International Reporting Case Bayer and Merck Presented are data and accounting policy notes for the goodwill of

Question:

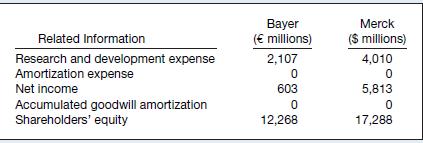

International Reporting Case Bayer and Merck Presented are data and accounting policy notes for the goodwill of two international drug companies.

Bayer, a German company, prepares its statements in accordance with International Financial Reporting Standards (IFRS). Merck, a U.S. company, prepares its financial statements in accordance with U.S. GAAP.

Both U.S. GAAP and IFRS do not allow amortization of goodwill.

Instructions

(a) Compute the return on equity for each of these companies, and use this analysis to briefly discuss the relative profitability of the two companies.

(b) IFRS requires that development costs must be capitalized if technical and commercial feasibility (economic viability) of the resulting product has been established. Assume that Bayer recorded €1 million of development costs in the year reported above. Discuss briefly how this accounting affects your ability to compare the financial results of Bayer and Merck.

Step by Step Answer:

Intermediate Accounting IFRS Edition

ISBN: 9781118443965

2nd Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield