Question: In this problem, you will process the sales and purchases transactions for the week of February 8 through February 14 for Vetter Vacuum Center. Step

In this problem, you will process the sales and purchases transactions for the week of February 8 through February 14 for Vetter Vacuum Center.

Step 1: Start Integrated Accounting 8e.

Step 2: Load opening balances file IA8 Problem 04-B.

Step 3: Enter your name in the Your Name text box and click OK.

Step 4: Save the file with a file name of 04-B Your name.

Step 5: Enter the following purchase order and purchase invoice transactions.

Weekly Purchase Order and Purchase Invoice Transactions

Feb 08

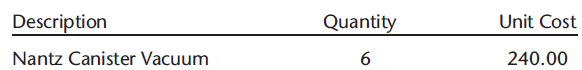

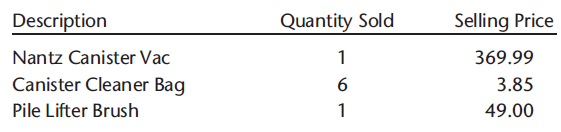

Ordered the following merchandise from Nantz Vacuum Cleaner Co., terms 2/10, n/30. Purchase Order No. 277.

09

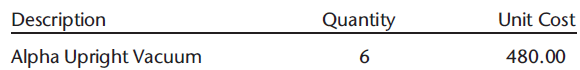

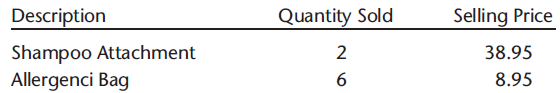

Ordered the following merchandise from Alpha Vacuum Mfg., Inc., terms 2/10, n/30. Purchase Order No. 278.

12

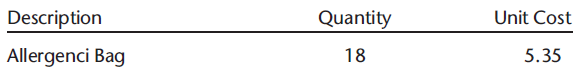

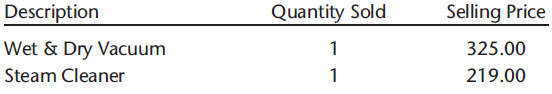

Received the following merchandise for Purchase Order No. 275 from Handy Manufacturing, Inc., terms 2/10, n/30. Purchase Invoice No. 859.

14

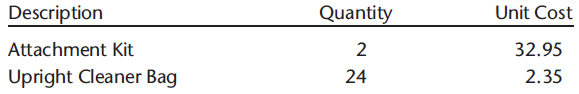

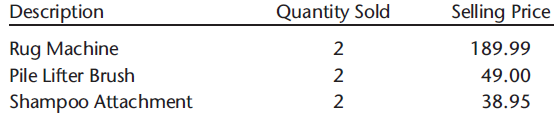

Received the following merchandise for Purchase Order No. 276 from Royal Accessories, Inc., terms 2/10, n/30. Purchase Invoice No. 860.

Step 6: Enter the following sales invoice transactions.

Weekly Sales Invoice Transactions

Feb 08

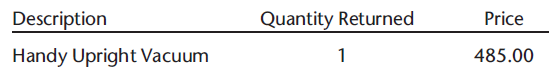

The following merchandise was returned to Vetter Vacuum Center by Wingler Motel, 7% sales tax, Sales Return No. R530:

Feb 08

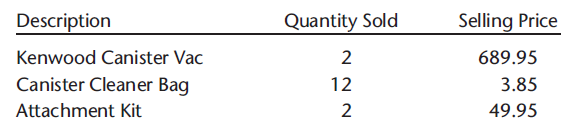

Sold the following merchandise to Wingler Motel, terms 2/10, n/30, 7% sales tax, Sales Invoice No. 531:

Feb 09

Sold the following merchandise to Fraze Department Stores, terms 2/10, n/30, 7% sales tax, Sales Invoice No. 532:

Feb 10

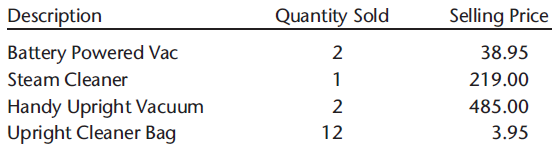

Sold the following merchandise to Robert Thorson, terms 30 days, 7% sales tax, Sales Invoice No. 533:

Feb 11

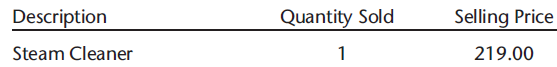

Sold the following merchandise to Jennifer Martens, terms 30 days, 7% sales tax, Sales Invoice No. 534:

Feb 12

Sold the following merchandise to Broderick Company, terms 2/10, n/30, 7% sales tax, Sales Invoice No. 535:

Feb 13

Sold the following merchandise to Lilly Industries, Inc., terms 2/10, n/30, 7% sales tax, Sales Invoice No. 536:

Feb 14

Sold the following merchandise to Matthew Cornish, terms 30 days, 7% sales tax, Sales Invoice No. 537:

Step 7: Enter the following cash payments transactions.

Weekly Cash Payment Transactions

Feb 13

Paid invoice 858 to Nantz Vacuum Cleaner Co., $157.50, less 2% discount, $3.15. Check No. 3621.

14

Paid invoice 850 to Alpha Vacuum Mfg., Inc., $3,314.75, no discount. Check No. 3622.

Step 8: Enter the following cash receipt transactions.

Weekly Cash Receipt Transactions

Feb 10

Received cash on account from Bassett Cleaning, Inc.,

covering Sales Invoice No. 527 for $909.13, less 2% discount, $18.18. 13

Received cash on account from Robert Thorson, covering Sales Invoice No. 528 for $347.75, no discount.

14

Received cash on account from Broderick Company, covering Sales Invoice No. 529 for $1,076.84, less 2% discount, $21.54.

Step 9: Display the purchase order, purchase invoice, and sales invoice registers for the period February 8 through February 14.

Step 10: Display the general, purchases, cash payments, sales, and cash receipts journals for the period February 8 through February 14.

Step 11: Display a General Ledger report for the Accounts Receivable, Sales, Sales Returns and Allowance, and Sales Discount accounts.

Step 12: Display a Trial Balance report.

Step 13: Display a Schedule of Accounts Receivable and an Accounts Receivable Ledger report for all customers.

Step 14: Display a statement of account for Wingler Motel.

Step 15: Display an Inventory List report.

Step 16: Display the inventory transactions for the period of February 8 through February 14.

Step 17: Display the Yearly Sales report.

Step 18: Display the Top Customers graph.

Step 19: Save your data to disk.

Step 20: Optional spreadsheet integration activity.

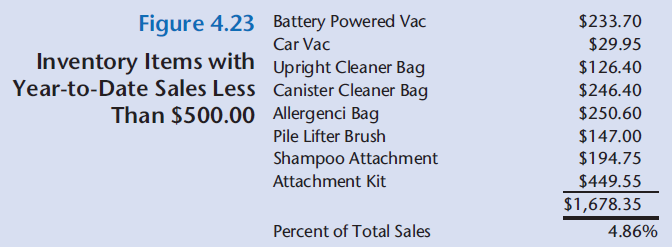

Use a spreadsheet to prepare a list of inventory items with year-to-date gross sales greater than $3,000.00. Use Figure 4.23 as a guide if necessary.

a. Display and copy the yearly sales report to the clipboard in spreadsheet format.

b. Start your spreadsheet software and load file IA8 Spreadsheet 04-S.

c. Select cell A1 as the current cell (if not already selected) and paste the yearly sales report into the spreadsheet.

d. In cell B35, enter the IF function appropriate for your spreadsheet software to display the description of each inventory item with year-to-date gross sales greater than $3,000.00 €“ if not, display €˜€˜Delete this row.€™€™ For example, @IF(E10>3000,B10,€™€™Delete this row€™€™). Copy the formula from cell B35 to cells B36-B50.

e. In cell C35, enter the IF function appropriate for your spreadsheet software to display the amount of each inventory item with year-to date gross sales greater than $3,000.00 €“ if not, display a blank. For example, @IF(E10>3000,E10,€˜€˜ €™€™). Copy the formula from cell C35 to cells C36-C50.

f. Delete the rows in cells B35-B50 that contain €˜€˜Delete this row.€™€™

g. Sum the amount (column C) of the items that match the criteria, and use this sum to calculate and display the percent of yearly total sales.

h. Print the list of items that meet the criteria.

i. Save your spreadsheet data with a file name of 04-B Your Name.

Step 21: Optional word processing integration activity.

Prepare a memorandum to the Owner of Vetter Vacuum Center (Diane Vetter) listing the items of inventory with year-to-date gross sales greater than $3,000.00 and their percent of total sales.

a. Copy the list of inventory items from the spreadsheet.

b. Start your word processing software and load template file IA8 Word processing 04-S (load as a document file).

c. Paste the contents of the clipboard into the memorandum at the location specified and change the text reference from less than $500.00 to greater than $3,000.00.

d. Format the document as necessary.

e. Enter your name and today€™s date where indicated.

f. Print the memorandum.

g. Save the memorandum document with a file name of 04-B Your Name.

Step 22: End the Integrated Accounting 8e session.

Unit Cost Description Quantity Nantz Canister Vacuum 240.00 Description Quantity Unit Cost Alpha Upright Vacuum 480.00

Step by Step Solution

3.42 Rating (168 Votes )

There are 3 Steps involved in it

Only the first purchase order for the period is shown The accuracy of the information in the invento... View full answer

Get step-by-step solutions from verified subject matter experts