Noah and Joan Arcs Tax Return Noah and Joan Arc live with their family in Dayton, OH.

Question:

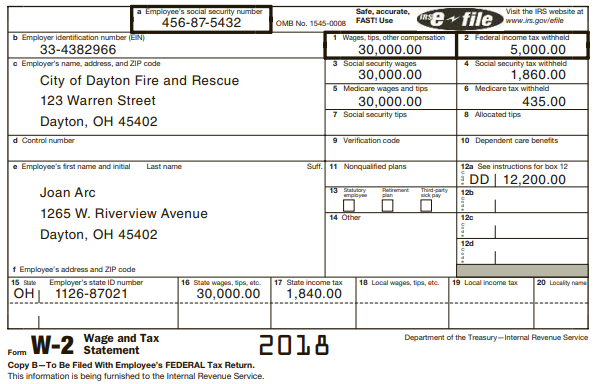

Noah and Joan Arc’s Tax Return Noah and Joan Arc live with their family in Dayton, OH. Noah’s Social Security number is 434-11-3311. Noah was born on February 22, 1983 and Joan was born on July 1, 1984. Both enjoy good health and eyesight. Noah owns and operates a pet store and Joan is a firefighter for the city of Dayton.

1. The Arcs have two children, a son named Billie Bob (Social Security number 598-01- 2345), born on March 21, 2011, and a daughter named Mary Sue (Social Security number 554-33-2411), born on December 3, 2014.

