Michele is single with no dependents and earns $32,000 this year. Michele claims exempt on her Form

Question:

Michele is single with no dependents and earns $32,000 this year. Michele claims exempt on her Form W-4. Which of the following is correct concerning her Form W-4?

a. Michele may not under any circumstances claim exempt.

b. Michele’s employer will require her to verify that she had no tax liability and expects to have none this year.

c. Michele’s employer must require her to prepare a corrected Form W-4 under any circumstances. If Michele is unwilling to update her Form W-4, then her employer should disregard her Form W-4 and withhold at the single taxpayer rate with no allowances.

d. Michele’s employer will submit a copy of her W-4 to the IRS if directed to do so by written notice.

e. None of the above is correct.

e. None of the above is correct.

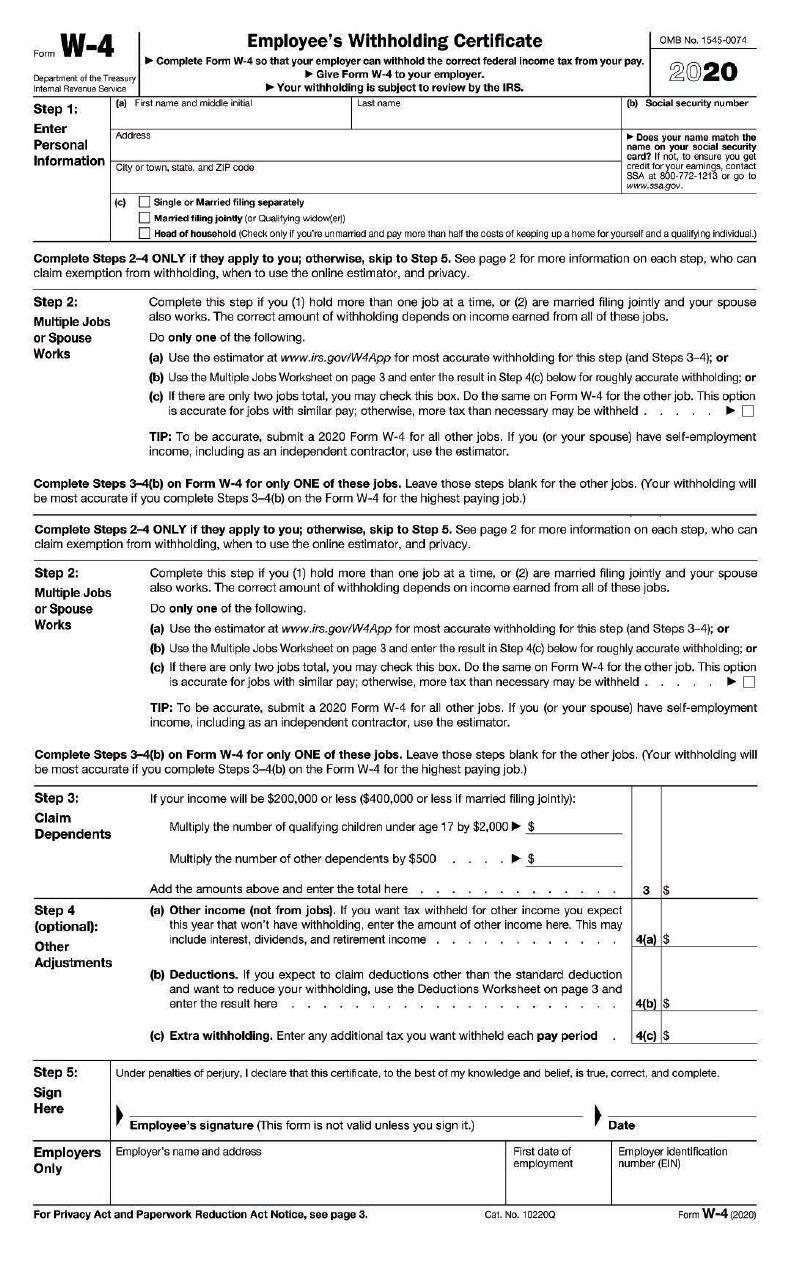

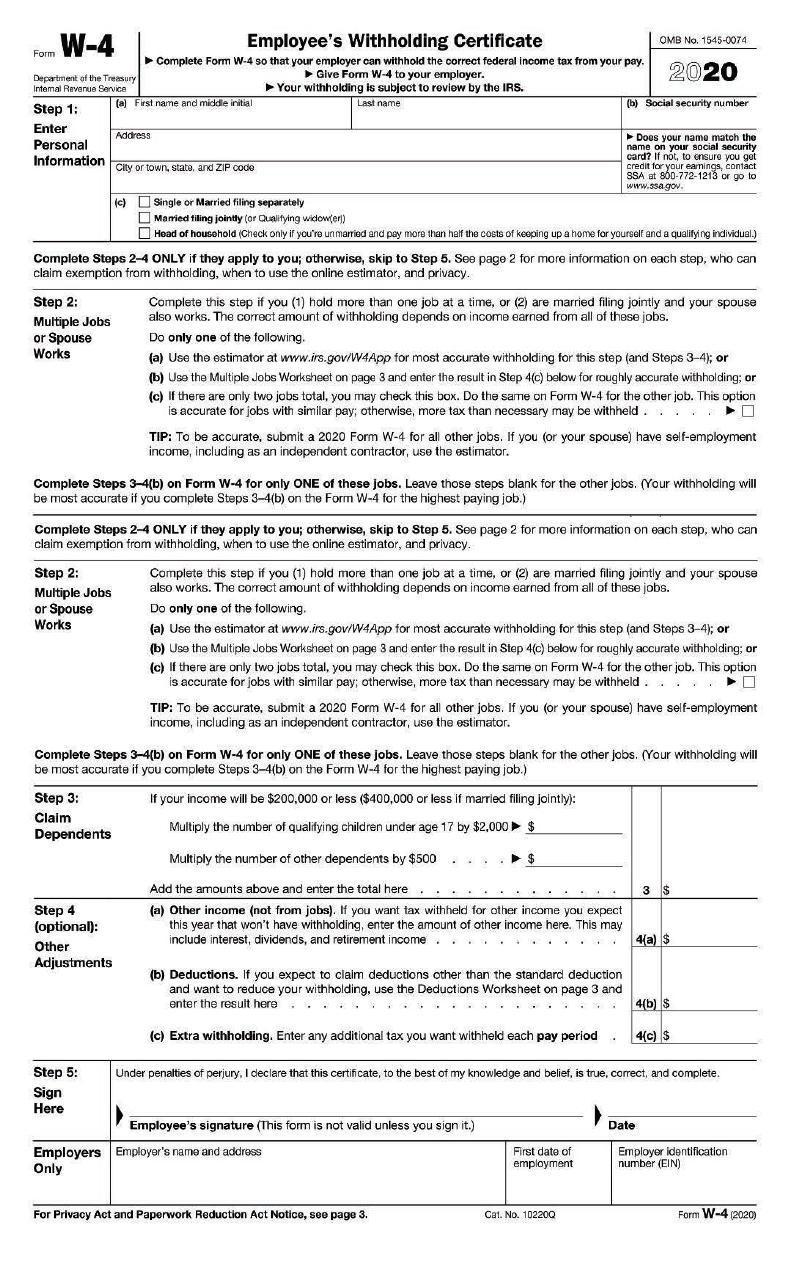

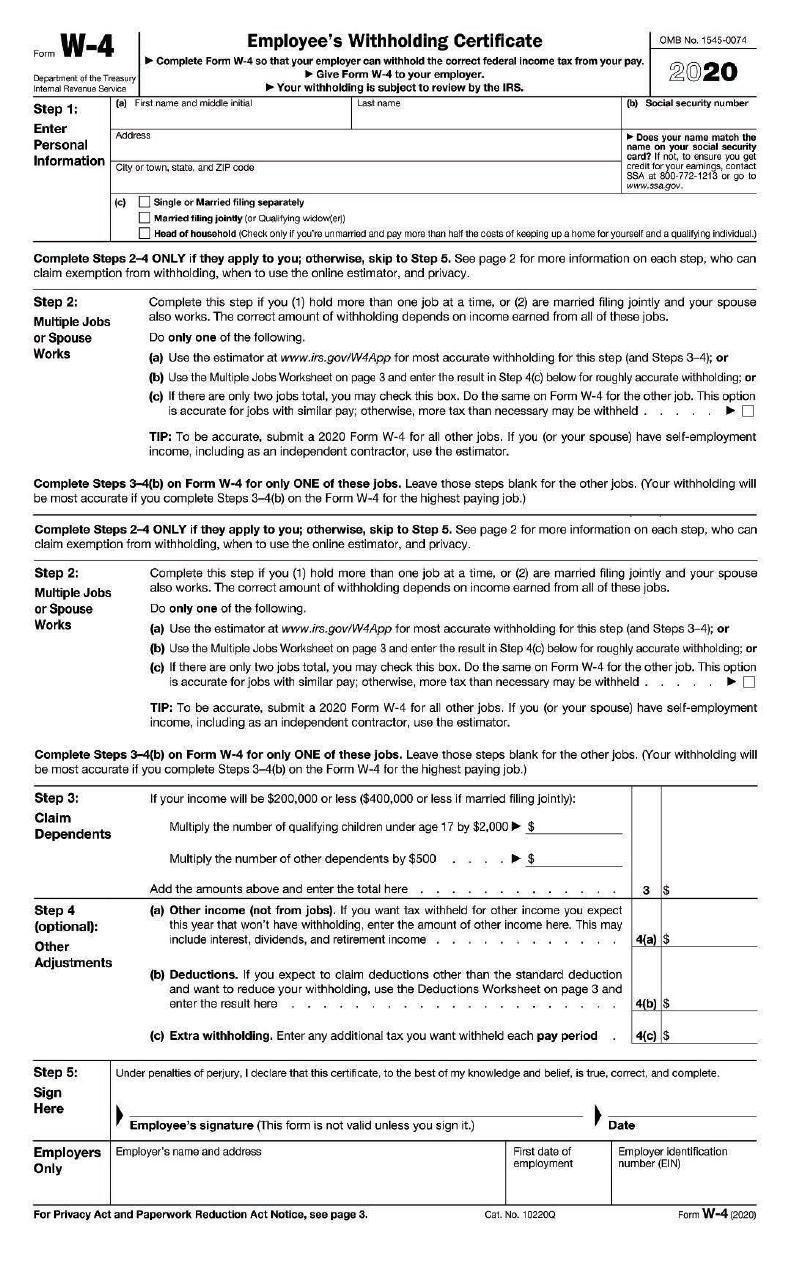

Form W-4 Department of the Treasury Internal Revenue Service Step 1: Enter Personal Information Step 2: Multiple Jobs or Spouse Works Step 2: Multiple Jobs or Spouse Works Employee's Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Give Form W-4 to your employer. Your withholding is subject to review by the IRS. Last name (a) First name and middle initial Step 3: Claim Dependents Address Step 4 (optional): Other Adjustments City or town, state, and ZIP code Step 5: Sign Here (c) Single or Married filing separately Complete Steps 2-4 ONLY if they apply to you; otherwise, skip to Step 5. See page 2 for more information on each step, who can claim exemption from withholding, when to use the online estimator, and privacy. Married filing jointly (or Qualifying widow(er)) Head of household (Check only if you're unmarried and pay more than half the costs of keeping up a home for yourself and a qualifying individual.) Complete Steps 3-4(b) on Form W-4 for only ONE of these jobs. Leave those steps blank for the other jobs. (Your withholding will be most accurate if you complete Steps 3-4(b) on the Form W-4 for the highest paying job.) Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse also works. The correct amount of withholding depends on income earned from all of these jobs. Do only one of the following. Complete Steps 2-4 ONLY if they apply to you; otherwise, skip to Step 5. See page 2 for more information on each step, who can claim exemption from withholding, when to use the online estimator, and privacy. (a) Use the estimator at www.irs.gov/W4App for most accurate withholding for this step (and Steps 3-4); or (b) Use the Multiple Jobs Worksheet on page 3 and enter the result in Step 4(c) below for roughly accurate withholding; or (c) If there are only two jobs total, you may check this box. Do the same on Form W-4 for the other job. This option is accurate for jobs with similar pay; otherwise, more tax than necessary may be withheld.... 0 OMB No. 1545-0074 2020 (b) Social security number TIP: To be accurate, submit a 2020 Form W-4 for all other jobs. If you (or your spouse) have self-employment income, including as an independent contractor, use the estimator. Does your name match the name on your social security card? If not, to ensure you get credit for your earnings, contact SSA at 800-772-1213 or go to www.ssa.gov. Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse also works. The correct amount of withholding depends on income earned from all of these jobs. Complete Steps 3-4(b) on Form W-4 for only ONE of these jobs. Leave those steps blank for the other jobs. (Your withholding will be most accurate if you complete Steps 3-4(b) on the Form W-4 for the highest paying job.) If your income will be $200,000 or less ($400,000 or less if married filing jointly): Multiply the number of qualifying children under age 17 by $2,000 $ $ Do only one of the following. (a) Use the estimator at www.irs.gov/W4App for most accurate withholding for this step (and Steps 3-4); or (b) Use the Multiple Jobs Worksheet on page 3 and enter the result in Step 4(c) below for roughly accurate withholding; or (c) If there are only two jobs total, you may check this box. Do the same on Form W-4 for the other job. This option is accurate for jobs with similar pay; otherwise, more tax than necessary may be withheld.... 0 TIP: To be accurate, submit a 2020 Form W-4 for all other jobs. If you (or your spouse) have self-employment income, including as an independent contractor, use the estimator. (b) Deductions. If you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the Deductions Worksheet on page 3 and enter the result here (c) Extra withholding. Enter any additional tax you want withheld each pay period Multiply the number of other dependents by $500 Add the amounts above and enter the total here (a) Other income (not from jobs). If you want tax withheld for other income you expect this year that won't have withholding, enter the amount of other income here. This may include interest, dividends, and retirement income... 4(a) $ Employee's signature (This form is not valid unless you sign it.) Employers Employer's name and address Only For Privacy Act and Paperwork Reduction Act Notice, see page 3. First date of employment ** Cat. No. 10220Q Under penalties of perjury, I declare that this certificate, to the best of my knowledge and belief, is true, correct, and complete. 3 $ 4(b) $ 4(c) $ Date Employer identification number (EIN) Form W-4 (2020)

