The process for employee withholding involves: a. Using only a 2020 Form W-4 for all employees to

Question:

The process for employee withholding involves:

a. Using only a 2020 Form W-4 for all employees to calculate income tax withholding.

b. Using a 2020 Form W-4 for new employees (all existing employees must use a pre- 2020 Form W-4) to calculate income tax withholding.

c. The employee provides filing status and the employer completes the Form W-4 and submits to the IRS for proper withholding.

d. Existing employees may use either their previous Form W-4 or may complete a new 2020 Form W-4 and new employees must complete a 2020 Form W-4 and the employer uses those forms to calculate income tax withholding.

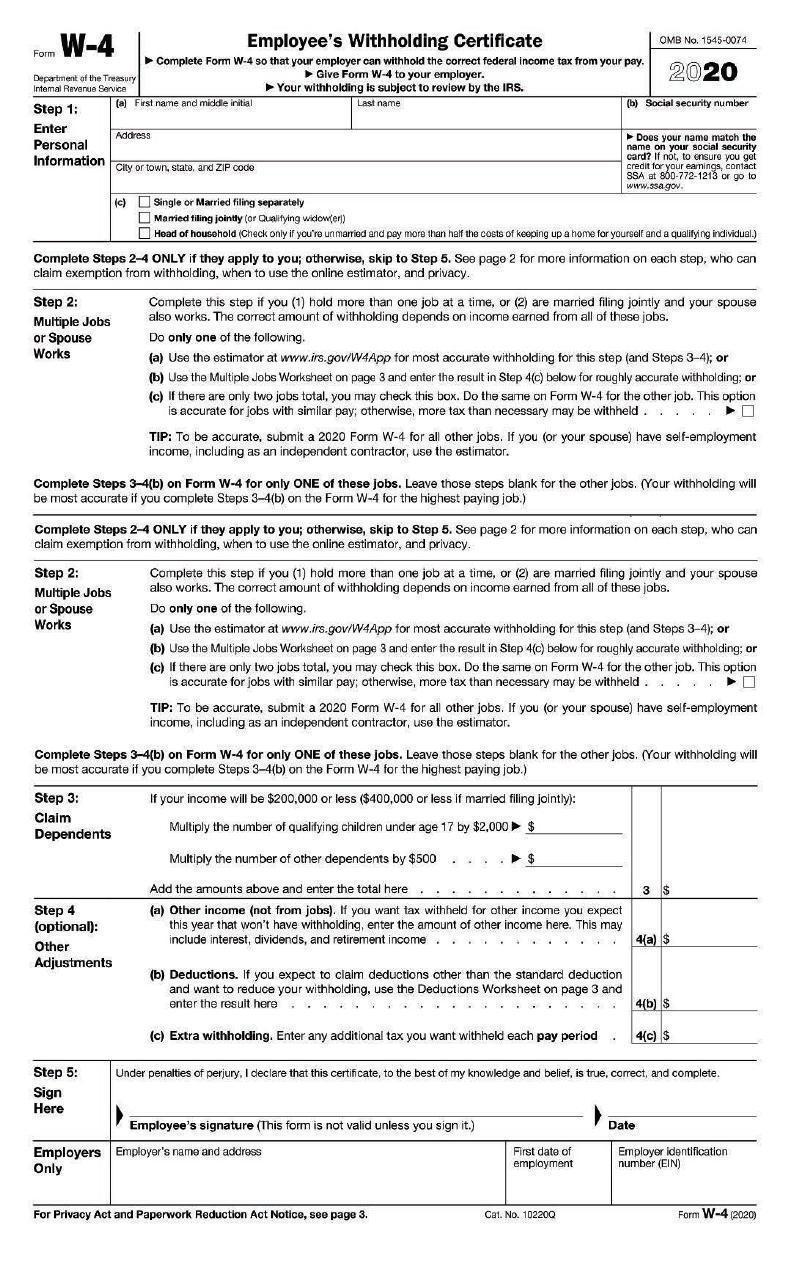

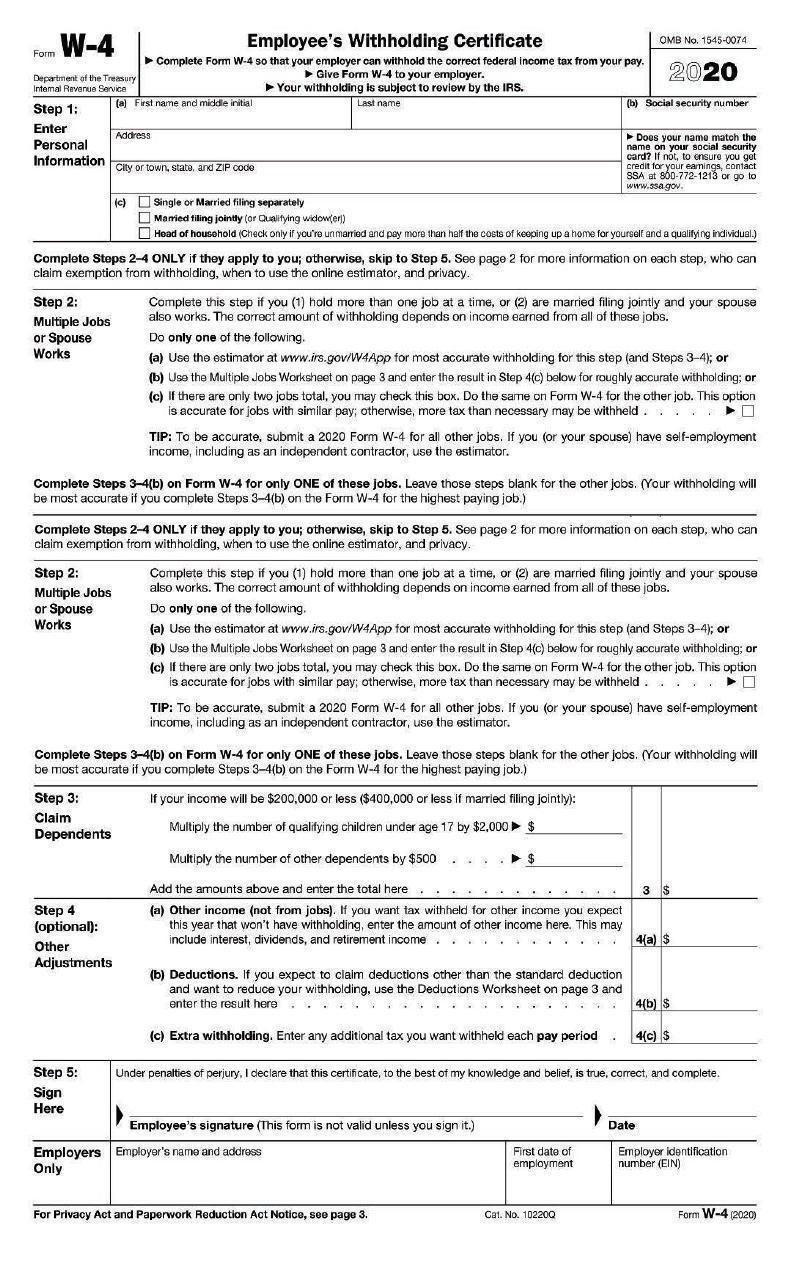

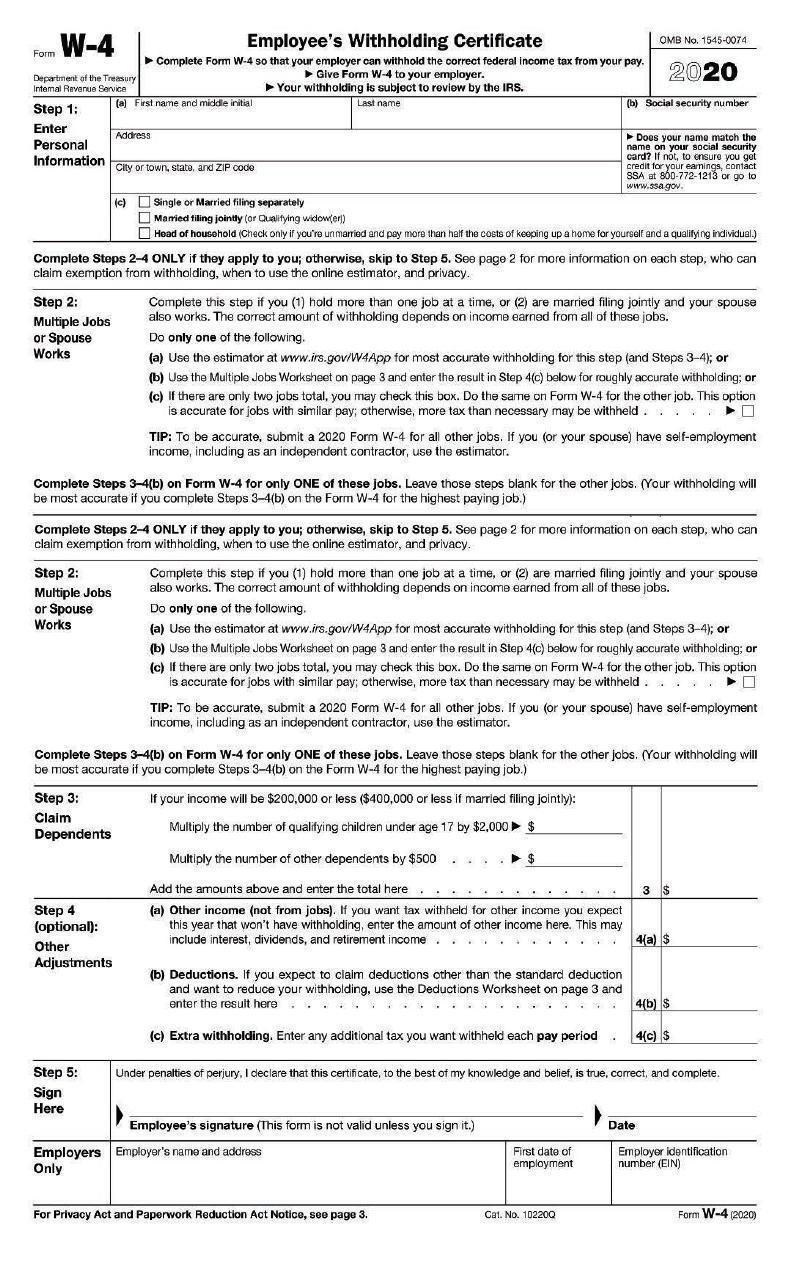

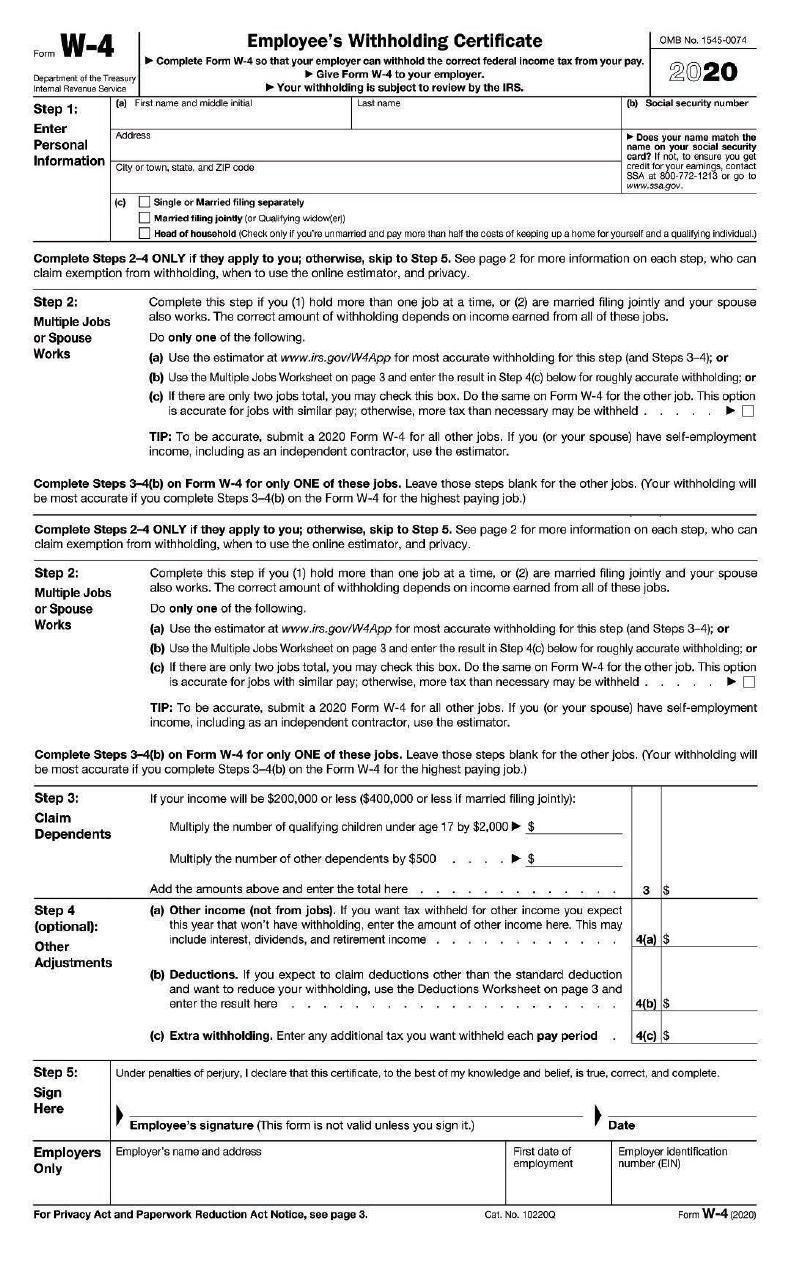

Form W-4 Department of the Treasury Internal Revenue Service Step 1: Enter Personal Information Step 2: Multiple Jobs or Spouse Works Step 2: Multiple Jobs or Spouse Works Employee's Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Give Form W-4 to your employer. Your withholding is subject to review by the IRS. Last name (a) First name and middle initial Step 3: Claim Dependents Address Step 4 (optional): Other Adjustments City or town, state, and ZIP code Step 5: Sign Here (c) Single or Married filing separately Complete Steps 2-4 ONLY if they apply to you; otherwise, skip to Step 5. See page 2 for more information on each step, who can claim exemption from withholding, when to use the online estimator, and privacy. Married filing jointly (or Qualifying widow(er)) Head of household (Check only if you're unmarried and pay more than half the costs of keeping up a home for yourself and a qualifying individual.) Complete Steps 3-4(b) on Form W-4 for only ONE of these jobs. Leave those steps blank for the other jobs. (Your withholding will be most accurate if you complete Steps 3-4(b) on the Form W-4 for the highest paying job.) Complete Steps 2-4 ONLY if they apply to you; otherwise, skip to Step 5. See page 2 for more information on each step, who can claim exemption from withholding, when to use the online estimator, and privacy. Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse also works. The correct amount of withholding depends on income earned from all of these jobs. Do only one of the following. (a) Use the estimator at www.irs.gov/W4App for most accurate withholding for this step (and Steps 3-4); or (b) Use the Multiple Jobs Worksheet on page 3 and enter the result in Step 4(c) below for roughly accurate withholding; or (c) If there are only two jobs total, you may check this box. Do the same on Form W-4 for the other job. This option is accurate for jobs with similar pay; otherwise, more tax than necessary may be withheld.... 0 OMB No. 1545-0074 2020 (b) Social security number TIP: To be accurate, submit a 2020 Form W-4 for all other jobs. If you (or your spouse) have self-employment income, including as an independent contractor, use the estimator. Does your name match the name on your social security card? If not, to ensure you get credit for your earnings, contact SSA at 800-772-1213 or go to www.ssa.gov. Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse also works. The correct amount of withholding depends on income earned from all of these jobs. Complete Steps 3-4(b) on Form W-4 for only ONE of these jobs. Leave those steps blank for the other jobs. (Your withholding will be most accurate if you complete Steps 3-4(b) on the Form W-4 for the highest paying job.) If your income will be $200,000 or less ($400,000 or less if married filing jointly): Multiply the number of qualifying children under age 17 by $2,000 $ Multiply the number of other dependents by $500 $ Add the amounts above and enter the total here (a) Other income (not from jobs). If you want tax withheld for other income you expect this year that won't have withholding, enter the amount of other income here. This may include interest, dividends, and retirement income... 4(a) $ Do only one of the following. (a) Use the estimator at www.irs.gov/W4App for most accurate withholding for this step (and Steps 3-4); or (b) Use the Multiple Jobs Worksheet on page 3 and enter the result in Step 4(c) below for roughly accurate withholding; or (c) If there are only two jobs total, you may check this box. Do the same on Form W-4 for the other job. This option is accurate for jobs with similar pay; otherwise, more tax than necessary may be withheld.... O (b) Deductions. If you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the Deductions Worksheet on page 3 and enter the result here (c) Extra withholding. Enter any additional tax you want withheld each pay period TIP: To be accurate, submit a 2020 Form W-4 for all other jobs. If you (or your spouse) have self-employment income, including as an independent contractor, use the estimator. Employee's signature (This form is not valid unless you sign it.) Employers Employer's name and address Only For Privacy Act and Paperwork Reduction Act Notice, see page 3. First date of employment Cat. No. 10220Q Under penalties of perjury, I declare that this certificate, to the best of my knowledge and belief, is true, correct, and complete. 3 $ 4(b) $ 4(c) $ Date Employer identification number (EIN) Form W-4 (2020)

Step by Step Answer:

d Existing employees may use either their previous Form W4 or may complete a new 2020 Form W4 and new employees must complete a 2020 Form W4 and the employer uses those forms to calculate income tax w...View the full answer

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Students also viewed these Business questions

-

The process for employee withholding involves: a. using only a 2020 Form W-4 for all employees to calculate income tax withholding. b. using a 2020 Form W-4 for new employees (all existing employees...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

Abbe, age 56, started a new job in 2020. At Abbes previous employer she had filed a Form W-4 with 5 allowances. Abbes new employer will: a. Use a copy of Abbes previous Form W-4 to calculate income...

-

Francis and Peter are in a partnership sharing profits and losses in the ratio 3:2. The following is their trial balance as at 30 September 2020. particulars D ebit C redit Buildings (cost: RM...

-

Was the meeting of the Bigmar board of directors valid? Bigmar was a Delaware corporation that manufactured and marketed pharmaceuticals in Europe. While trying to raise additional capital, the...

-

Birch Corp. is a real estate developer with its headquarters in Burlington, Ontario. As a result of recent increases in land prices, Birch has accumulated a substantial amount of excess cash. It is...

-

The following is a general result from matrix theory: Let $\mathbf{A}$ be an $m \times n$ matrix. Suppose that the equation $\mathbf{A x}=\mathbf{p}$ can achieve no $\mathbf{p} \geq \mathbf{0}$...

-

1. How does virtualization work? In your own words, describe what you understand about the virtualization process as depicted in the case. 2. In software development and testing, where does...

-

An invoice, with payment terms of 3/10, n/30, was issued on April 28 for $240. If the payment was made on May 12. What will be the amount of payment? (Round your answer to the nearest cent)

-

Using the information from Problem 11, complete Form 941 and Worksheet 1 located on Pages 9-55 to 9-58 for Drew for the second quarter of 2020. Assume the following additional information: Drew was...

-

Pat sells land for $25,000 cash and a $75,000 5-year note. If her basis in the property is $30,000 and she receives only the $25,000 down payment in the year of sale, how much is Pats taxable gain in...

-

The following is the profit and loss account and balance sheet of Sach International Ltd. Redraft these for the purpose of ratio analysis and calculate profitability ratios based on sales....

-

Assume that 90-day U.S. securities have a 4.5% annualized interest rate whereas 90-day Swiss securities have a 5% annualized interest rate. In the spot market, 1 U.S. dollar can be exchanged for 1.2...

-

Why would management want to increase the riskiness of the firm? Why would this make bondholders unhappy?

-

What does the Miller model with personal and corporate taxes imply about value relative to the MM model with just corporate taxes?

-

What two characteristics can lead to conflicts between the NPV and the IRR when evaluating mutually exclusive projects?

-

Why does the MM theory with corporate taxes lead to 100% debt?

-

Kevin Finnegan, CPA, has just billed a customer $ 40,000 for services rendered. The customer wants to pay for this bill by making monthly payments over the next three years. A. Determine the amount...

-

Find an equation of the given line. Slope is -2; x-intercept is -2

-

George receives a $1,500 distribution from his educational savings account. He uses $1,200 to pay for qualified higher education expenses. Immediately prior to the distribution, Georges account...

-

Ramon, a single taxpayer, has adjusted gross income for 2016 of $350,100. His itemized deductions total $50,000 consisting of $30,000 of state income taxes and $20,000 of charitable contributions....

-

Jim and Martha are married taxpayers with $404,000 of adjusted gross income in 2016. They are allowed two personal exemptions. What is the amount of each of their $4,050 exemption deductions after...

-

How do advanced analytics and artificial intelligence contribute to the development of data-driven strategies, enabling organizations to derive actionable insights, optimize resource allocation, and...

-

How do organizations effectively balance emergent strategies with deliberate strategies in dynamic environments characterized by uncertainty and rapid change ?

-

Write an equation of the line satisfying the given conditions. Write the answer in slope - intercept form. The line passes through the point (2, 13) and has a slope of 4.

Study smarter with the SolutionInn App