Julie, a single taxpayer, has completed her 2020 Schedule C and her net loss is $40,000. Her

Question:

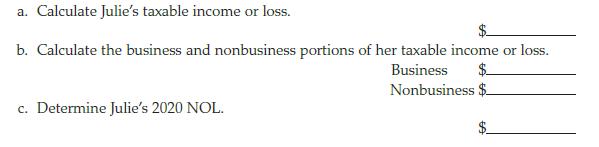

Julie, a single taxpayer, has completed her 2020 Schedule C and her net loss is $40,000. Her only other income is wages of $30,000. Julie takes the standard deduction of $12,400 in 2020.

Transcribed Image Text:

a. Calculate Julie's taxable income or loss. b. Calculate the business and nonbusiness portions of her taxable income or loss. Business Nonbusiness $ c. Determine Julie's 2020 NOL. BA

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 0% (2 reviews)

a 22400 loss 30000 4...View the full answer

Answered By

Muhammad Umair

I have done job as Embedded System Engineer for just four months but after it i have decided to open my own lab and to work on projects that i can launch my own product in market. I work on different softwares like Proteus, Mikroc to program Embedded Systems. My basic work is on Embedded Systems. I have skills in Autocad, Proteus, C++, C programming and i love to share these skills to other to enhance my knowledge too.

3.50+

1+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Julie, a single taxpayer, has completed her 2018 Schedule C and her net loss is $40,000. Her only other income is wages of $30,000. Julie takes the standard deduction of $12,000 in 2018. a. Calculate...

-

Julie, a single taxpayer, has completed her 2019 Schedule C and her net loss is $40,000. Her only other income is wages of $30,000. Julie takes the standard deduction of $12,200 in 2019. a. Calculate...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

Solve the equation symbolically. Then solve the related inequality. 1 - X

-

What is the difference between afferent and efferent data flow?

-

Is there a best way for a company to acquire new products for its export product line?

-

Why does average employee contribution offer a better estimate of the contribution of individuals to an organization than total compensation (wages, incentives, and benefits)?

-

In 1992, Donna Smith telephoned Clark, the manager of Penbridge Farms, in response to an advertisement Clark had placed in the July issue of the Emu Finder about the availability for sale of proven...

-

How do cultural nuances impact collaborative efforts in multinational corporations? Explain with example

-

Clifford Johnson has a limited partnership investment and a rental condominium. Clifford actively manages the rental condominium. During 2020, his share of the loss from the limited partnership was...

-

In November 2020, Ben and Betty (married, filing jointly) have a long-term capital gain of $54,000 on the sale of stock. They have no other capital gains and losses for the year. Their ordinary...

-

Would you take the job offer if you were Maria? If you're not sure, what additional information would help you make your decision?

-

Due to your good credit, your bank reduces the interest rate on your $14,000 loan from 9.3% to 7% per year. Thanks to the change, how much will you save in interest this year?

-

You have $900 and a bank is offering 4% interest on deposits. If you deposit the money in the bank, how much will you have in one year?

-

Bob, Sam, and Tom formed IU Inc. in 2019. Bob contributed equipment (Code Sec. 1231 property) he acquired in 2016 for $190,000. On the date of transfer, the equipments adjusted basis and fair market...

-

Brett has almond orchards, but he is sick of almonds and prefers to eat walnuts instead. The owner of the walnut orchard next door has offered to swap this years crop with him. Assume he produces...

-

In 2017, Susan Christian transferred a machine with a fair market value of $30,000 and an adjusted basis of $40,000 to JPC Corporation in return for 60 shares of stock. The stock qualified as Code...

-

Classify each of the following as an example of systematic or unsystematic risk. a) The labor unions at Caterpillar, Inc. declared a strike yesterday. b) Contrary to what polls stated, the President...

-

The Ferris wheel in the figure has a radius of 68 feet. The clearance between the wheel and the ground is 14 feet. The rectangular coordinate system shown has its origin on the ground directly below...

-

Adam Grisly, a single taxpayer, retired from a long career in coal mining in 2017 when he was only 58 years of age. In 2018, his only source of income is wages of $17,500 from a part-time job. Adam...

-

Yasmeen purchases stock on January 30, 2017. If she wishes to achieve a long-term holding period, what is the first date that she can sell the stock as a long-term gain? a. January 20, 2018 b....

-

Which of the following forms is used to report government payments such as a state income tax refund? a. Form W-2G b. Form 1099-Casino c. Form 1099-G d. Form 1099-Lottery e. Form 1099-C

-

How does the lipophilicity of a drug affect its efficacy? Explain

-

Why is termination of a construction contract a high risk option?

-

When performing urine chemistry screening using reagent strips, you notice that the urobilinogen pad is already brown when you remove the strip from the container. 1. What is your course of action?

Study smarter with the SolutionInn App