Kana is a single wage earner with no dependents and taxable income of $168,700 in 2020. Her

Question:

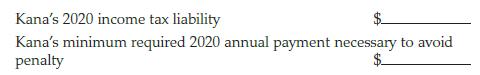

Kana is a single wage earner with no dependents and taxable income of $168,700 in 2020. Her 2019 taxable income was $155,000 and tax liability was $31,375. Calculate the following (note: this question requires the use of the tax tables in Appendix A):

Transcribed Image Text:

Kana's 2020 income tax liability Kana's minimum required 2020 annual payment necessary to avoid penalty

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (4 reviews)

3499950 Kanas tax liability is 168700 163300 x 3...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Kana is a single wage earner with no dependents and taxable income of $205,000 in 2018. Her 2017 taxable income was $155,000 and tax liability was $36,382. Calculate the following Kanas 2018 income...

-

Kana is a single wage earner with no dependents and taxable income of $155,000 in 2017. Her 2017 withholding was $32,000. Her 2016 taxable income was $151,000 and tax liability was $35,317. Calculate...

-

Michele is single with no dependents and earns $32,000 this year. Michele claims exempt on her Form W-4. Which of the following is correct concerning her Form W-4? a. Michele may not under any...

-

Consider the example in Exhibit 5.5. Can you think of anything else you might do with that example that would be helpful to the ultimate decisionmaker? exhibit 5.5 Decision Tree Analysis Using Net...

-

The marbled murrelet is a seabird on the list of endangered species. Pacific Lumber Co. received permission to harvest trees from land on which the murrelet nested, on the condition that it would...

-

A trader enters into a short forward contract on 100 million yen. The forward exchange rate is $0.0080 per yen. How much does the trader gain or lose if the exchange rate at the end of the contract...

-

This exercise considers nursing home data provided by the Wisconsin Department of Health and Family Services (DHFS) and described in Exercises 1.2 and 2.10. You decide to examine the relationship...

-

1. Complete pages 1 and 2 of Form 1040 for Marc and Michelle. 2. Complete Schedule 1 of Form 1040 for Marc and Michelle. (use the most recent form available). Form 1040: Not sure if correct? Schedule...

-

Lulzbot.com sells 6,000 units of its product for $500 each. The sales price includes a one-year warranty on parts. 3% of units are expected to be defective and repair costs are expected to average...

-

Amy is a single taxpayer. Her income tax liability in the prior year was $3,803. Amy earns $50,000 of income ratably during the current year and her tax liability is $4,315. In order to avoid...

-

Sherina Smith (Social Security number 785-23-9873) lives at 536 West Lapham Street, Milwaukee, WI 53204, and is self-employed for 2020. She estimates her required annual estimated income tax payment...

-

What are typical qualifications for a data analyst?

-

Describe the two individual differences pertinent to communication style principles.

-

Service, retail, manufacturing, and wholesale firms that embrace the marketing concept have adopted or are adopting consultative selling practices. Describe the major features of consultative selling.

-

Consider Southeast Home Care, a for-profit business. In 2020, its net income was $1,500,000 and it distributed $500,000 to owners in the form of dividends. Its beginning-of-year equity balance was...

-

What type of health services organization is most likely to use fund accounting?

-

Describe an ethical firm that you are aware of. What makes it attractive to you, as a customer?

-

Lauer Company has 700,000 shares of $ 1 par value common stock outstanding and 12,000 shares of $ 100 par value preferred stock outstanding. Earlier in the year, Lauers common stock had been selling...

-

Can partitioned join be used for r r.A s? Explain your answer

-

Tom has a successful business with $100,000 of taxable income before the election to expense in 2019. He purchases one new asset in 2019, a new machine which is 7-year MACRS property and costs...

-

Derek purchases a small business from Art on June 30, 2019. He paid the following amounts for the business: Fixed assets...........................$180,000...

-

William sold Section 1245 property for $25,000 in 2019. The property cost $38,500 when it was purchased 5 years ago. The depreciation claimed on the property was $19,200. a. Calculate the adjusted...

-

Define what the position of a project manager is and what does a project manager do. Define what the position of a contract manager is and what does a contract manager do. Identify a specific example...

-

Figure 1 is a snapshot of the moment a data packet, p, is about to enter router B, on its way to destination computer D. The outgoing link rate from B towards C is 2 Mbps and one packet has just left...

-

Answer the questions below with reference to the Layered Model (maximum 300 words): i) Discuss the main reasons why computer networks have been structured in a layered model and the major benefits of...

Study smarter with the SolutionInn App