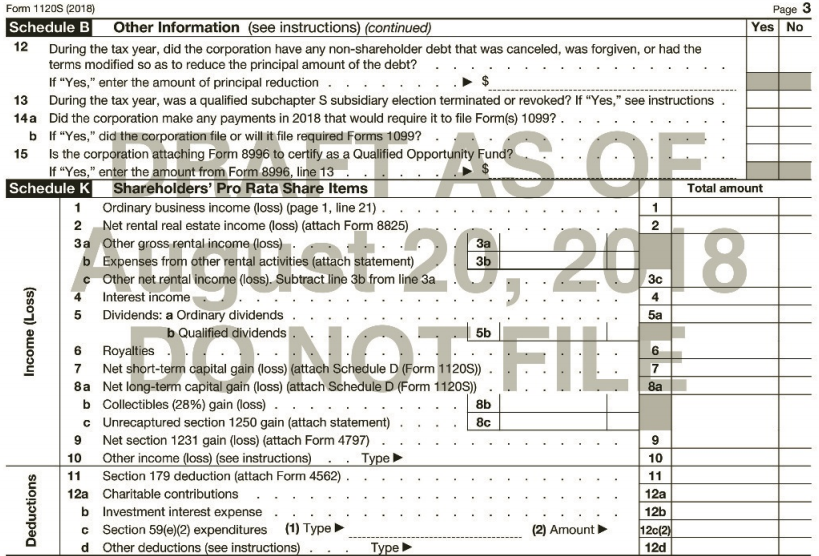

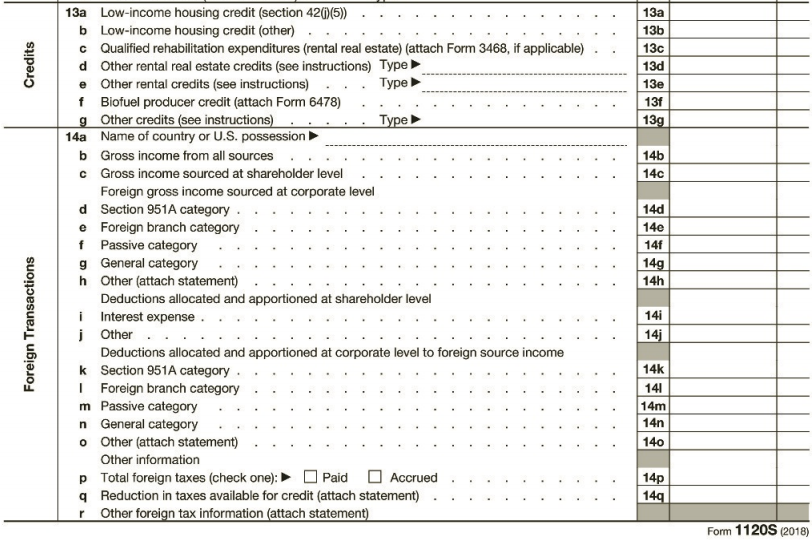

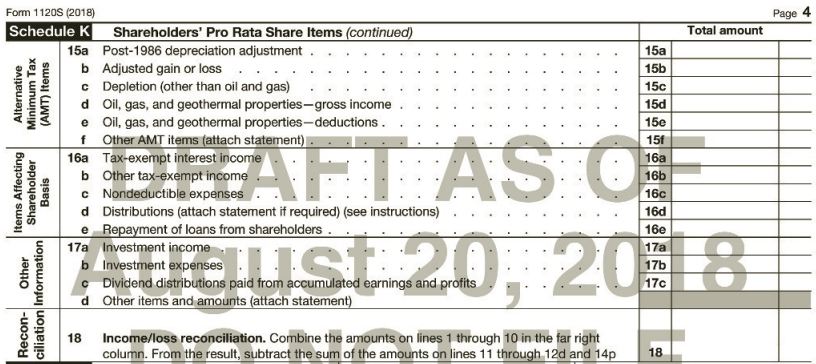

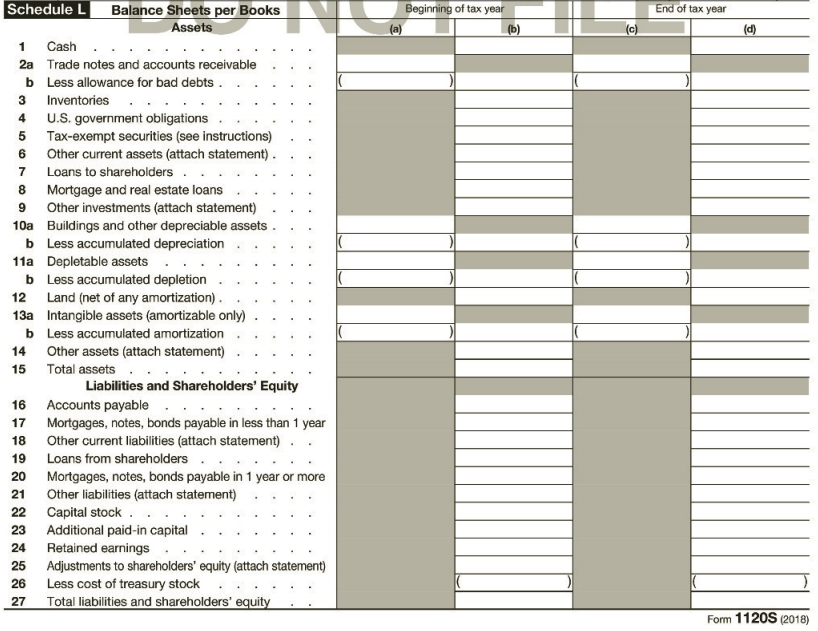

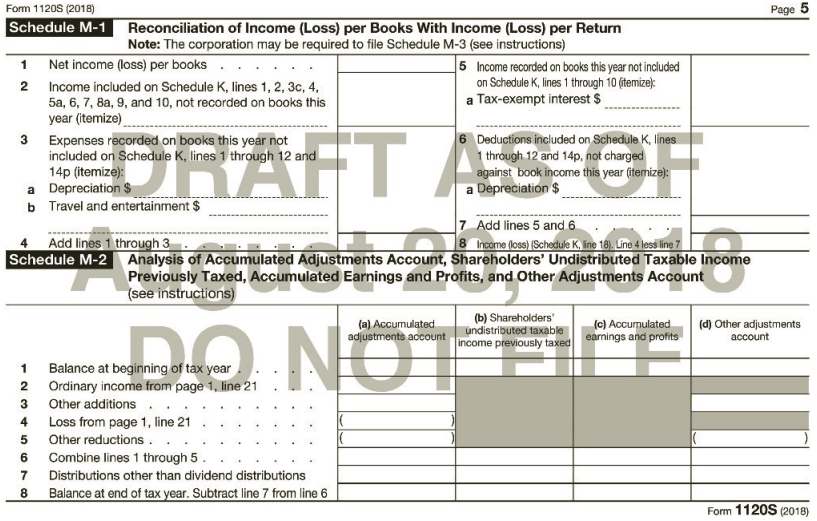

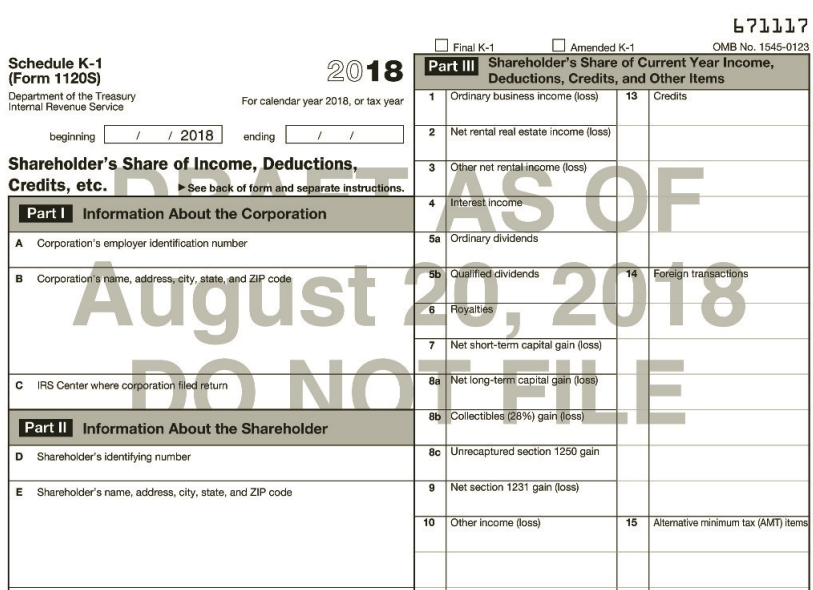

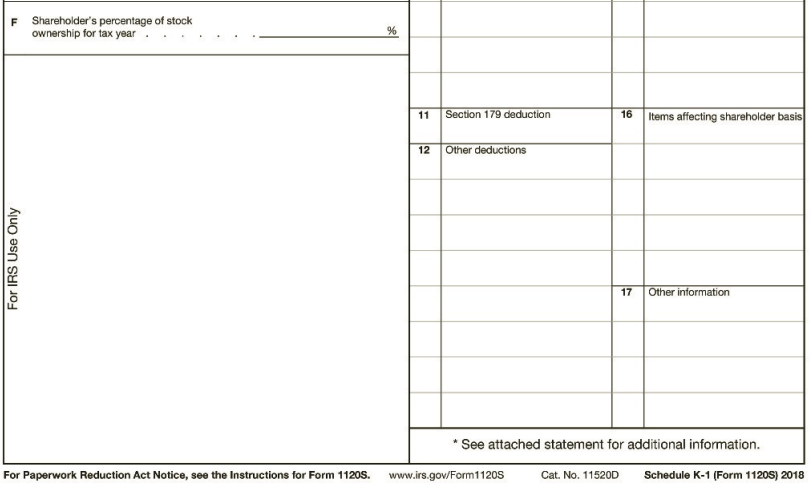

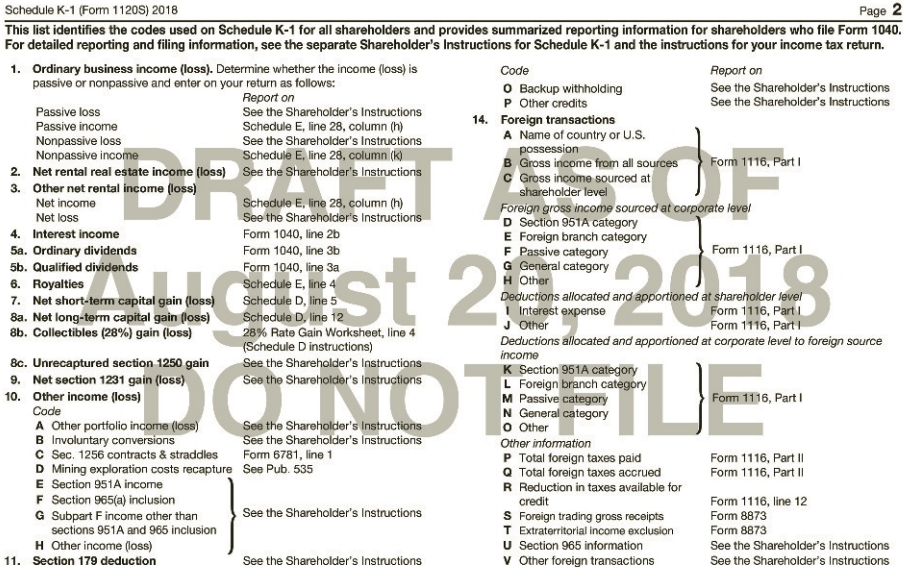

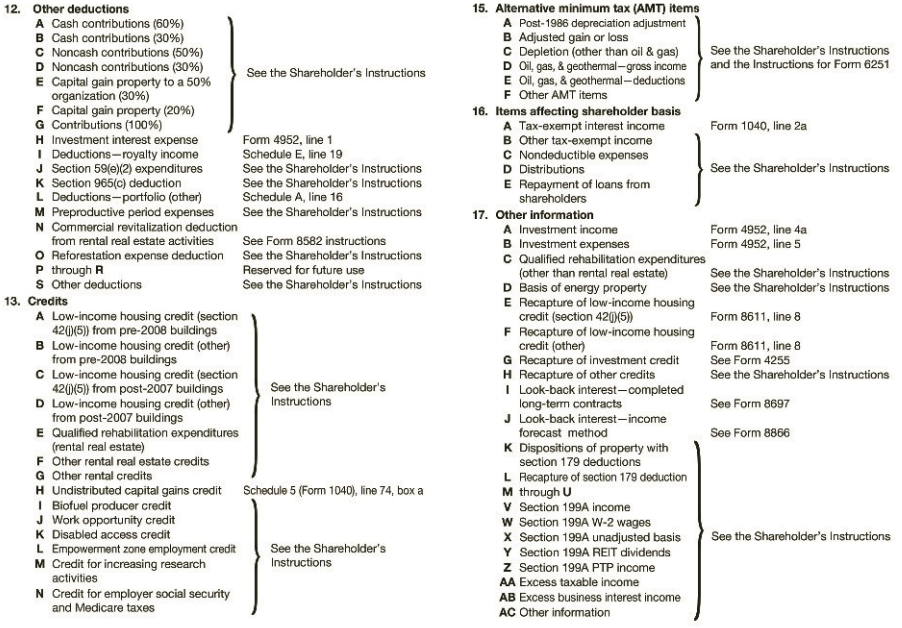

Assume that Olive Corporation, in Comprehensive Problem 1, is an S corporation owned 50 percent by Linda Holiday and 50 percent by Ralph Winston. The corporation is not subject to any special taxes. Using the relevant information given in Comprehensive Problem 1 and assuming the corporation’s retained earnings are $33,000 instead of $28,800, accounts payable are $2,000 instead of $6,200, and no estimated tax payments are made, complete Form 1120S for Olive Corporation and Schedule K-1 for Linda on Pages 11-45 through 11-52. Assume there were no cash distributions during the year.

Accounts payable (AP) are bills to be paid as part of the normal course of business.This is a standard accounting term, one of the most common liabilities, which normally appears in the balance sheet listing of liabilities. Businesses receive...

Transcribed Image Text:

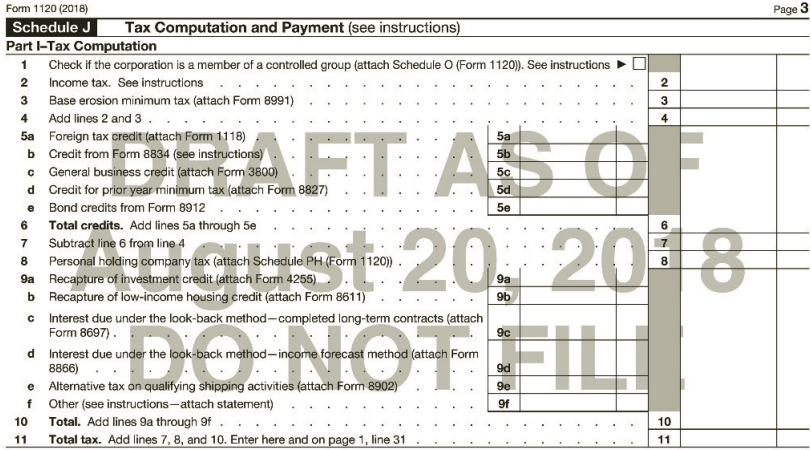

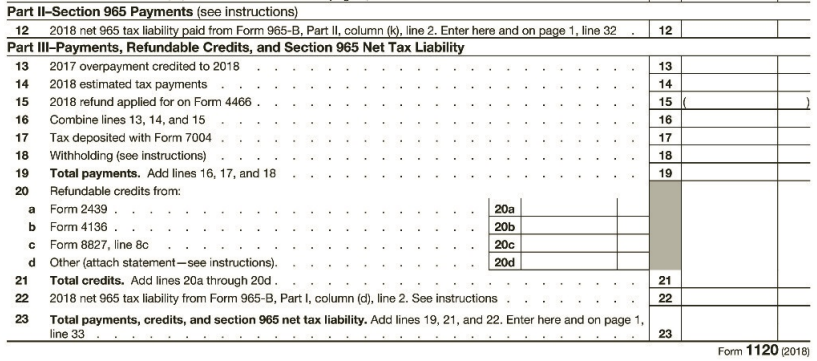

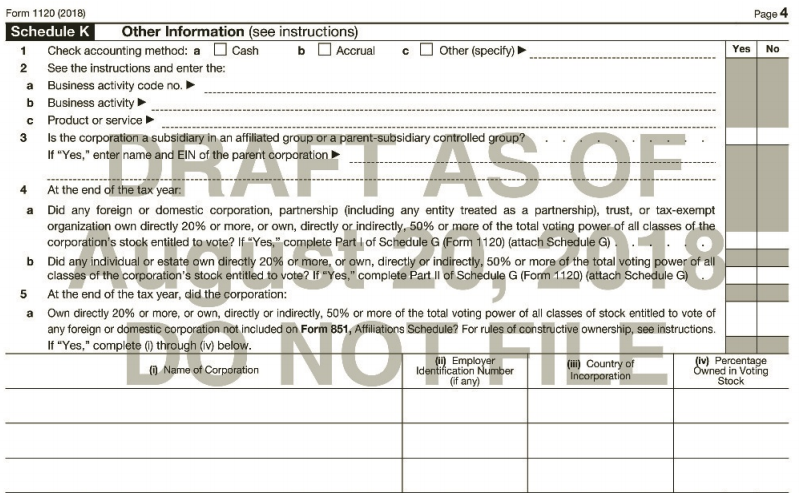

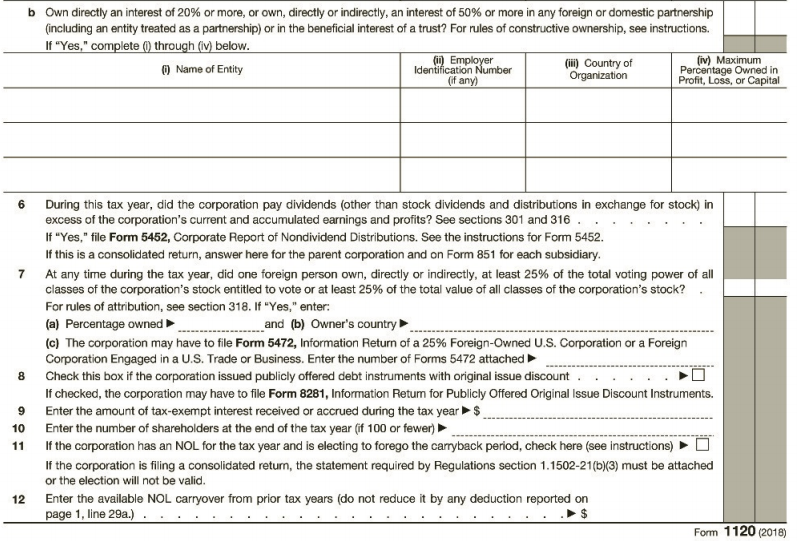

U.S. Corporation Income Tax Return OMB No. 1545-0123 Form 1120 For calendar year 2018 or tax year beginning ,2018, ending 20 2018 Department of the Treasury Internal Revenue Service A Check it: 1a Consolidated retum (attach Form 851) b Life/nonlife consoli- dated return. Go to www.irs.gov/Form1120 for instructions and the latest information. Name B Employer identification number ΤΥPE Number, street, and room or suite no. If a P.O. box, see instructions. C Date incorporated OR ERAFTAS OF ugast 20, 2018 NOT FILI 2 Personal holding co. (attach Sch. PH). 3 Personal service corp. (see instructions). 4 Schedule M-3 attached 1a Gross receipts or sales . PRINT City or town, state, or province, country, and ZIP or foreign postal code D Total assets (see instructions) %24 (4) E Check if: (1) Address change Initial return (2) Final retum (3) Name change 1a b Retums and allowances. 1b Balance. Subtract line 1b from line 1a Cost of goods sold (attach Form 1125-A). Gross profit. Subtract line 2 from line 1c. Dividends and inclusions (Schedule C, line 23, column (a) 4 Interest Gross rents 6. Gross royalties Capital gain net income (attach Schedule D (Form 1120) 8. Net gain or (loss) from Form 4797, Part II, line 17 (attach Form 4797) Other income (see instructions-attach statement). 10 10 Total income. Add lines 3 through 10 11 11 Compensation of officers (see instructions-attach Form 1125-E) Salaries and wages (less employment credits) Repairs and maintenance Bad debts. 12 12 13 13 14 14 15 15 Rents. 16 16 Taxes and licenses 17 17 Interest (see instructions) 18 18 Charitable contributions. Depreciation from Form 4562 not claimed on Form 1125-A or elsewhere on retum (attach Form 4562) 8 21 Advertising 19 19 20 20 Depletion 21 22 22 23 Pension, profit-sharing, etc., plans Employee benefit programs 23 24 24 Reserved for future use. 25 25 Other deductions (attach statement) Total deductions. Add lines 12 through 26. Taxable income before net operating loss deduction and special deductions. Subtract line 27 from line 11. 26 26 27 27 28 28 29a 29a Net operating loss deduction (see instructions) b Special deductions (Schedule C, line 24, column (c) C Add lines 29a and 29b 29b 29c Deductions (See instructions for limitations on deductions.) Income Taxable income. Subtract line 29c from line 28. See instructions 30 Total tax (Schedule J, Part I, line 11) 31 30 31 32 33 32 2018 net 965 tax liability paid (Schedule J, Part II, line 12) . 33 Total payments, credits, and section 965 net tax liability (Schedule J, Part II, line 23) 34 Estimated tax penalty. See instructions. Check if Form 2220 is attached 35 Amount owed. If line 33 is smaller than the total of lines 31, 32, and 34, enter amount owed 36 Overpayment. If line 33 is larger than the total of lines 31, 32, and 34, enter amount overpaid Enter amount from line 36 you want: Credited to 2019 estimated tax 37 O 34 35 36 Refunded 37 Under penalties of perjury. I declare that I have examined this retum, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct. Sign and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Here May the IRS discuss this return with the preparer shown below? See instructions. OYes Signature of officer Print/Type preparer's name Date Title No Preparer's signature PTIN Check O if Date Paid Preparer Use Only For Paperwork Reduction Act Notice, see separate instructions. self-employed Firm's name Firm's EIN Firm's address Phone no. Cat. No. 11450Q Form 1120 (2018) Tax, Refundable Credits, and Payments

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 64% (14 reviews)

1120S Department of the Treasury Internal Revenue Service For calendar year 2018 or tax year beginning Name A S election effective date 010118 B Business activity code number see instructions OR Form ...View the full answer

Answered By

MOHAMMED SAMEER

I always believe that giving proof to a problem even if it is not asked is something intuitive, there is always something to learn from proofs. I worked as a tutor for a year and giving intuitively appealing answers is what I always try to provide to student.

0.00

0 Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Assume that Wrigley Juice is an S corporation owned equally by Henry, Iris, and Jasmine. Prepare a memo explaining the effect of Wrigleys results on Henrys, Iriss, and Jasmines tax returns. Wrigley...

-

Natural Salt is one of the 350 price-taker firms in Country X producing and selling salt. The market price of salt is $16 per bag and Natural Salt has a fixed production cost of $13,000. The firm's...

-

What is the correct answer (with the appropriate number of significant figures) for the calculation of 7.5+ 2.26 + 1.311+ 2? 13 13.071 10 13.0

-

Enviro-Tech has only two retail and two wholesale customers. Information relating to each customer for 2012 follows (in thousands): Enviro-Tech's annual distribution-channel costs are $33 million for...

-

During the month of September, the Texas Go-Kart Company had the following business activities: a. On September 1, paid rent on the track facility for six months at a total cost of $12,000. b. On...

-

a. Given that 2(sin x + 2 cos x) = sin x + 5 cos x, find the exact value of tan x. b. Given that sin x cos y + 3 cos x sin y = 2 sin x sin y 4 cos x cos y, express tan y in terms of tan x.

-

Parker Waichman is a New Yorkbased law firm. In November 2007, Parker Waichman hired Jordan Chaikin, a lawyer licensed and based in Florida, as an associate attorney to assist in screening Florida...

-

a. Create a data f1ow diagram of the current system. b. Create a system flowchart of the existing system. c. Analyze the internal control weaknesses in the system. Model your response according to...

-

What type of company is Walmart, what industry it is in, and any relevant background information?

-

On January 1, 20X1, Wade Crimbring, Inc., a dealer in used manufacturing equipment, sold a CNC milling machine to Fletcher Bros., a new business that plans to fabricate utility trailers. To conserve...

-

Ulmus Corporation is an engineering consulting firm and has $1,120,000 in taxable income for 2018. Calculate the corporations income tax liability for 2018.

-

For its current tax year, Ilex Corporation has ordinary income of $260,000, a short-term capital loss of $60,000, and a long-term capital gain of $20,000. Calculate Ilex Corporations tax liability...

-

What are counting rules? Why are they important?

-

Cusic Music Company is considering the sale of a new sound board used in recording studios. The new board would sell for $24,000, and the company expects to sell 1,570 per year. The company currently...

-

Woody earns an annual salary of $50,000. His company matches 50% of his 401(k) contributions up to 6% of his compensation (max 3% company contribution). Woody contributed $5,000 to the plan this year...

-

For what reasons does Ervin Goffman agrue that we conform to social norms and display certain values?

-

a) 20 1. Idealize the following cross-sections if we applied a force Sx = P and Sy=2P (both loads applied at the same time) and draw the idealized cross-sections with their equivalent boom areas. Use...

-

Malise received dining room furniture as a gift from a friend, Alary. Alary's adjusted basis was $9,200, and the fair market value on the date of the gift was $7,000. Malise decided the furniture was...

-

Like many start-up companies, DomainCo struggled with cash flows as it developed new business opportunities. A student found a financial statement for DomainCo that stated that the increase in...

-

If a and b are positive numbers, find the maximum value of f ( x ) = x a (9 x ) b on the interval 0 x 9.

-

Jay contributes property with a fair market value of $16,000 and an adjusted basis of $5,000 to a partnership in exchange for an 8 percent partnership interest. a. Calculate the amount of gain...

-

a. Loren is a secretary in a lawyers office. Since he often deals with legal matters, Loren feels that a law degree will be beneficial to him. May Loren deduct his educational expenses for law...

-

Marty is a sales consultant. Marty incurs the following expenses related to the entertainment of his clients in 2018: a. How much is Martys deduction for entertainment expenses for 2018? $ __________...

-

How do the following relate to Information security auditing and what do they mean in that context 1. Standards 2. Polices 3. Procedures 4. Guidelines 5. Framework 6. Internal controls 7. Processes...

-

Suppose user on host with IP address 192.168.1.2/29 wants to send a packet to the user on host with IP address 10.0.0.2/29. Consider the gateway router connected to both private networks makes use of...

-

6) Your company has 60 employees, 23 of whom are left-handed. At promotion time, out of 10 promoted employees, only one was left- handed. A civil rights attorney claims that you are biased against...

Study smarter with the SolutionInn App