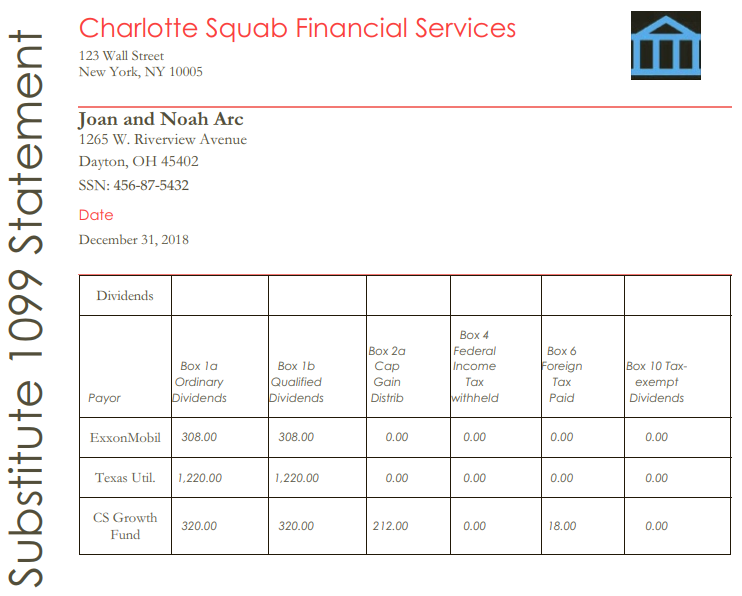

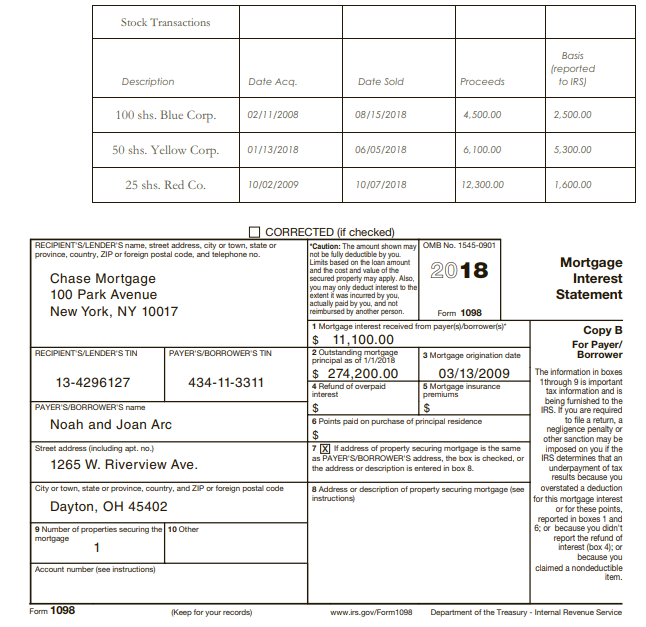

2. Joan and Noah brought a folder of tax documents located on Pages D-3 to D-5.

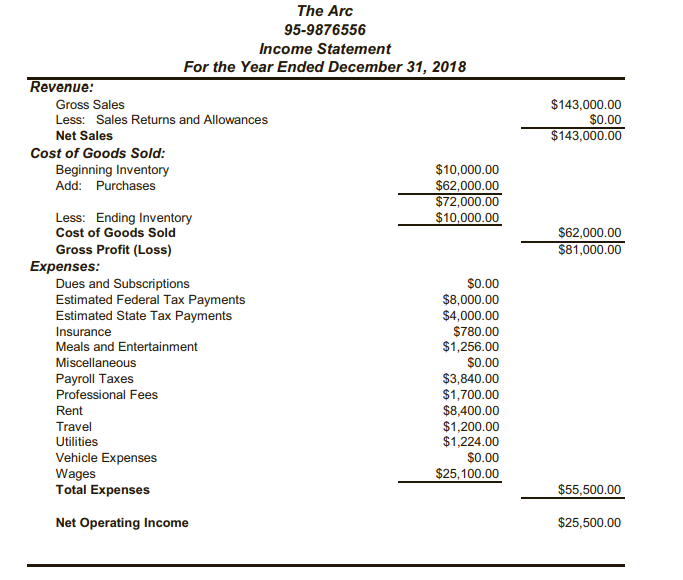

3. Noah’s pet store is located at 1415 S. Patterson Blvd, Dayton, OH 45409. The name of the store is ‘‘The Arc,’’ and its taxpayer identification number is 95-9876556. Since you handle Noah’s bookkeeping, you have printed the income statement from your Quickbooks software, shown on Page D-5.

4. Detail of The Arc’s meals and entertainment:

Food costs for Arc holiday party...................250

Meals associated with business travel...................400

Overtime meals for employees...................50

Sports tickets for entertaining large customers...................556

Total...................$ 1,256

5. Noah and Joan paid the following amounts during the year (all by check):

Political contributions...............$ 250

Church donations (for which a written acknowledgment was received)...............2,625

Real estate taxes on their home...............2,375

Medical co-pays for doctor visits...............700

Mortgage interest for purchase of home See Form 1098 (Page D-4)

Tax return preparation fees...............350

Credit card interest...............220

Automobile insurance premiums...............600

Uniforms for Joan...............125

6. Noah has a long-term capital loss carryover from last year of $2,375.

7. Noah and Joan own rental property located at 16 Oakwood Ave, Unit A, Dayton, OH 45409. Noah provides the management services for the rental including selection of tenants, maintenance, repairs, rent collection, and other services as needed. The revenue and expenses for the year are as follows:

Rental income................$13,800

Insurance................575

Interest expense................6,870

Property taxes................1,000

Miscellaneous expenses................700

Depreciation (the house was acquired in 1993)................3,000

8. All members of the Arc household were covered for the entire year under health care insurance through Joan’s employer.

9. The Arcs paid Ohio general sales tax of $976 during the year.

Required:

You are to prepare their federal income tax return in good form, signing the return as the preparer. Do not complete an Ohio state income tax return. Make realistic assumptions about any missing data (addresses, etc.) that you may need. The following forms and schedules are required:

Form 1040.................Schedule D

Schedule 1.................Schedule E

Schedule 3.................Schedule SE

Schedule 4.................Form 2441

Schedule 5.................Form 8812

Schedule A.................Form 8949

Schedule B.................Qualified Dividends and Capital Gain Tax Worksheet

Schedule C.................Child Tax Credit Worksheet

Note: The forms included in Appendix D are provided for the student to work on only one of the two comprehensive problems. If desired, additional forms may be obtained from the IRS website at www.irs.gov.

Step by Step Answer:

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill