Question: In this problem, you will process the sales and purchases transactions for the week of February 8 through February 14 for Vetter Vacuum Center. Step

In this problem, you will process the sales and purchases transactions for the week of February 8 through February 14 for Vetter Vacuum Center.

Step 1: Start Integrated Accounting 8e.

Step 2: Load opening balances file IA8 Problem 04-A.

Step 3: Enter your name in the Your Name text box and click OK.

Step 4: Save the file with a file name of 04-A Your name.

Step 5: Enter the following purchase order and purchase invoice transactions.

Weekly Purchase Order and Purchase Invoice Transactions

Feb 08

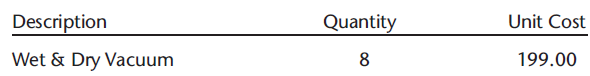

Ordered the following merchandise from Handy Manufacturing, Inc., terms 2/10, n/30. Purchase Order No. 277.

11

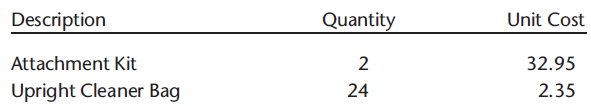

Received the following merchandise for Purchase Order No. 275 from Handy Manufacturing, Inc., terms 2/10, n/30. Purchase Invoice No. 859.

12

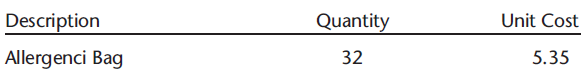

Received the following merchandise for Purchase Order No. 276 from Royal Accessories, Inc., terms 2/10, n/30. Purchase Invoice No. 860.

14

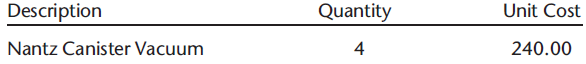

Ordered the following merchandise from Nantz Vacuum Cleaner Co., terms 2/10, n/30. Purchase Order No. 278.

Step 6: Enter the following sales invoice transactions.

Weekly Sales Invoice Transactions

Feb 08

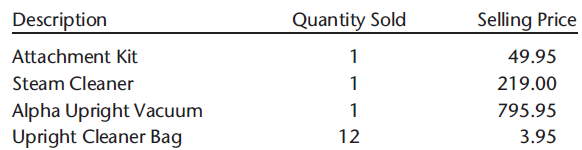

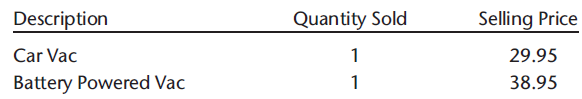

Sold the following merchandise to Fraze Department Stores, terms 2/10, n/30, 7% sales tax, Sales Invoice No. 531:

Feb 09

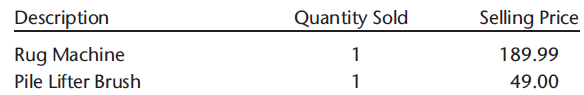

Sold the following merchandise to Jennifer Martens, terms 30 days, 7% sales tax, Sales Invoice No. 532:

Feb 10

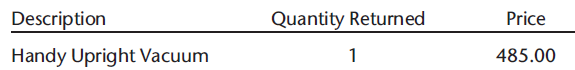

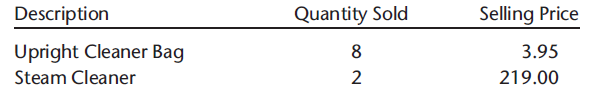

The following merchandise was returned to Vetter Vacuum Center by Wingler Motel, 7% sales tax, Sales Return No. R530:

Feb 10

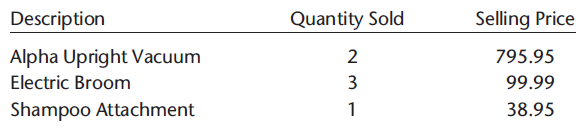

Sold the following merchandise to Wingler Motel, terms 2/10, n/30, 7% sales tax, Sales Invoice No. 533:

Feb 11

Sold the following merchandise to Robert Thorson, terms 30 days, 7% sales tax, Sales Invoice No. 534:

Feb 12

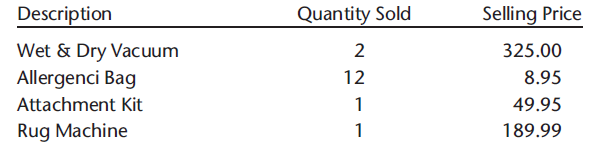

Sold the following merchandise to Bassett Cleaning, Inc., terms 2/10, n/30, 7% sales tax, Sales Invoice No. 535:

Feb 13

Sold the following merchandise to Lilly Industries, Inc., terms 2/10, n/30, 7% sales tax, Sales Invoice No. 536:

Feb 14

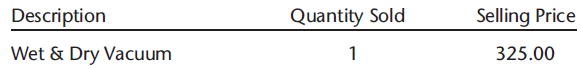

Sold the following merchandise to Matthew Cornish, terms 30 days, 7% sales tax, Sales Invoice No. 537:

Step 7: Enter the following cash payments transactions.

Weekly Cash Payment Transactions

Feb 13

Paid invoice 859 to Handy Manufacturing, Inc., $171.20, less 2% discount, $3.42. Check No. 3621.

14

Paid invoice 855 to Royal Accessories, Inc., $511.20, no discount. Check No. 3622.

Step 8: Enter the following cash receipt transactions.

Weekly Cash Receipt Transactions

Feb 10

Received cash on account from Lilly Industries, Inc., covering Sales Invoice No. 525 for $828.66, less 2% discount, $16.57.

12

Received cash on account from Bassett Cleaning, Inc., covering Sales Invoice No. 527 for $909.13, less 2% discount, $18.18.

13

Received cash on account from Broderick Company, covering Sales Invoice No. 518 for $7,594.73, no discount.

Step 9: Display the purchase order, purchase invoice, and sales invoice registers for the period February 8 through February 14.

Step 10: Display the general, purchases, cash payments, sales, and cash receipts journals for the period February 8 through February 14.

Step 11: Display a General Ledger report for the Accounts Receivable, Sales, Sales Returns and Allowance, and Sales Discount accounts.

Step 12: Display a Trial Balance report.

Step 13: Display a Schedule of Accounts Receivable and an Accounts Receivable Ledger report for all customers.

Step 14: Display a statement of account for Bassett Cleaning, Inc.

Step 15: Display an Inventory List report.

Step 16: Display the inventory transactions for the period of February 8 through February 14.

Step 17: Display the Yearly Sales report.

Step 18: Display the Top Customers graph.

Step 19: Save your data to disk.

Step 20: Use Check on the toolbar to check your work.

Step 21: Optional spreadsheet integration activity.

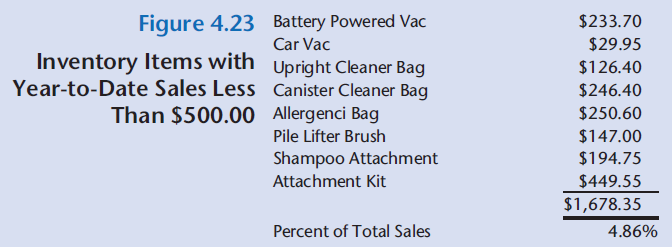

Use a spreadsheet to prepare a list of inventory items with year-to-date gross sales greater than $1,000.00. Use Figure 4.23 as a guide if necessary.

a. Display and copy the yearly sales report to the clipboard in spreadsheet format.

b. Start your spreadsheet software and load file IA8 Spreadsheet 04-S.

c. Select cell A1 as the current cell (if not already selected) and paste the yearly sales report into the spreadsheet.

d. In cell B35, enter the IF function appropriate for your spreadsheet software to display the description of each inventory item with year-to-date gross sales greater than $1,000.00 €“ if not, display €˜€˜Delete this row.€™€™ For example, @IF(E10>1000,B10,€™€™Delete this row€™€™). Copy the formula from cell B35 to cells B36-B50.

e. In cell C35, enter the IF function appropriate for your spreadsheet software to display the amount of each inventory item with year-to date gross sales greater than $1,000.00 €“ if not, display a blank. For example, @IF(E10>1000,E10,€˜€˜ €™€™). Copy the formula from cell C35 to cells C36-C50.

f. Delete the rows in cells B35-B50 that contain €˜€˜Delete this row.€™€™

g. Sum the amount (column C) of the items that match the criteria, and use this sum to calculate and display the percent of yearly total sales.

h. Print the list of items that meet the criteria.

i. Save your spreadsheet data with a file name of 04-A Your Name.

Step 22: Optional word processing integration activity.

Prepare a memorandum to the Owner of Vetter Vacuum Center (Diane Vetter) listing the items of inventory with year-to-date gross sales greater than $1,000.00 and their percent of total sales.

a. Copy the list of inventory items from the spreadsheet.

b. Start your word processing software and load template file IA8 Word processing 04-S (load as a document file).

c. Paste the contents of the clipboard into the memorandum at the location specified and change the text reference from less than $500.00 to greater than $1,000.00.

d. Format the document as necessary.

e. Enter your name and today€™s date where indicated.

f. Print the memorandum.

g. Save the memorandum document with a file name of 04-A Your Name.

Step 23: End the Integrated Accounting 8e session.

Unit Cost Quantity 8 Description Wet & Dry Vacuum 199.00 Unit Cost Description Allergenci Bag Quantity 32 5.35

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Only the first purchase order for the period is shown The accuracy of the information in the invento... View full answer

Get step-by-step solutions from verified subject matter experts