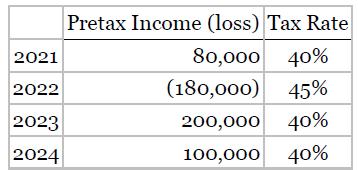

Jennings plc reported the following pretax income (loss) and related tax rates during the years 20212024. Pretax

Question:

Jennings plc reported the following pretax income (loss) and related tax rates during the years 2021–2024.

Pretax financial income (loss) and taxable income (loss) were the same for all years since Jennings began business. The tax rates from 2021–2024 were enacted in 2021.

Instructions

a. Prepare the journal entries for the years 2022–2024 to record income taxes payable (refundable), income tax expense (benefit), and the tax effects of the loss carryforward. Assume that it is probable that it will realize the benefits of any loss carryforward in the year that immediately follows the loss year.

b. Indicate the effect the 2022 entry or entries has on the December 31, 2022, statement of financial position.

c. Prepare the portion of the income statement starting with “Operating loss before income taxes” for 2022.

d. Prepare the portion of the income statement starting with “Income before income taxes” for 2023.

Step by Step Answer:

Intermediate Accounting IFRS

ISBN: 9781119607519

4th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield