Bea Jones (birthdate March 27, 1985) moved from Texas to Florida in January 2020 after divorcing her

Question:

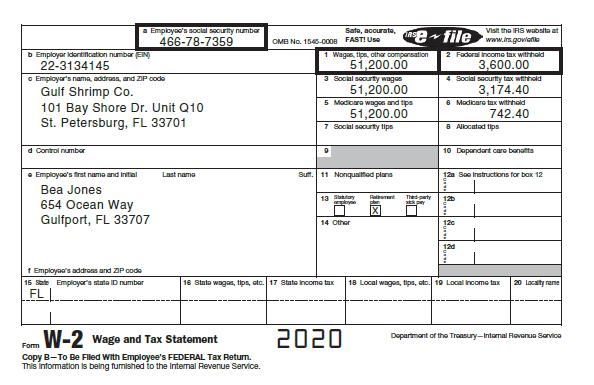

Bea Jones (birthdate March 27, 1985) moved from Texas to Florida in January 2020 after divorcing her spouse in 2019. She and her daughter, Dee Jones (birthdate 5/30/2010, Social Security number 121-44-6666) live at 654 Ocean Way, Gulfport, FL 33707. Bea provides all of Dee’s support. Bea can claim a child tax credit for Dee. Bea’s Social Security number is 466-78-7359 and she is single. Her earnings and income tax withholding for 2020 for her job as a manager at a Florida shrimp-processing plant are:

Bea’s other income includes interest on a savings account at Beach National Bank of $1,200 and $600 per month alimony from her ex-husband in accordance with their August 2019 divorce decree. In 2020, during the COVID pandemic, Bea’s employer agreed to pay $5,250 of her student loans under the employee educational assistance plan. $4,500 went to the loan principal and the rest was interest. Unfortunately, that did not cover all of Bea’s student loan payment and she was required to pay another $450 of student loan interest herself.

Bea received a $1,700 EIP in 2020.

In order to move herself and Dee after the divorce, Bea spent $800 moving her household goods (trailer rental), $200 on meals and $300 on lodging while traveling between Texas and Florida. The drive was 1,005 miles.

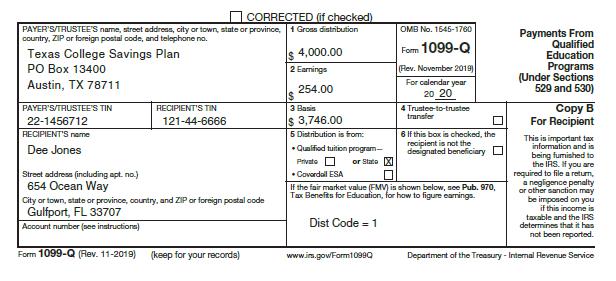

After moving to Gulfport, Bea sent Dee to a local private school for the remainder of 5th grade. Bea used $4,000 from Dee’s Section 529 plan to pay for private school tuition as reported on the Form 1099-Q below. Dee had always attended public schools in Texas.

Bea’s employer operates a 401(k) plan, and although she is eligible, Bea does not participate.

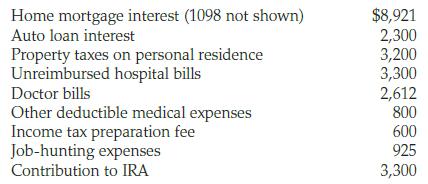

During 2020, Bea paid the following amounts (all of which can be substantiated):

After the divorce, Bea had to purchase a car for herself and all the furnishings for her home. She kept her receipts and has total sales taxes of $2,730, which exceeds the sales tax estimate from the IRS tables.

In September 2020, Tropical Storm Yuri struck Gulfport and a tree fell on Bea’s home. Bea acquired the home in January 2020 for $112,000. The estimated loss in market value from damage was equal to her repair charge of $12,000. The damage caused by TS Yuri was declared a federal disaster (code EM-1212). Bea’s deductible was quite high and her insurance company only reimbursed her $2,000.

Required:

Complete Bea’s federal tax return for 2020. Use Form 1040, Schedule 1, Schedule A, and Form 4684 (if needed) to complete this tax return. Make realistic assumptions about any missing data.

Step by Step Answer:

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill