Gregory and Lulu Clifdens Tax Return Gregory R. and Lulu B. Clifden live with their family at

Question:

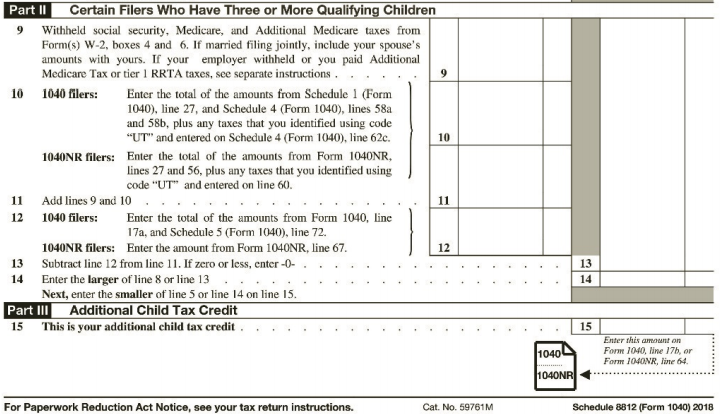

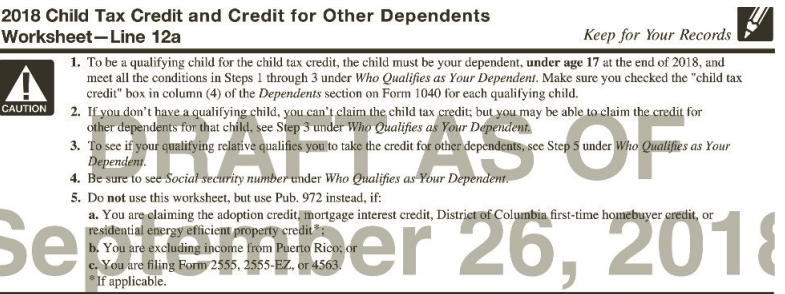

Gregory and Lulu Clifden’s Tax Return Gregory R. and Lulu B. Clifden live with their family at the Rock Glen House Bed & Breakfast, which Gregory operates. The Bed & Breakfast (B&B) is located at 33333 Fume Blanc Way, Temecula, CA 92591. Gregory and Lulu enjoy good health and eyesight. 1. The Clifdens have three sons. Gerald is 17 years old, Gary is 12 years old, and Glenn is 10 years old. All three boys live at home and the Clifdens provide more than 50% of their support.

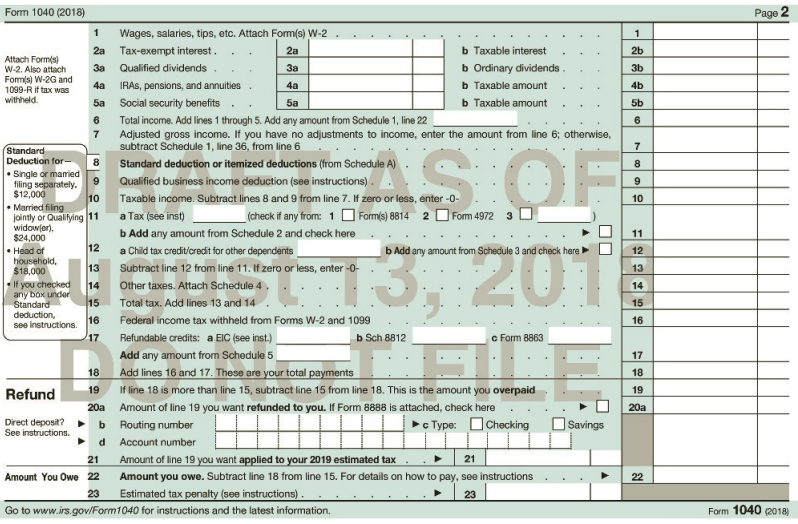

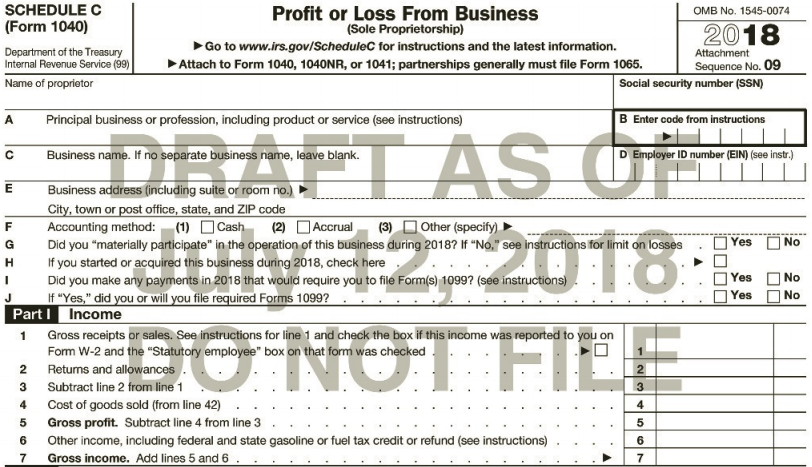

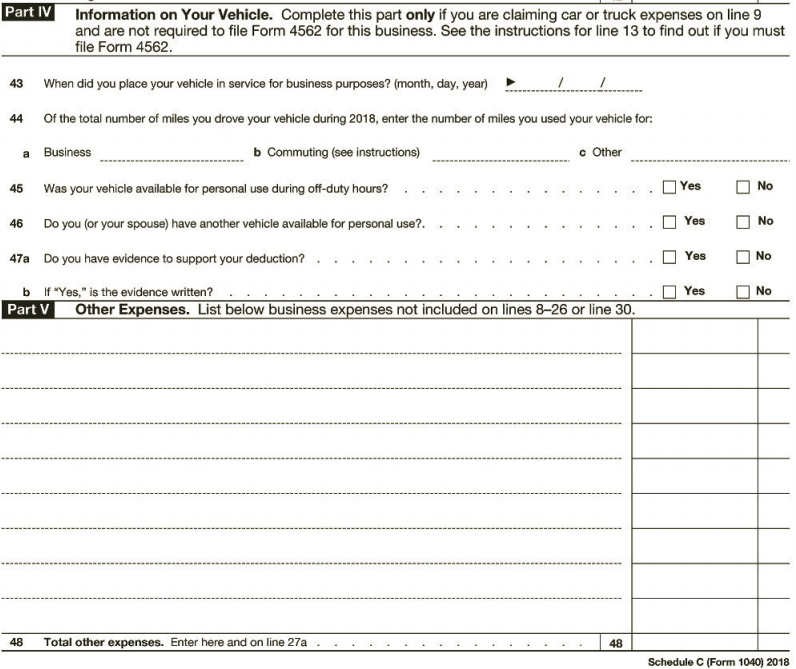

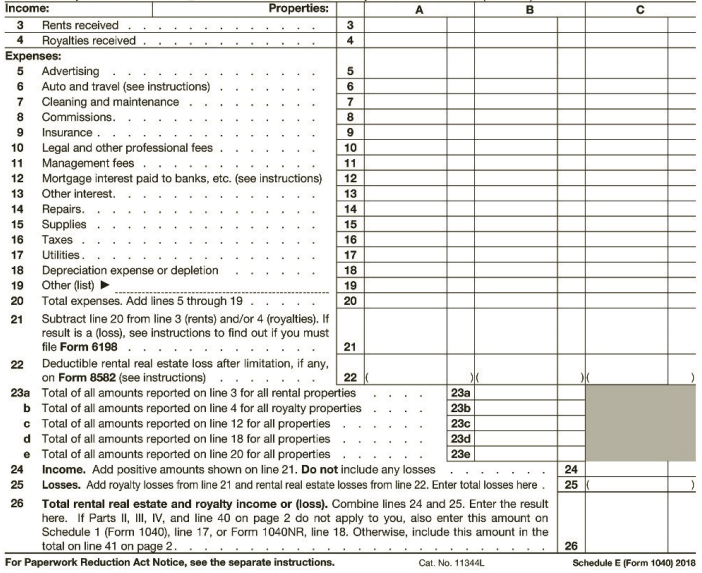

2. The Rock Glen House B&B is operated as a sole proprietorship and had the following income and expenses for the year:

Room rental income...............$138,000

Vending machine income...............2,100

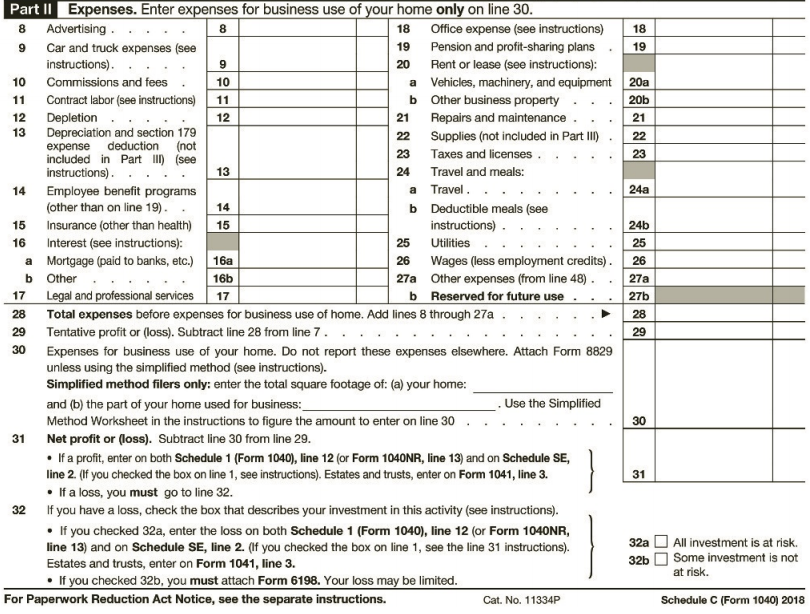

Advertising expense...............4,810

Depreciation for book and tax purposes...............18,100

Mortgage interest on the B&B...............23,010

Wages of cleaning people...............17,540

Taxes and licenses...............6,420

Supplies consumed...............18,870

Business insurance...............6,300

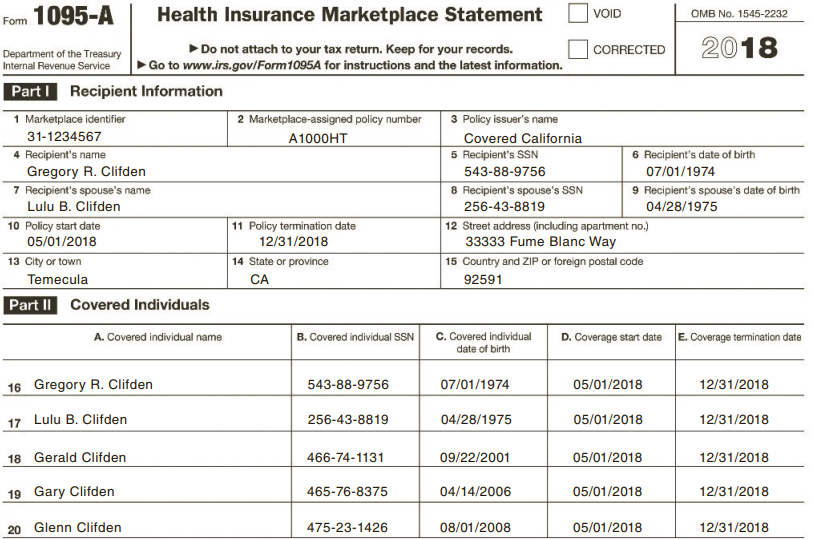

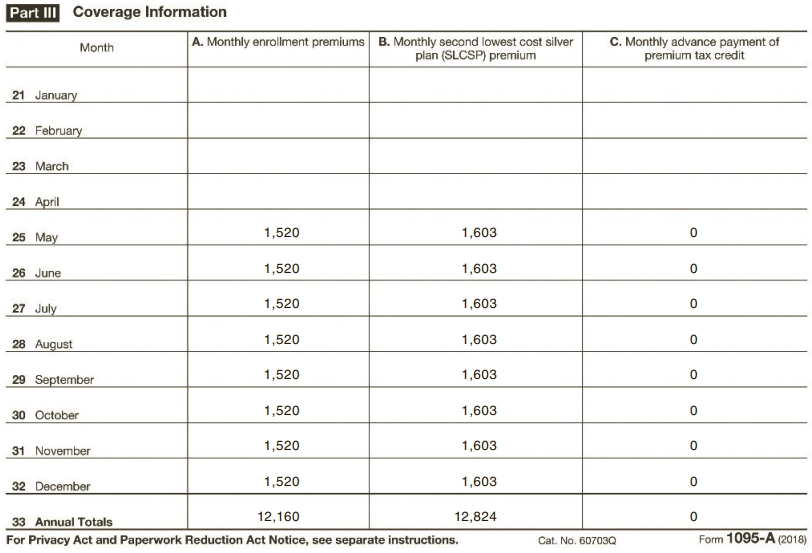

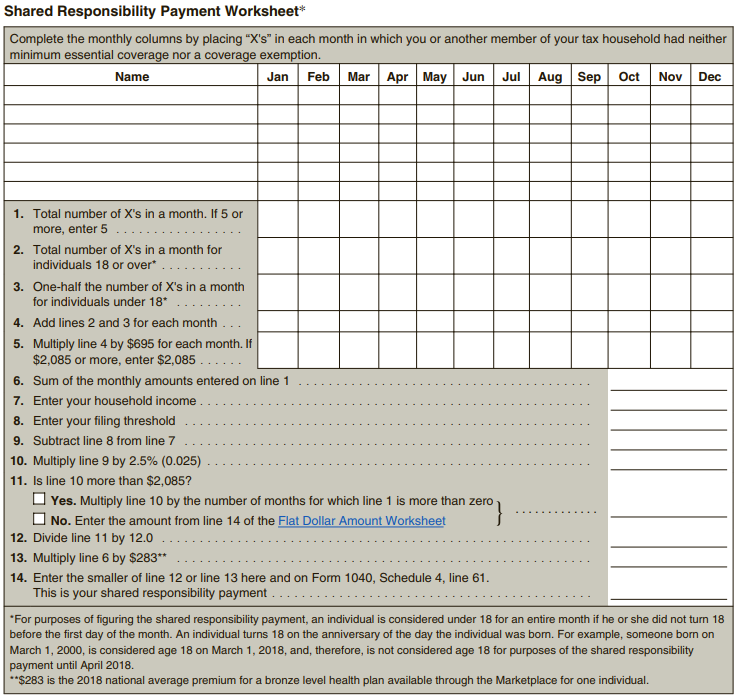

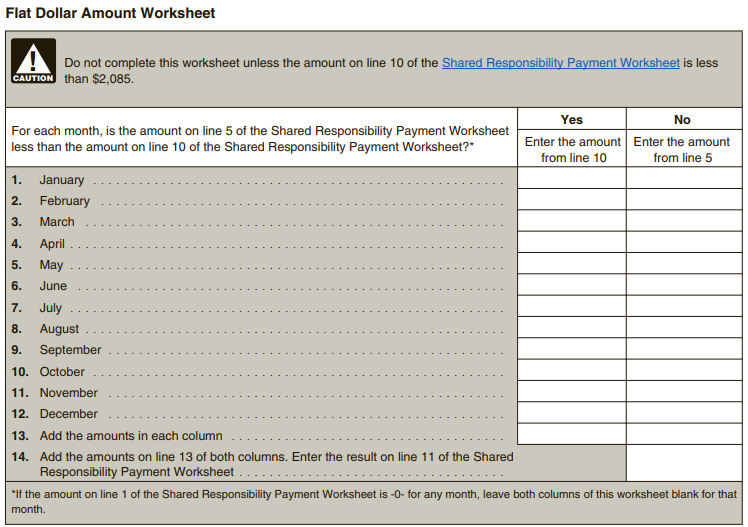

Laundry expenses...............4,289

Accounting fees...............1,850

Office expenses...............2,400

Utilities...............6,350

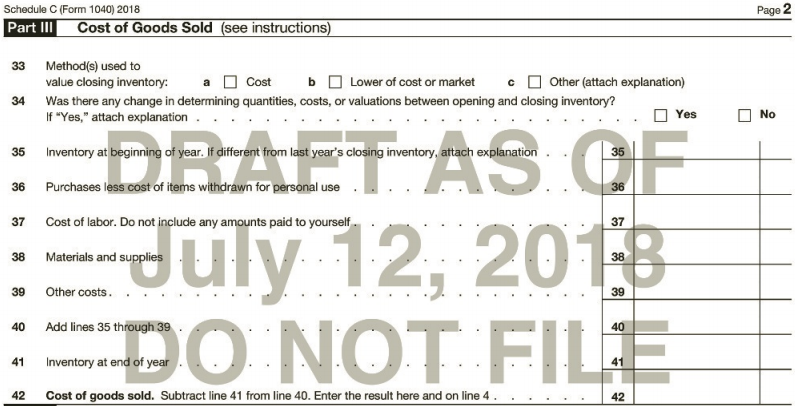

All of the above amounts relate to the business portion of the Bed & Breakfast; the personal portion is accounted for separately. The Rock Glen House B&B uses the cash method of accounting and has no inventory. The employer tax ID number is 95-1234567.

3. The Clifdens made estimated federal income tax payments of $2,000 and estimated state income tax payments of $6,000 (all made during 2018).

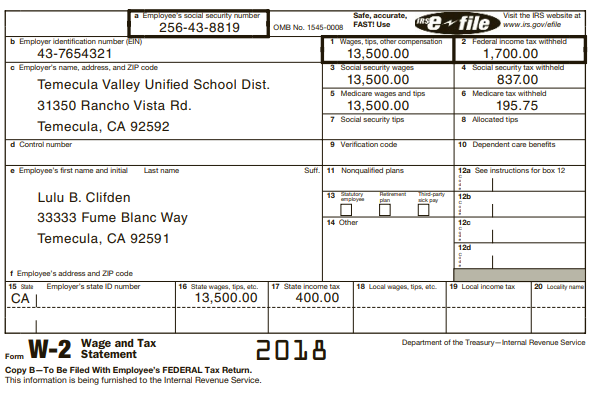

4. Lulu worked about 1,000 hours as a substitute schoolteacher with the local school district. She also spent $276 out-of-pocket for various supplies for her classroom. For the current year, Lulu’s Form W-2 from the school district showed the following:

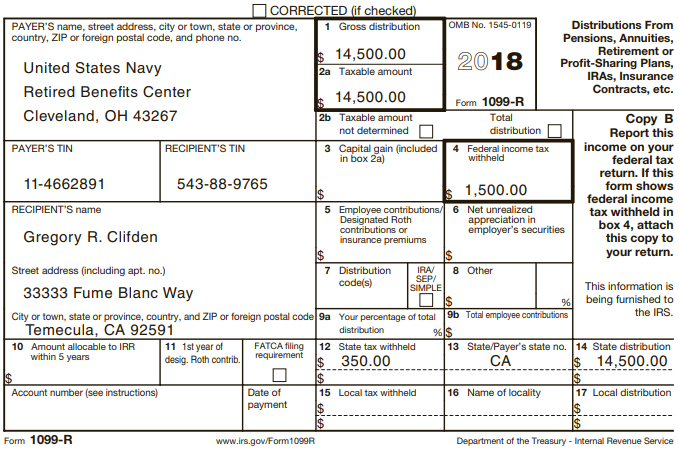

5. Gregory is retired from the U.S. Navy. His annual statement from the Navy, Form 1099-R, is on Page D-12.

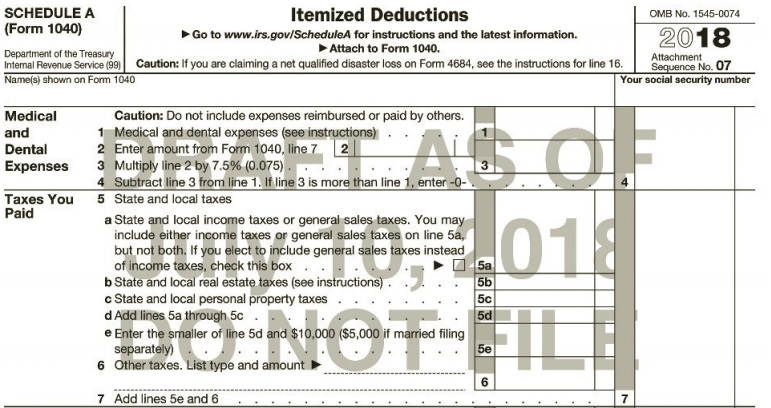

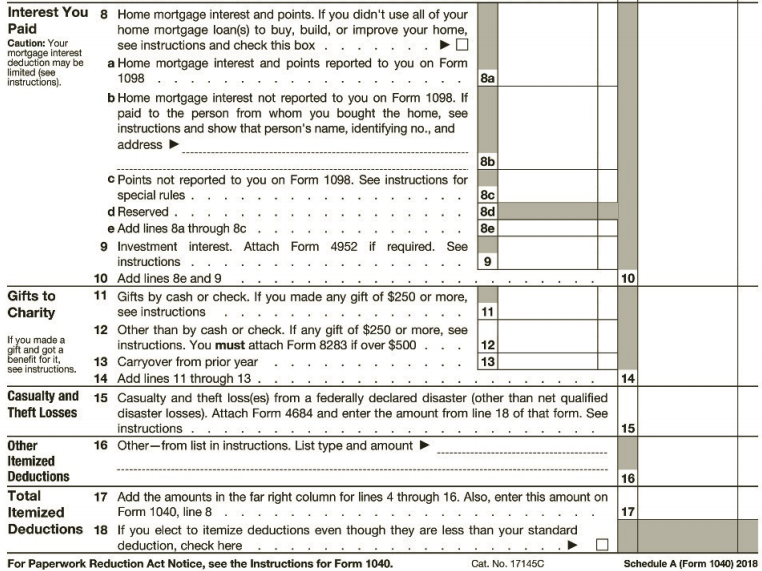

6. Gregory and Lulu paid (and can substantiate) the following amounts during the year:

Mastercard interest $1,480

Dental expenses (orthodontics for Gary) 4,600

California state income tax (for 2017) 2,450

Charitable contributions 3,875

Deductible interest on home (personal portion) 7,631

Real estate taxes (personal portion).................2,830

Life insurance premiums.................845

Automobile registration fees (deductible portion).................45

Tax return preparation fee.................475

Contributions to Donald Trump’s election campaign.................1,000

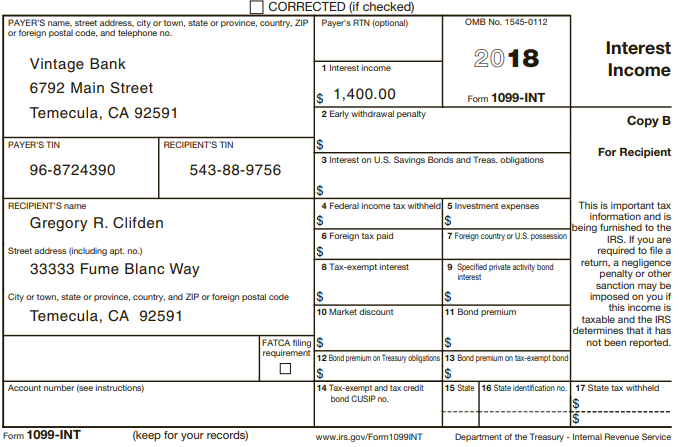

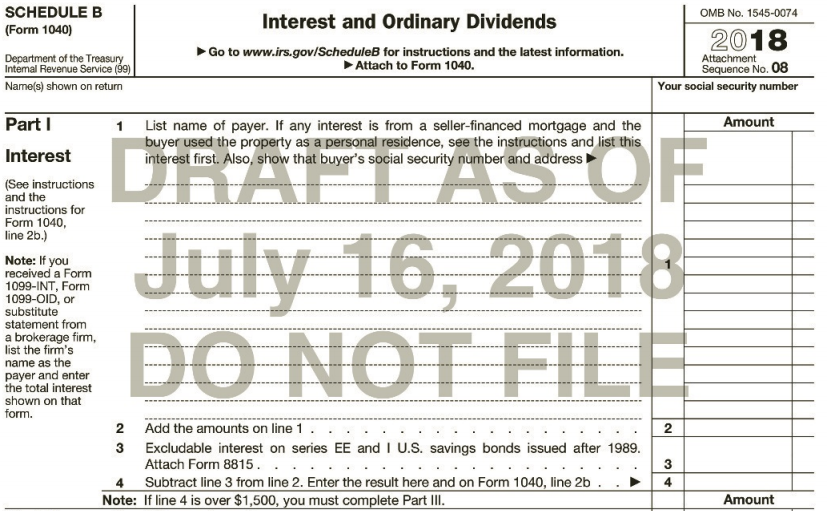

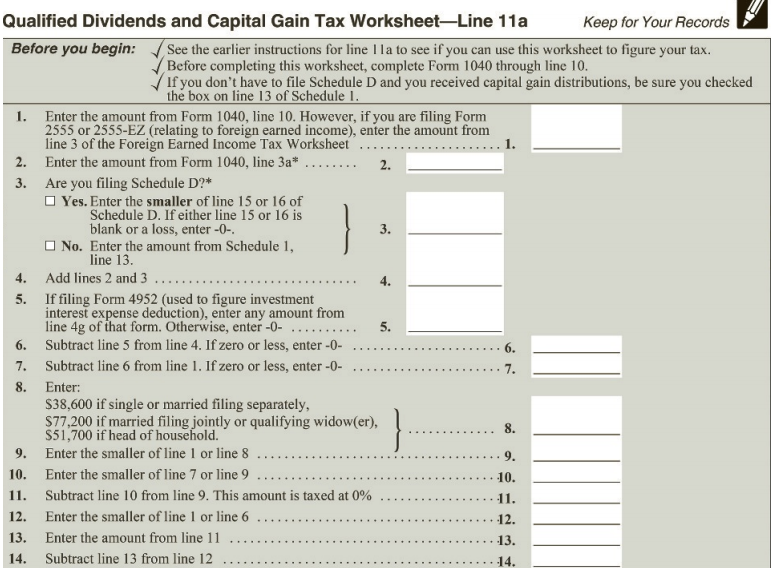

7. During the year, Gregory and Lulu received the following qualifying dividends and interest:

Interest: Bob’s Big Bank...............$ 375

Bank of Ireland...............220

City of Temecula Tax Exempt Bonds...............1,490

Vintage Bank See 1099-INT (Page D-12)

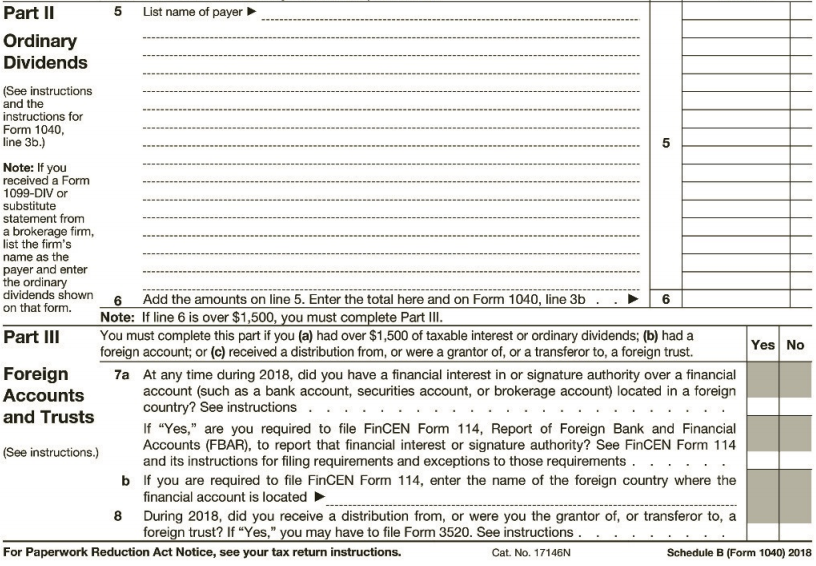

Qualified dividends:

Southwest Airlines...............$ 250

Heinz Foods................550

Also, Lulu owns Series EE U.S. savings bonds. During the year, the bond redemption value increased by $1,300. Lulu has not elected the accrual method for these bonds. There were no Irish taxes paid on the interest from the Bank of Ireland. All the above stocks, bonds, and bank accounts are community property.

Also, Lulu owns Series EE U.S. savings bonds. During the year, the bond redemption value increased by $1,300. Lulu has not elected the accrual method for these bonds. There were no Irish taxes paid on the interest from the Bank of Ireland. All the above stocks, bonds, and bank accounts are community property.

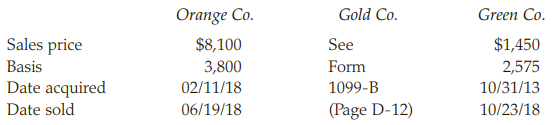

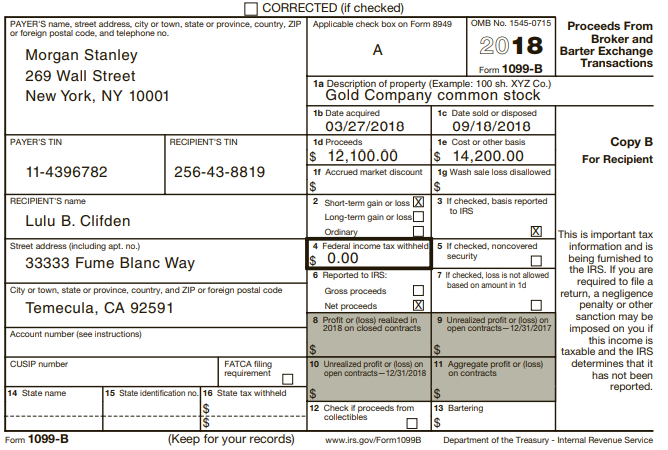

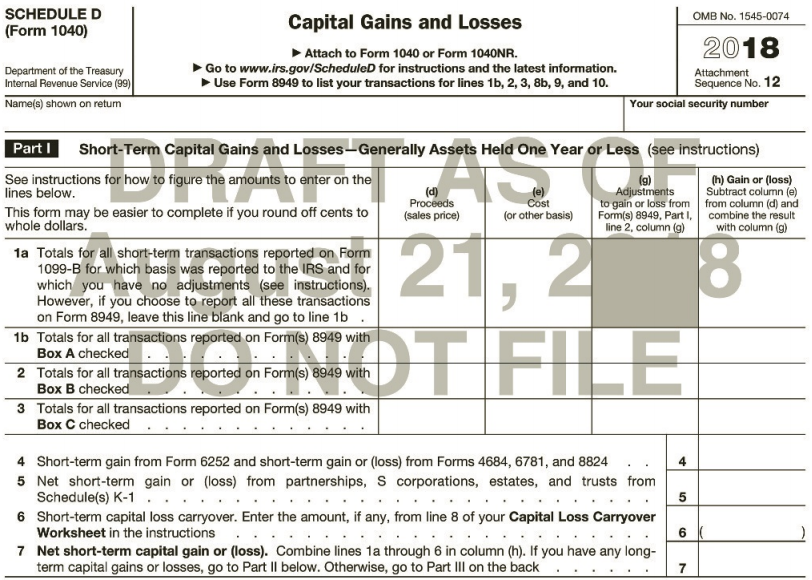

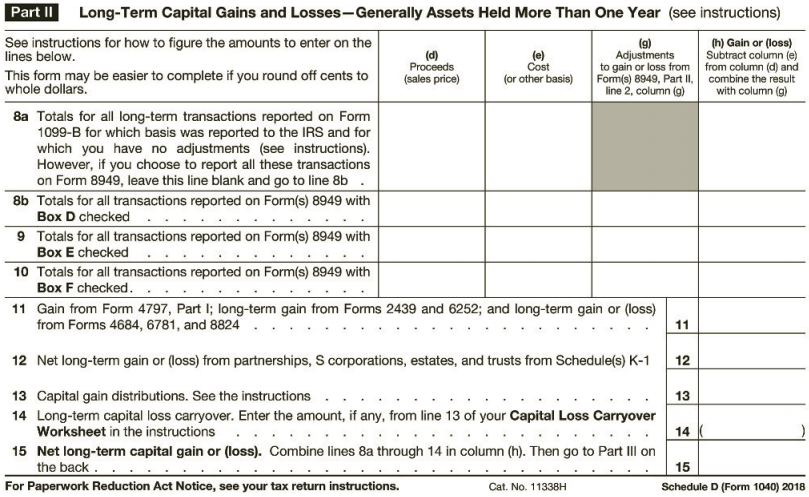

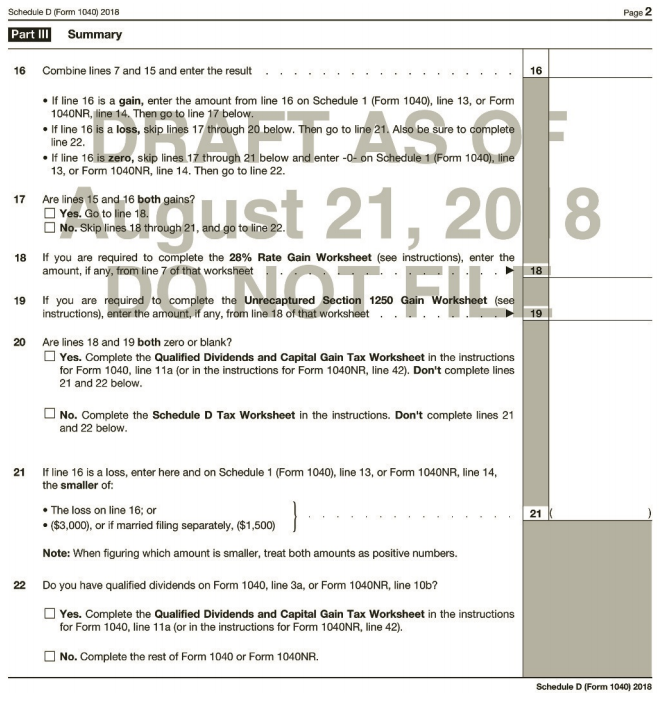

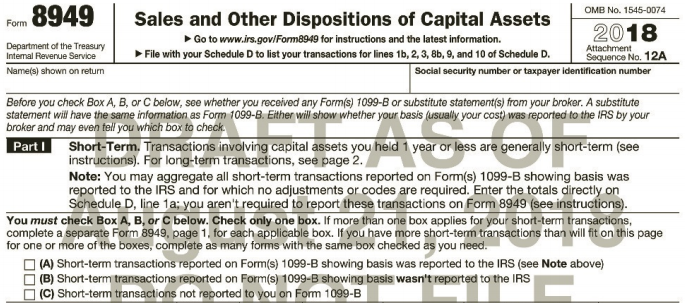

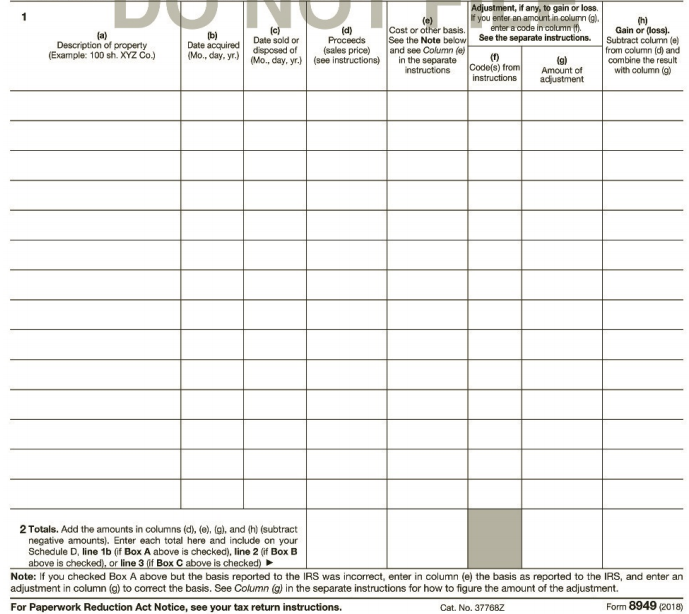

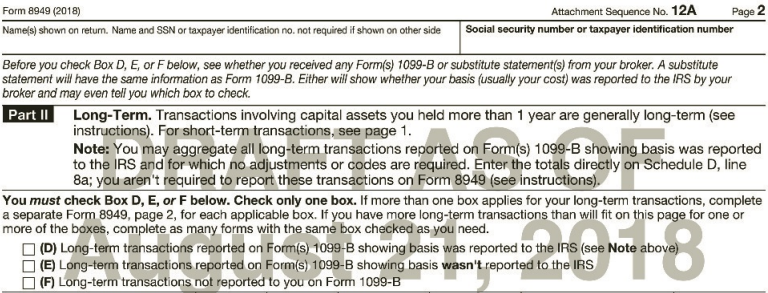

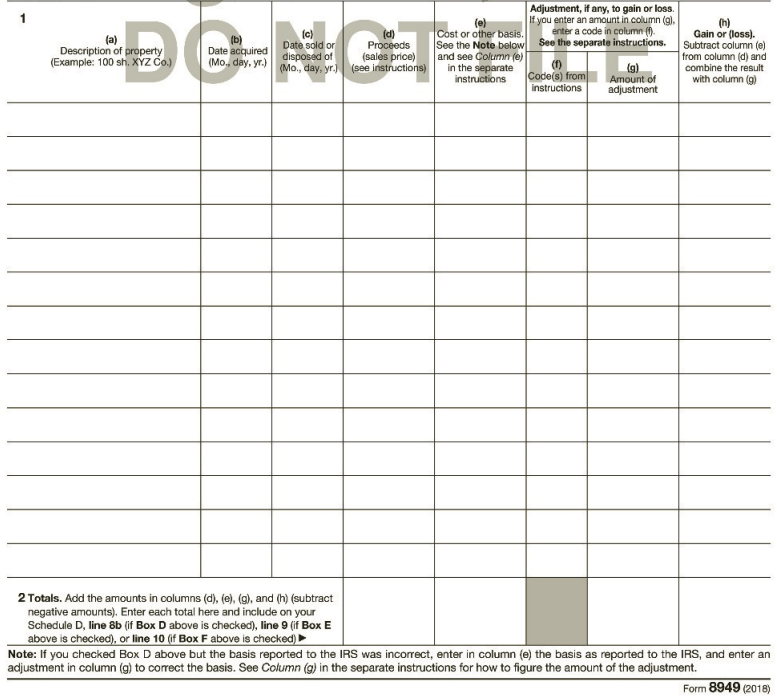

8. Lulu has a stock portfolio. During the year, she sold the following stock, shown on her Forms 1099-B as follows (basis was provided to the IRS in all cases):

9. Lulu paid her ex-husband $4,800 alimony in the current year, as required under the 2014 divorce decree. Her ex-husband’s name is Hector Leach and his Social Security number is 566-23-5431.