Step by Step Answer:

ANSWER So among the above statements statement4 is the ...View the full answer

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Students also viewed these Business questions

-

Which of the following amounts paid by an employer to an employee is not subject to withholding? a. Salary b. Bonus c. Commissions d. Reimbursement of expenses under an accountable plan e. All of the...

-

Michele is single with no dependents and earns $23,000 this year. Michele claims sixteen allowances on her Form W-4 for 2016. Which of the following is correct concerning her Form W-4? a. Michele may...

-

Michele is single with no dependents and earns $23,000 this year. Michele claims sixteen allowances on her Form W-4 for 2016. Which of the following is correct concerning her Form W-4? a. Michele may...

-

Oakey Wines is considering expanding on from the cafe to build a restaurant that will provide an evening experience of a meal, wine and entertainment. The package will be used to showcase new season...

-

Is there any good reason to be in a partnership? If so, for what sort of business would it make sense?

-

Identify a portable wireless device other than a mobile phone, and give an example of an ethical issue and a legal issue that could arise with its use.

-

A venture capitalist with a utility function \($U(x)=\sqrt{x}$\) carried out the procedure of Example 11.3. Find an analytical expression for \($C$\) as a function of \($e$,\) and for \($e$\) as a...

-

The net income (after income tax) of McCants Inc. was $2 per common share in the latest year and $6 per common share for the preceding year. At the beginning of the latest year, the number of shares...

-

If there were a shift of $8,000 in sales revenue from the banquet area to the dining room, would you expect the restaurant's overall operating income to increase or decrease? Explain your reasoning...

-

On September 14, 2020, Jay purchased a passenger automobile that is used 75 percent in his business. The automobile has a basis for depreciation purposes of $45,000, and Jay uses the accelerated...

-

Nadia Shalom has the following transactions during the year: Sale of office equipment on March 15 that cost $21,500 when purchased on July 1, 2018. Nadia has claimed $21,500 in depreciation and sells...

-

A school currently pays $23,000 a year for the electricity it uses at a unit price of $0.11/kWh. The school management decides to install a wind turbine with a blade diameter of 20 m and an average...

-

What does the term value of an unlevered firm mean?

-

What do the acronyms ACRS and MACRS stand for?

-

What should a firms goal be regarding the cash conversion cycle, holding other things constant? Explain your answer.

-

Describe the steps required to apply the compressed APV approach.

-

Cash flows, rather than accounting profits, are used in project analysis. What is the basis for this emphasis on cash flows as opposed to net income?

-

Albany County wants to raise $ 4,000,000 to finance the construction of a new high school. The school board wants to make quarterly payments to repay the loan over the next 10 years. What will be the...

-

Determine the center and radius of each circle. Sketch each circle. 4x 2 + 4y 2 9 = 16y

-

James did not have minimum essential coverage for any part of 2016. If James is single and has 2016 adjusted gross income of $40,950, what is his individual shared responsibility payment? a. $0 b....

-

Which of the following is not an acceptable cause for claiming an exemption from minimum essential coverage? a. Religious opposition b. Income below the filing status threshold to file c. A one-month...

-

Taxpayers with minimum essential coverage for the entire year for all members of their household will a. Pay any unpaid health care insurance premiums with their tax return b. Check a box indicating...

-

When chest compressions are in progress, how often should the heart rate be assessed?

-

DewDrops is a struggling global startup with a project team located on three different continents. The customer of the project just radically altered one of the triple constraints. What is the best...

-

The project sponsor has called the project manager into his office. He lets her know that some additional funding has been secured to allow more resources to be hired onto the project. What was the...

Study smarter with the SolutionInn App