John Williams (birthdate August 2, 1976) is a single taxpayer. Johns earnings and withholdings as the manager

Question:

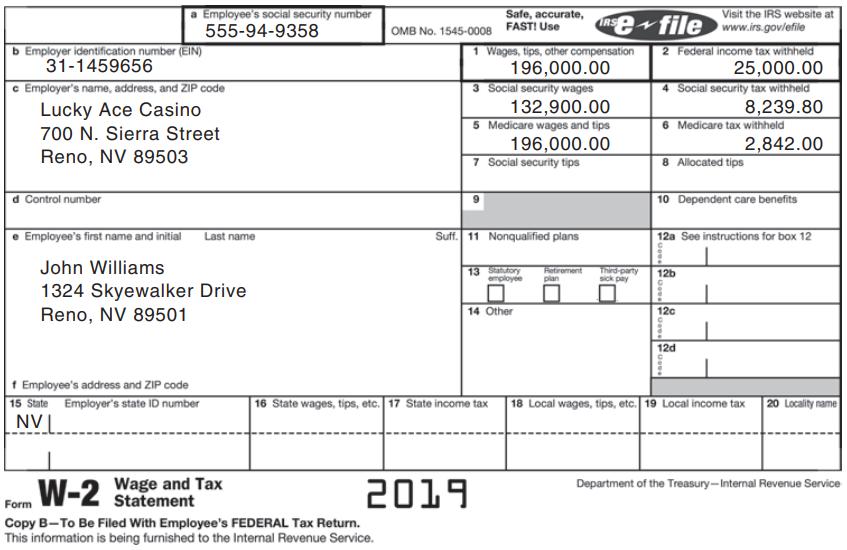

John Williams (birthdate August 2, 1976) is a single taxpayer. John’s earnings and withholdings as the manager of a local casino for 2019 are reported on his Form W-2:

John’s other income includes interest on a savings account at Nevada National Bank of $13,691.

John pays his ex-wife, Sarah McLoughlin, $3,900 per month in accordance with their February 12, 2013 divorce decree. When their 12-year-old child (in the ex-wife’s custody) reaches the age of 18, the payments are reduced to $2,800 per month. His exwife’s Social Security number is 554-44-5555.

In 2019, John purchased a new car and so he kept track of his sales tax receipts during the year. His actual sales tax paid is $3,700, which exceeds the estimated amount per the IRS tables.

John participates in a high-deductible health plan and is eligible to contribute to a health savings account. His HSA earned $75 in 2019.

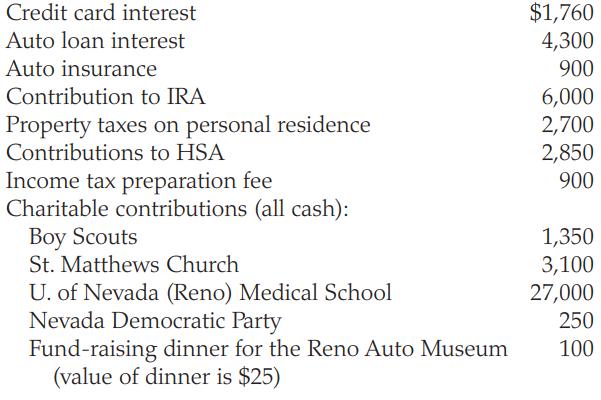

During the year, John paid the following amounts (all of which can be substantiated):

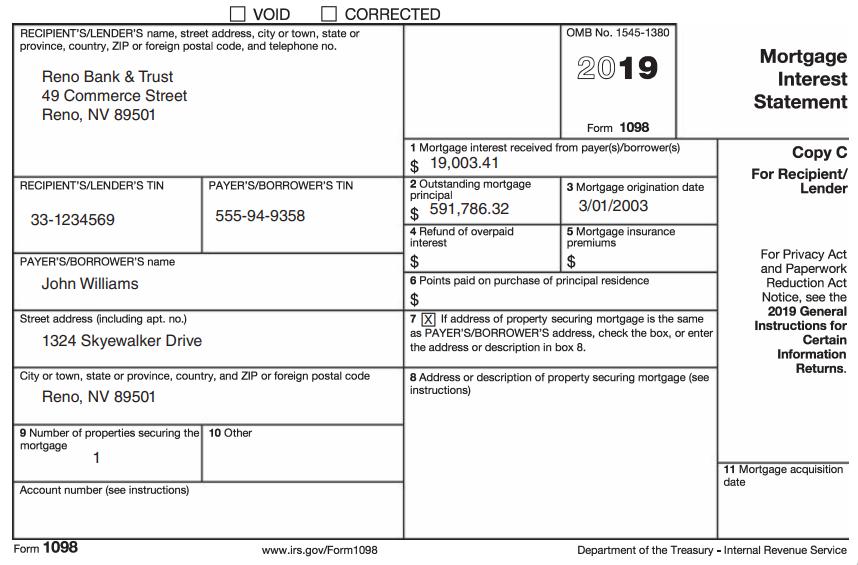

John also received the following Form 1098:

Required:

Complete John’s federal tax return for 2019. Use Form 1040, Schedule 1, Schedule A, Schedule B, and Form 8889 to complete this tax return. Make realistic assumptions about any missing data.

Step by Step Answer:

Income Tax Fundamentals 2020

ISBN: 9780357108239

38th Edition

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven Gill