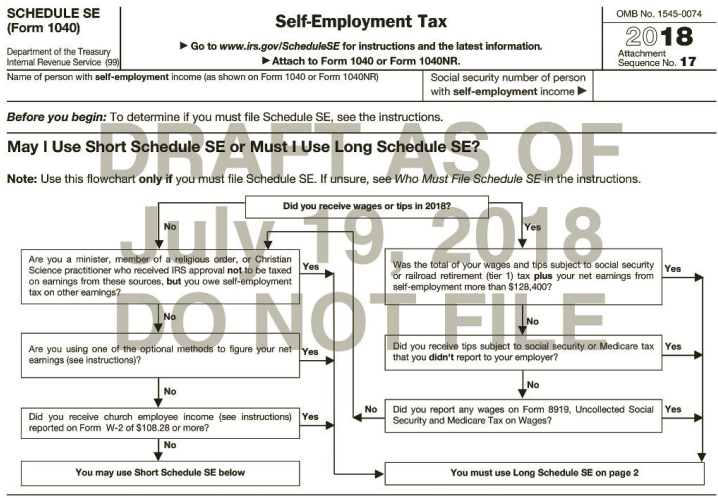

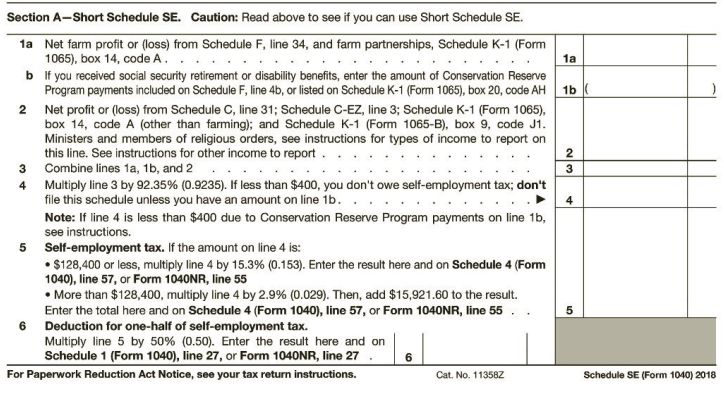

10. Gregory does all the significant work in the Bed & Breakfast and therefore he pays selfemployment tax on 100 percent of the earnings from the B&B.

11. During the year, Gregory’s uncle Martin died. Martin had a $50,000 life insurance policy that named Gregory as the beneficiary. Gregory received the check for the benefits payable under the policy on November 30 of the current year. Martin also left Gregory a small nonoperating farm with an appraised value of $120,000.

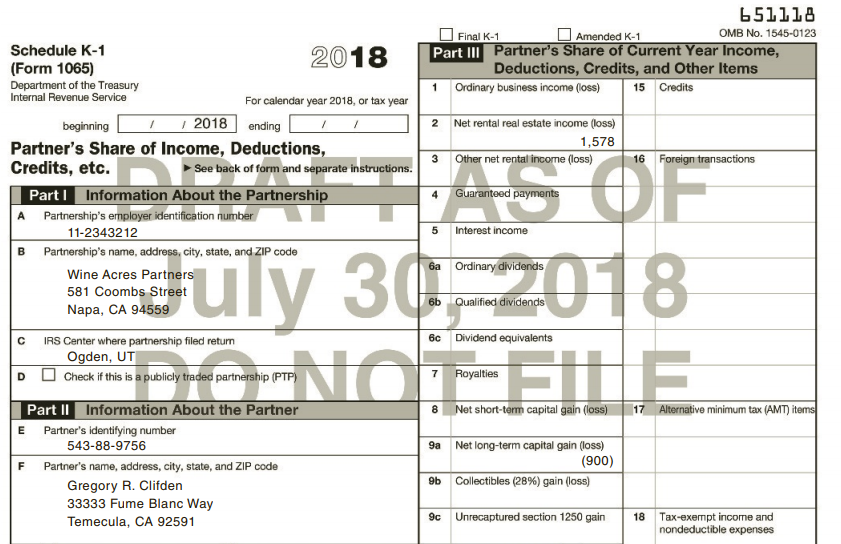

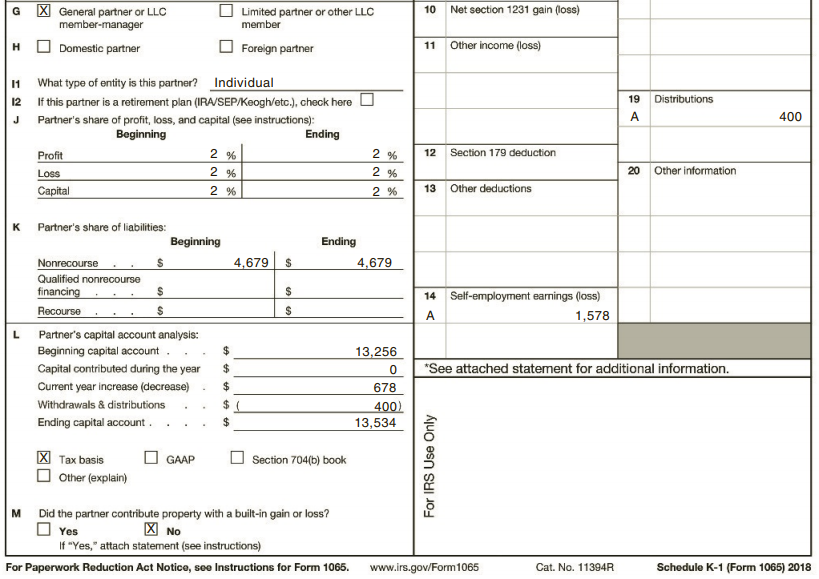

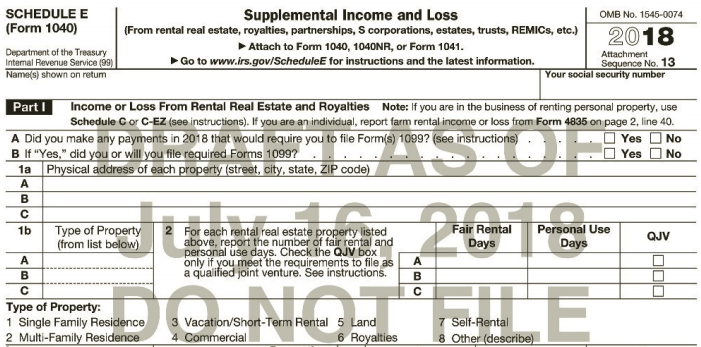

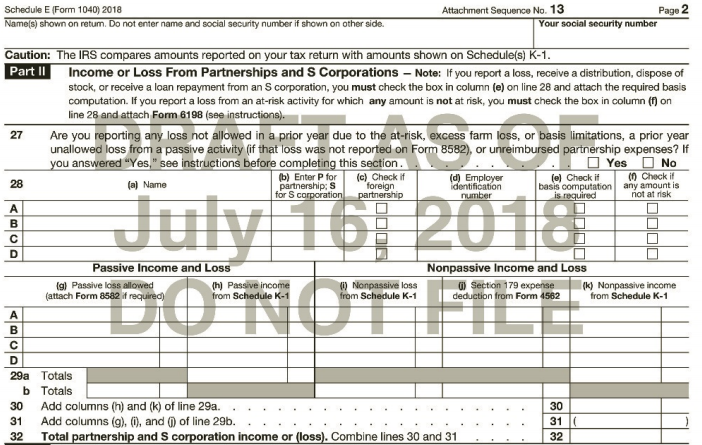

12. Gary is a general partner in a partnership that owns a boutique hotel in northern California and leases the property to a hotel management company. Gary does not materially participate in the partnership activity but the partnership activity does rise to the level of a trade or business. The Schedule K-1 from the partnership is shown on Page D-9.

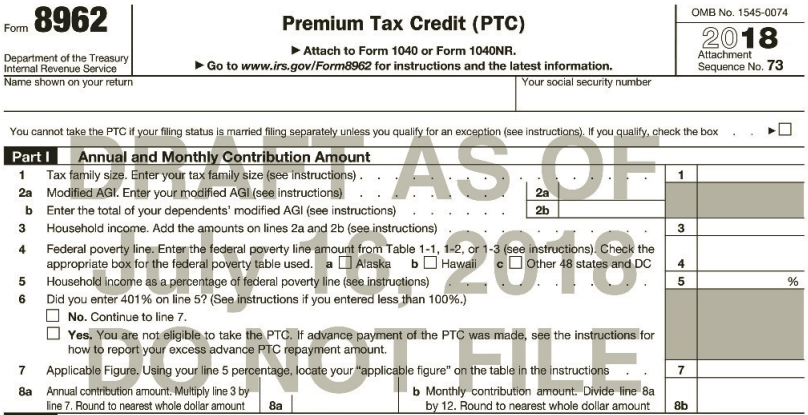

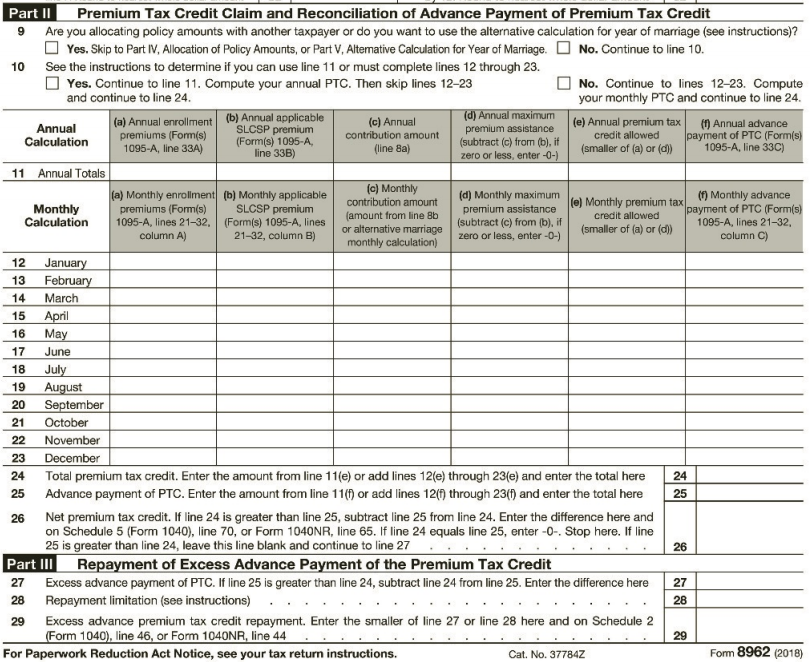

13. Lulu was not eligible for health care benefits due to the part-time nature of her job, thus health insurance for the Clifden household was purchased by Gregory. The Clifdens are not eligible from an exemption from coverage. The Clifdens purchased health insurance through the Covered California program and received the Form 1095-A shown on Page D-11. They had no other health insurance during 2018. Assume that the selfemployed health insurance deduction is $1,540. The Clifdens did not claim an advance premium credit.

Required:

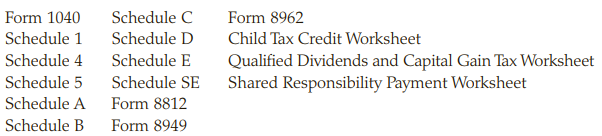

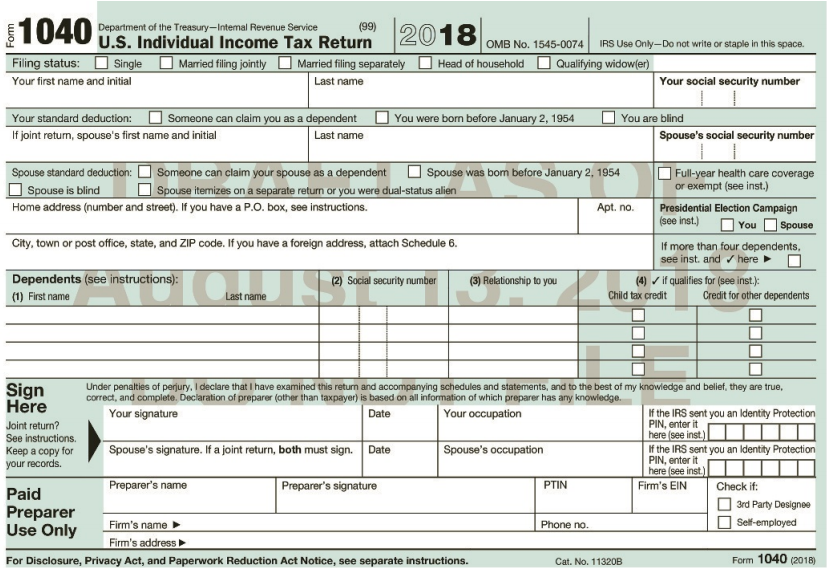

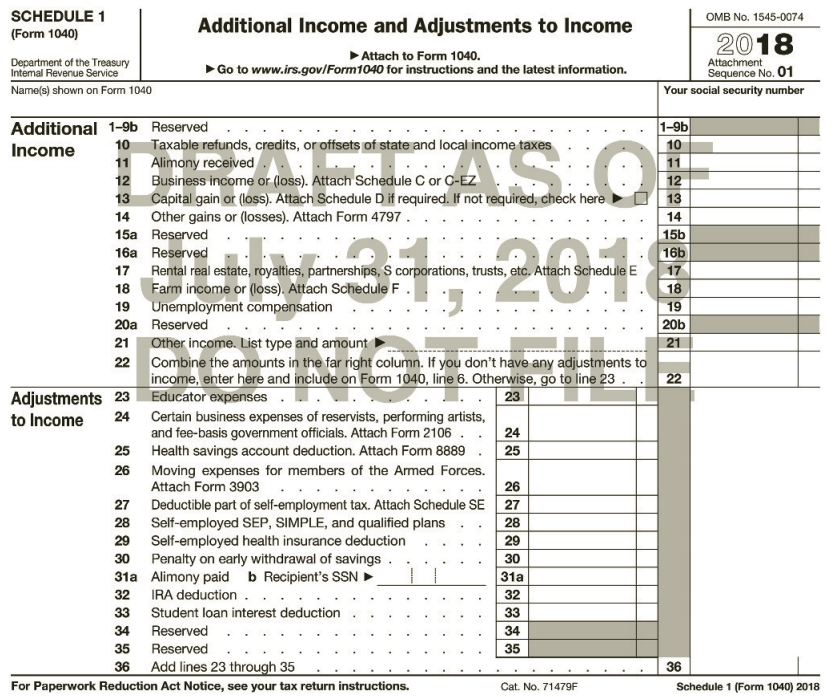

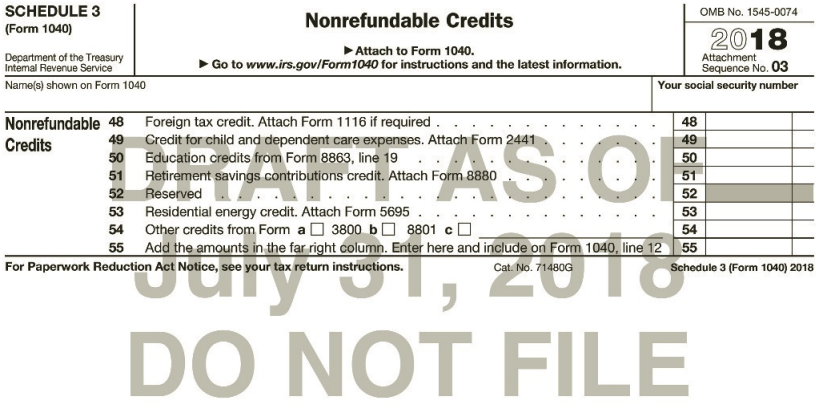

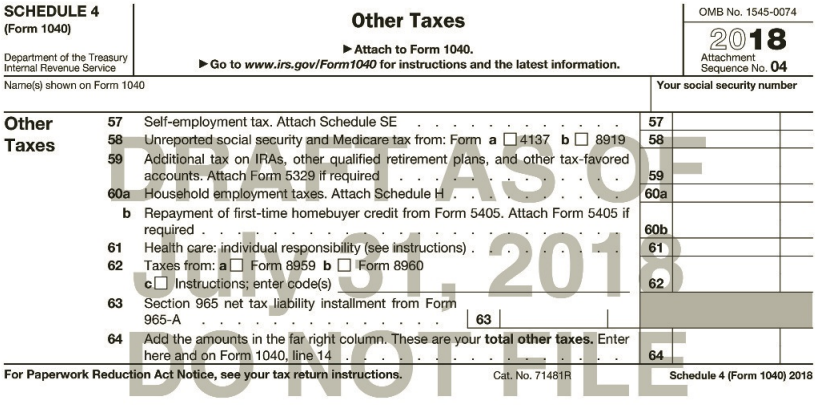

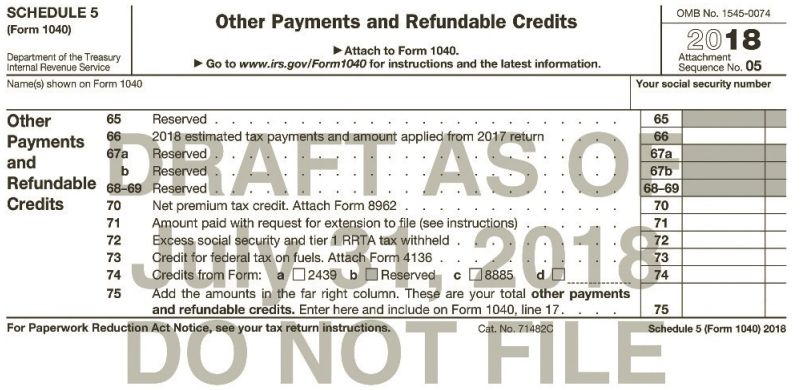

Gregory and Lulu have come to you to prepare their 2018 federal income tax return. Do not complete a California state income tax return. Gregory and Lulu have given you several IRS forms (see Pages D-11 and D-12). Make realistic assumptions about any missing data (addresses, etc.) that you need. Do not file a federal Form 4952. The following is a list of the forms and schedules that you will need to complete the tax return:

Note:

The forms included in Appendix D are provided for the student to work on only one of the two comprehensive problems. If desired, additional forms may be obtained from the IRS website at www.irs.gov.

A legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer:

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill