Marty is a sales consultant. Marty incurs the following expenses related to the entertainment of his clients

Question:

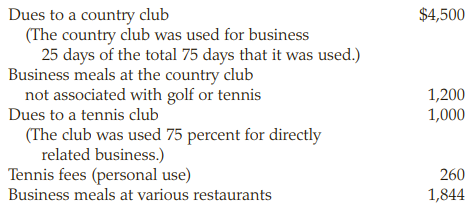

Marty is a sales consultant. Marty incurs the following expenses related to the entertainment of his clients in 2018:

a. How much is Marty’s deduction for entertainment expenses for 2018? $ __________

b. For each item listed above that you believe is not allowed as a deduction, explain the reason it is not allowed.

Transcribed Image Text:

Dues to a country club (The country club was used for business 25 days of the total 75 days that it was used.) Business meals at the country club not associated with golf or tennis Dues to a tennis club $4,500 1,200 1,000 (The club was used 75 percent for directly related business.) Tennis fees (personal use) 260 Business meals at various restaurants 1,844

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 53% (13 reviews)

a Business meals at the country club 1200 Business meals at various resta...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Question Posted:

Students also viewed these Business questions

-

During the year, Brenda has the following expenses related to her employment. Airfare ............................................................................... $8,500 Meals...

-

A&J Co. incurred the following expenses related to patented drugs. 1. Indicate costs that are reported as research and development expenses on the income statement. 2. Indicate costs that are...

-

Can Joe Corporation deduct the following expenses related to its business? a. Legal fee paid ($40,000) to acquire a competing chain of stores b. Legal fee paid ($12,000) to determine whether it...

-

Amie, Inc., has 100,000 shares of $2 par value stock outstanding. Prairie Corporation acquired 30,000 of Amie's shares on January 1, 2015, for $120,000 when Amie's net assets had a total fair value...

-

Using the transactions in CP5-1, complete the following table by indicating the sign of the effect (+ for increase, - for decrease, NE for no effect, and CD for cannot determine) of each transaction....

-

Your next-door neighbor has donated $100 in support of cancer research and is horrified to learn that her money is being spent on studying brewers yeast. How could you put her mind at ease?

-

Why is diversity important in the composition of a governing board?

-

Consumer Research Associates, owned by Sam Hill, is retained by large companies to test consumer reaction to new products. On January 31, 2016, the firms worksheet showed the following adjustments...

-

The Fedder Aircon Repair Center had the following transactions for its first month of operation. Record the following transactions in the general journal. These transactions occurred during May 2013....

-

The plant capacity of a 3-phase generating station consists of two 8 MVA generators of reactance 145% each and one 4 MVA generator of reactance 95%. These are connected to a common bus-bar from which...

-

Which of the following taxpayers may not deduct their educational expense? a. A CPA who attends a course to review for the real estate agents exam. b. An independent sales representative who attends...

-

Which of the following is not likely to be a deductible expense? a. The cost of tickets to a stage play for a client and the taxpayer. b. The cost for Rosa to take a potential customer to lunch to...

-

If you were presenting an open book pay request to a repeat client, what additional detail/line items would you make to the GMP SOV Figure 24.3, Column 3? Figure 24.3 Project: CSI Division 1...

-

Define self as an instrument for change. What behaviors will you need to employ to bring this principle to life during your organization's project? Why? Why is self as an instrument for change such...

-

A company repaid a $5,000 loan with $1,000 in cash and the remaining through a check. How do the accounts change? Explain

-

Charter Communications had beginning net fixed assets of $7,420 and ending net fixed assets of $8,316. Assets valued at $298 were sold during the year. Depreciation was $388. What is the amount of...

-

Suppose a company has proposed a new 4-year project. The project has an initial outlay of $62,000 and has expected cash flows of $19,000 in year 1, $25,000 in year 2, $28,000 in year 3, and $34,000...

-

Define labor productivity. Discuss the relationship between labor productivity, human capital growth, and technology change. Explain thoroughly with words + graph. Explain also the graph and how its...

-

The statement of changes in partnership equity for PQR Partners is shown below a. What was the income-sharing ratio in 2015? b. What was the income-sharing ratio in 2016? c. How much cash did Randy...

-

Match each of the key terms with the definition that best fits it. _______________ A record of the sequence of data entries and the date of those entries. Here are the key terms from the chapter. The...

-

Charlies Green Lawn Care is a cash basis taxpayer. Charlie Adame, the sole proprietor, is considering delaying some of his December 2018 customer billings for lawn care into the next year. In...

-

The Au Natural Clothing Corporation has changed its year-end from a calendar yearend to March 31, with permission from the IRS. The income for its short period from January 1 to March 31 is $24,000....

-

Barbara donates a painting that she purchased three years ago for $8,000, to a university for display in the presidents office. The fair market value of the painting on the date of the gift is...

-

If someone were to throw an object vertically, and catch it as it returned back down, describe how the velocity vector of this object changes over this period?

-

Module 06 Course Project - Whistleblower Hotline Throughout the course, we have explored the legal and ethical factors that impact marketing decisions. Now, it's time to put that knowledge into...

-

How to create a class Vector that can be initialized with a list of numbers Implement a method to print a user-friendly string representation of the vector Overload the + operator to add two vectors...

Study smarter with the SolutionInn App