Financial Statement Analysis Cases Case 1 Northland Cranberries Despite being a publicly traded company only since 1987,

Question:

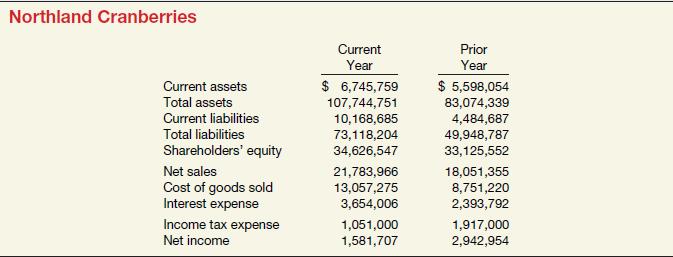

Financial Statement Analysis Cases Case 1 Northland Cranberries Despite being a publicly traded company only since 1987, Northland Cranberries (USA) of Wisconsin Rapids, Wisconsin, is one of the world’s largest cranberry growers. Despite its short life as a publicly traded corporation, it has engaged in an aggressive growth strategy. As a consequence, the company has taken on significant amounts of both short-term and long-term debt. The following information is taken from recent annual reports of the company.

Instructions

(a) Evaluate the company’s liquidity by calculating and analyzing working capital and the current ratio.

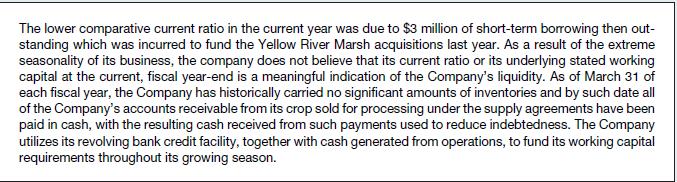

(b) The following discussion of the company’s liquidity was provided by the company in the Management Discussion and Analysis section of the company’s annual report. Comment on whether you agree with management’s statements, and what might be done to remedy the situation.

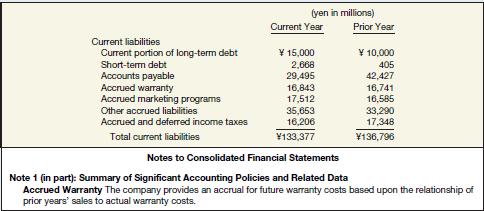

Case 2 Suzuki Company Presented below is the current liabilities section and related note of Suzuki Company.

Instructions Answer the following questions.

(a) What type of warranty is Suzuki Company providing to customers?

(b) Under what circumstance, if any, would it be appropriate for Suzuki Company to recognize unearned revenue on warranty contracts?

(c) If Suzuki Company recognized unearned revenue on warranty contracts, how would it recognize this revenue in subsequent periods?

Case 3 BOP Clothing Co.

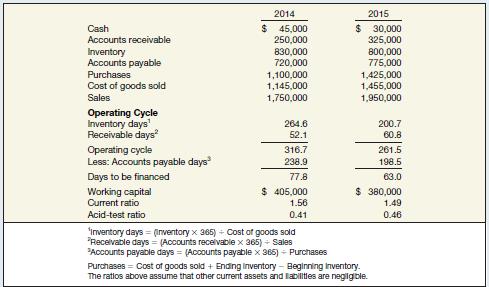

As discussed in the chapter, an important consideration in evaluating current liabilities is a company’s operating cycle. The operating cycle is the average time required to go from cash to cash in generating revenue. To determine the length of the operating cycle, analysts use two measures: the average days to sell inventory (inventory days) and the average days to collect receivables (receivable days). The inventory-days computation measures the average number of days it takes to move an item from raw materials or purchase to final sale (from the day it comes in the company’s door to the point it is converted to cash or an account receivable). The receivable-days computation measures the average number of days it takes to collect an account.

Most businesses must then determine how to finance the period of time when the liquid assets are tied up in inventory and accounts receivable. To determine how much to finance, companies first determine accounts payable days—how long it takes to pay creditors. Accounts payable days measures the number of days it takes to pay a supplier invoice. Consider the following operating cycle worksheet for BOP Clothing Co.

These data indicate that BOP has reduced its overall operating cycle (to 261.5 days) as well as the number of days to be financed with sources of funds other than accounts payable (from 78 to 63 days). Most businesses cannot finance the operating cycle with accounts payable financing alone, so working capital financing, usually short-term interest-bearing loans, is needed to cover the shortfall. In this case, BOP would need to borrow less money to finance its operating cycle in 2015 than in 2014.

Instructions

(a) Use the BOP analysis to briefly discuss how the operating cycle data relate to the amount of working capital and the current and acid-test ratios.

(b) Select two other real companies that are in the same industry and complete the operating cycle worksheet (similar to that prepared for BOP), along with the working capital and ratio analysis.

Briefly summarize and interpret the results. To simplify the analysis, you may use ending balances to compute turnover ratios.

Step by Step Answer:

Intermediate Accounting IFRS Edition

ISBN: 9781118443965

2nd Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield