Xialu is a single taxpayer who is under age 65 and in good health. For 2020, she

Question:

Xialu is a single taxpayer who is under age 65 and in good health. For 2020, she has a salary of $25,000 and itemized deductions of $7,000. Leslie allows her mother to live with her during the winter months (3–4 months per year), but her mother provides all of her own support otherwise.

Transcribed Image Text:

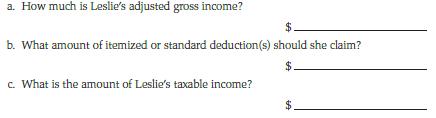

a. How much is Leslie's adjusted gross income? b. What amount of itemized or standard deduction (s) should she claim? c. What is the amount of Leslie's taxable income?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (5 reviews)

a 25000 b 12400 the gr...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Leslie is a single taxpayer who is under age 65 and in good health. For 2018, she has a salary of $24,000 and itemized deductions of $1,000. Leslie allows her mother to live with her during the...

-

Leslie is a single taxpayer who is under age 65 and in good health. For 2019, she has a salary of $24,000 and itemized deductions of $1,000. Leslie allows her mother to live with her during the...

-

Leslie is a single taxpayer who is under age 65 and in good health. For 2014, she has a salary of $23,000 and itemized deductions of $1,000. Leslie is entitled to one exemption on her tax return. a....

-

Solve each system. If a system is inconsistent or has dependent equations, say so. -5x + 2y = -4 6x + 3y = -6

-

What are the four basic parts of a use case model? What is its purpose or objective?

-

It took roughly 14 years for the Dow Jones Average of 30 Industrial Stocks to go from 1,000 to 2,000. To double from 2,000 to 4,000 took only 8 years, and to go from 4,000 to 8,000 required roughly 2...

-

Explain public policies that protect employees from unlawful discharge.

-

Delphi Company has developed a new product that will be marketed for the first time during the next fiscal year. Although the marketing department estimates that $35,000 units could be sold at $36...

-

Question -The US Trade Deficit - Is it Good or Bad for the US Economy? If so what's the reason?

-

Typical corporate income is reported on: a. Form 1040 b. Form 1120 c. Form 1040X d. Form 1065

-

Jason and Mary Wells, friends of yours, were married on December 30, 2020. They know you are studying taxes and have sent you an e-mail with a question concerning their filing status. Jason and Mary...

-

A firm started advertising its product and this changed the products elasticity from - 2 to -1.5. If, prior to advertising, the firm charged $10, the firm should a. Raise price from $10 to $15.00. b....

-

In June 2018, Bernard Ramish set up a $48,000 trust fund through West Plains Credit Union to provide tuition for his nephew, Nathan Covacek, to attend Tri-State Polytechnic Institute. The trust was...

-

Bill is the pharmacy owner and PIC at Bills Pharmacy. The state Bills pharmacy is in has a freedom of choice law regarding third-party plans. You have been a long-time customer of Bills and you...

-

The following situations are similar, but each represents a variation of a particular crime. Identify the crime and point out the differences in the variations. 1. Chen, posing fraudulently as...

-

Heesham Broussard obtained counterfeit money instruments. To distribute them, he used account information and numbers on compromised FedEx accounts procured from hackers. Text messages from Broussard...

-

Using your state laws and rules, how does your state regulate LTCFs regarding pharmacies and/or pharmacists? Are these laws and regulations under the states pharmacy practice act or in another set of...

-

Energy prices are forecast to go higher. How would this affect your decision to purchase the stocks and bonds of a) ExxonMobil? b) American Airlines? c) Ford? d) Archer Daniels Midland, a food...

-

Continuation of Exercise 4-83. (a) What is the probability that the first major crack occurs between 12 and 15 miles of the start of inspection? (b) What is the probability that there are no major...

-

In 2019, Gale and Cathy Alexander hosted an exchange student, Axel Muller, for 9 months. Axel was part of International Student Exchange Programs (a qualified organization). Axel attended tenth grade...

-

John Williams (birthdate August 2, 1976) is a single taxpayer. Johns earnings and withholdings as the manager of a local casino for 2019 are reported on his Form W-2: Johns other income includes...

-

Which of the following entities is likely to have the greatest flexibility in choosing a year-end other than a calendar year-end? a. Sole proprietor b. General partnership c. Corporation d. S...

-

High Country, Incorporated, produces and sells many recreational products. The company has just opened a new plant to produce a folding camp cot that will be marketed throughout the United States....

-

The ledger account balances for Greely Corporation at December 31, 2022 are as follows: Cash $ 300 Accounts Receivable 522 Prepaid Insurance 82 Supplies 180 Equipment 4,000 Accumulated Depreciation,...

-

looking over various business plans, select two or three plans to discuss and analyze. How a business plan can contribute to the overall success of a business. Why the overall presentation of a...

Study smarter with the SolutionInn App