Clifford Johnson has a limited partnership investment and a rental condominium. Clifford actively manages the rental condominium.

Question:

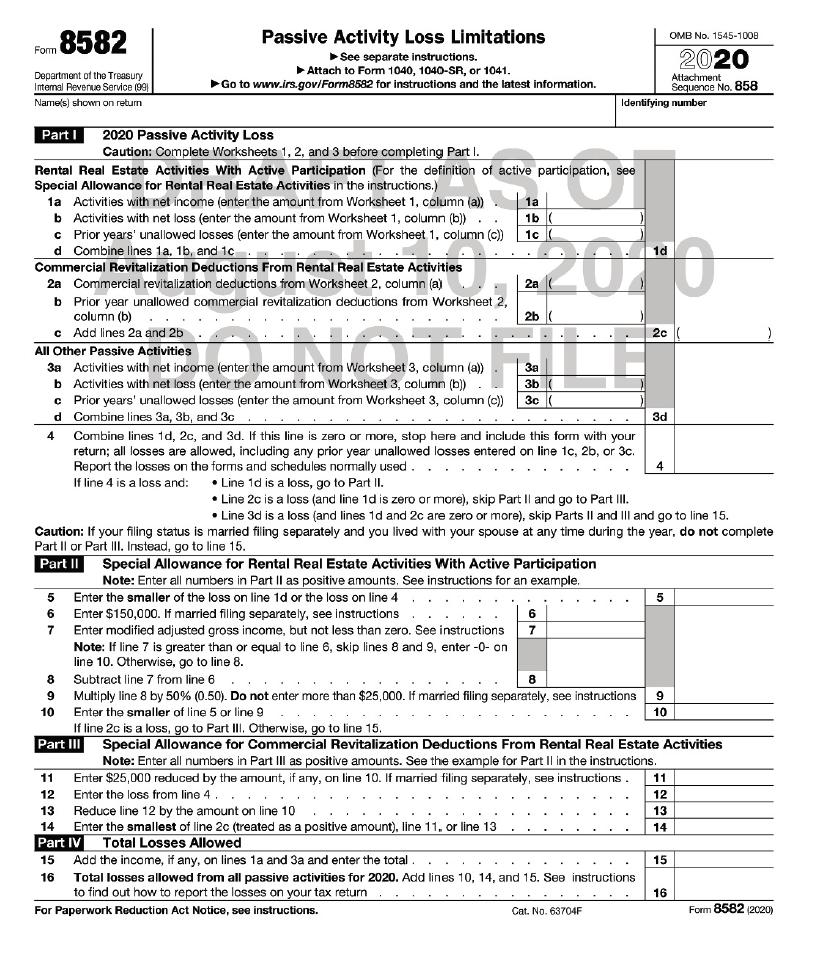

Clifford Johnson has a limited partnership investment and a rental condominium. Clifford actively manages the rental condominium. During 2020, his share of the loss from the limited partnership was $12,000, and his loss from the rental condo was $16,000. Assuming Clifford’s modified adjusted gross income is $130,000 for 2020, and he has no prior year unallowed losses from either activity, complete Form 8582 on Page 4-60.

Transcribed Image Text:

Form 8582 Department of the Treasury Internal Revenue Service (99) Name(s) shown on return Part I 2020 Passive Activity Loss Caution: Complete Worksheets 1, 2, and 3 before completing Part I. Rental Real Estate Activities With Active Participation (For the definition of active participation, see Special Allowance for Rental Real Estate Activities in the instructions.) 1a Activities with net income (enter the amount from Worksheet 1, column (a)). See b Activities with net loss (enter the amount from Worksheet 1, column (b)). . c Prior years' unallowed losses (enter the amount from Worksheet 1, column (c)) d Combine lines 1a, 1b, and 1c Commercial Revitalization Deductions From Rental Real Estate Activities 2a Commercial revitalization deductions from Worksheet 2, column (a) b Prior year unallowed commercial revitalization deductions from Worksheet 2, column (b) c c All Other Passive Activities 3a Activities with net income (enter the amount from Worksheet 3, column (a)) Activities with net loss (enter the amount from Worksheet 3, column (b)) . Prior years' unallowed losses (enter the amount from Worksheet 3, column (c)) Combine lines 3a, 3b, and 3c d 4 5 Passive Activity Loss Limitations ► See separate instructions. Attach to Form 1040, 1040-SR, or 1041. ►Go to www.irs.gov/Form8582 for instructions and the latest information. 6 7 SELON Add lines 2a and 2b 8 9 10 1a 1b 1c J. 2010 2a Part III 2b .... 3a 3b 3c ( Combine lines 1d, 2c, and 3d. If this line is zero or more, stop here and include this form with your return; all losses are allowed, including any prior year unallowed losses entered on line 1c, 2b, or 3c. Report the losses on the forms and schedules normally used If line 4 is a loss and: Line 1d is a loss, go to Part II. • Line 2c is a loss (and line 1d is zero or more), skip Part II and go to Part III. Line 3d is a loss (and lines 1d and 2c are zero or more), skip Parts II and III and go to line 15. Caution: If your filing status is married filing separately and you lived with your spouse at any time during the year, do not complete Part II or Part III. Instead, go to line 15. Part II Special Allowance for Rental Real Estate Activities With Active Participation Note: Enter all numbers in Part II as positive amounts. See instructions for an example. Enter the smaller of the loss on line 1d or the loss on line 4 Enter $150,000. If married filing separately, see instructions Enter modified adjusted gross income, but not less than zero. See instructions Note: If line 7 is greater than or equal to line 6, skip lines 8 and 9, enter -0- on line 10. Otherwise, go to line 8. Enter the smallest of line 2c (treated as a positive amount), line 11, or line 13 Total Losses Allowed Identifying number 6 7 Subtract line 7 from line 6 8 Multiply line 8 by 50% (0.50). Do not enter more than $25,000. If married filing separately, see instructions Enter the smaller of line 5 or line 9 13 14 Part IV 15 Add the income, if any, on lines 1a and 3a and enter the total 16 Total losses allowed from all passive activities for 2020. Add lines 10, 14, and 15. See instructions to find out how to report the losses on your tax return For Paperwork Reduction Act Notice, see instructions. 2c Cat. No. 63704F 3d If line 2c is a loss, go to Part III. Otherwise, go to line 15. Special Allowance for Commercial Revitalization Deductions From Rental Real Estate Activities Note: Enter all numbers in Part III as positive amounts. See the example for Part II in the instructions. 11 Enter $25,000 reduced by the amount, if any, on line 10. If married filing separately, see instructions. Enter the loss from line 4..... 12 Reduce line 12 by the amount on line 10 5 9 10 OMB No. 1545-1008 2020 Attachment Sequence No. 858 11 12 13 14 15 16 Form 8582 (2020)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

See Form 8582 on page 49 Form 8582 Department of the Treasury Internal Revenue Service 99 Names shown on return Clifford Johnson Part I 2020 Passive Activity Loss Passive Activity Loss Limitations See ...View the full answer

Answered By

PALASH JHANWAR

I am a Chartered Accountant with AIR 45 in CA - IPCC. I am a Merit Holder ( B.Com ). The following is my educational details.

PLEASE ACCESS MY RESUME FROM THE FOLLOWING LINK: https://drive.google.com/file/d/1hYR1uch-ff6MRC_cDB07K6VqY9kQ3SFL/view?usp=sharing

3.80+

3+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Refer to Exercise 13.53. Construct a 90% confidence interval for the mean monthly salary of all secretaries with 10 years of experience. Construct a 90% prediction interval for the monthly salary of...

-

Clifford Johnson has a limited partnership investment and a rental condominium. Clifford actively manages the rental condominium. During 2019, his share of the loss from the limited partnership was...

-

Clifford Johnson has a limited partnership investment and a rental condominium. Clifford actively manages the rental condominium. During 2016, his share of the loss from the limited partnership was...

-

Solve the compound linear inequality graphically. Write the solution set in set-builder or interval notation, and approximate endpoints to the nearest tenth whenever appropriate. 1.59.10.5x6.8

-

Explain module coupling and module cohesion. Why are these concepts important?

-

Is there really such a thing as a global brand? If so, describe it and give examples. If not, explain why this is so.

-

What are the factors you would have to use in calculating a cost-benefit ratio to support a decision to purchase a new HRIS when the organization already has an HRIS that was acquired 10 years ago?...

-

Forecasting with the Parsimonious Method and Estimating Share Value Using the ROPI Model Following are income statements and balance sheets for Cisco Systems. Cisco Systems Consolidated Statements of...

-

What role does trust play in fostering fruitful collaboration among stakeholders in strategic alliances and partnerships? Explain

-

Tyler, a single taxpayer, generates business income of $3,000 in 2016. In 2017, he generates an NOL of $2,000. In 2018, he incurs another NOL of $5,000. In 2019, he generates a modest business income...

-

Julie, a single taxpayer, has completed her 2020 Schedule C and her net loss is $40,000. Her only other income is wages of $30,000. Julie takes the standard deduction of $12,400 in 2020. a. Calculate...

-

Consider the sports ratings model in section 7.6. If you were going to use the approach used there to forecast future sports contests, what problems might you encounter early in the season? How might...

-

Those who bargain ruthlessly and are intent on maximizing their personal gain are sometimes called "hawks." "Doves" give in easily, favoring peaceful accord over the potential gains from conflict The...

-

You plan to borrow $5000 from a bank. In exchange for $5000 today, you promise to pay $5400 in one year. What does the cash flow timeline look like from your perspective? What does it look like from...

-

Olivia and Tatiana form Jen Co. earlier this year. Olivia contributed services worth $24,000 and property worth $1,000 and Tatiana contributed property worth $25,000. Each received 25 shares of Jen...

-

What is the discount factor that is equivalent to a 5% discount rate?

-

A friend asks to borrow $54 from you and in return will pay you $57 in one year. If your bank is offering a 5.8% interest rate on deposits and loans: a. How much would you have in one year if you...

-

What is meant by the Capital Asset Pricing Model? Describe how it relates to expected return and risk.

-

Use translations to graph f. f(x) = x-/2 +1

-

In 2018, what is the top tax rate for individual long-term capital gains and the top tax rate for long-term capital gains of collectible items assuming that the Medicare tax does not apply. a. 10; 20...

-

During 2018, Tom sold Sears stock for $10,000. The stock was purchased 4 years ago for $13,000. Tom also sold Ford Motor Company bonds for $35,000. The bonds were purchased 2 months ago for $30,000....

-

Charu Khanna received a Form 1099-B showing the following stock transactions and basis during 2018: None of the stock is qualified small business stock. The stock basis was reported to the IRS....

-

On July 15, 2022, Carl received 50 shares of stock as an inheritance from his father, who died April 15, 2022. His father's adjusted basis in the stock was $50,000. The stock's fair market value on...

-

Lyle plans to invest $2,000 at the end of each 6-month period into a retirement account that earns an annual rate of 16% compounded semiannually. If he continues with his plan for 3 years, use the...

-

Write the requested essay (the successful effort will consist of around 150 words): In the definition of a regular language, could we have defined it in terms of regular expressions and then moved on...

Study smarter with the SolutionInn App